Announcements

Drinks

Henkel amps up M&A with coatings and adhesives deals after a decade of mostly bolt-on acquisitions

The latest information on the rating, including rating reports and related methodologies, is available on this LINK.

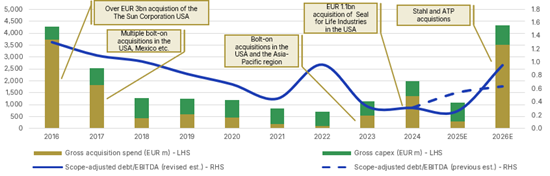

Henkel’s agreement to acquire Dutch specialty coatings company Stahl for EUR 2.1bn earlier this month represents one of the German chemical company’s biggest purchases in many years and follows swiftly on the deal announced in January to acquire Swiss based ATP Adhesive Systems (ATP). The exact details of the transactions including timing and purchase price for ATP are not yet known. Based on Scope estimates, Henkel’s leverage (Scope-adjusted debt/EBITDA) is estimated to increase to ~0.8-1.0x in 2026E from ~0.3x in 2024 and 2025E, assuming partial debt funding for the transactions. For comparison, Scope adjusted debt/EBITDA for Henkel averaged ~0.5x over 2020-2024. The projected post-acquisition leverage would therefore exceed the company’s recent levels but remain below 1.0x, supported by minimal acquisition spending in 2025 – and still comfortably below the 2.0x negative rating-change driver. In Scope’s view the transactions are credit neutral to the A/Stable issuer rating, with Henkel’s strong discretionary cash generation continuing to support its robust deleveraging capacity.

Exhibit 1: Trend in Henkel’s acquisition and capex spends, as well as leverage (Scope-adjusted debt/EBITDA) over the past decade

Source: Henkel Annual Reports, Scope estimates

M&A has remained an integral part of Henkel's strategy across both Adhesive Systems and Consumer Brands segments. At the same time, the company has consistently pursued a conservative financial policy over the years, underscored by its commitment to maintaining a single A rating category, strong credit metrics, and a prudent dividend payout ratio of 30%–40% of adjusted net income (after minority interests). In this context, Stahl acquisition stands out as one of Henkel’s largest in the past decade. Other major transactions include the EUR 3bn acquisition of The Sun Products Corporation (USA) in 2016, the roughly EUR 1bn acquisitions of Darex Packaging Technologies and the Sonderhoff Group in 2017, and the EUR 1.1bn acquisition of Seal for Life Industries (USA) in 2024.

Although the consideration for ATP has not been disclosed, it is likely to be significantly below Stahl’s EUR 2.1bn, reflecting ATP’s smaller scale, narrower market reach, and more focused product offering. Including other possible bolt-on acquisitions, Scope’s estimates assume a combined EUR 3.0-3.5bn acquisition outflow in 2026 – higher than the EUR 1.5bn per year previously built into forecasts for 2025E–2027E. Together, Stahl and ATP generated approximately EUR 725m and EUR 270m in 2025 revenues, respectively. Their combined contribution represents around 5% of Henkel’s group sales and approximately 9% of Adhesive Technologies’ LTM September 2025 sales. Strategically, the two acquisitions are expected to strengthen Henkel’s Adhesive Technologies portfolio by accelerating its expansion into specialty coatings and enabling entry into complementary, higher value end markets.

This commentary does not constitute a credit-rating action, nor does it indicate the likelihood that Scope will conduct a credit-rating action in the short term. Information about the latest credit-rating action connected with this monitoring note along with the associated ratings history can be found on scoperatings.com.