Announcements

Drinks

War in Ukraine will impact long-term EU energy policy

While the US has banned the import of Russian oil, LNG and coal, and the UK announced the phase-out of energy imports from Russia by the end of 2022, the EU’s sanctions have so far fallen short on impacting Russia’s energy exports, though the EU did announce an ambition to significantly cut its natural gas imports from the country.

Even if Russian gas supply remains broadly uninterrupted during this crisis, Europe’s political perspective will change. “We expect a review of relevant regulations to strengthen security of supply and reduce Russian reliance, but this will require significant investments across the natural gas value chain, and it will come at a cost, but there seems to be political momentum at present for the implementation of such a shift in gas strategy,” said Marton Zempleni, a senior representative of Scope’s project finance team.

Germany's suspension of the Nord Stream 2 pipeline will not directly impact Gazprom’s ability to supply gas to Europe; existing pipeline capacity is sufficient to meet demand. “But if there is disruption to any of the major existing pipeline routes, most notably the Ukrainian network, the remaining routes would have insufficient replacement capacity to fill the gap,” Zempleni cautioned.

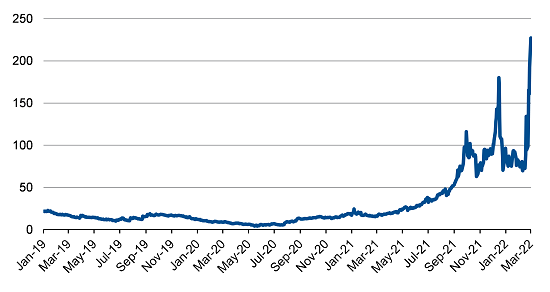

Natural gas prices (TTF, April 2022 delivery, EUR/MWh)

Source: Macrobond, ICE, Scope

Scope’s base-case at this point remains that full scale supply disruption can be avoided. But if there was a complete disruption to gas supplies without significant demand curtailment, Europe will not be in a position to find an alternative to Russia in the short to medium term at least. There is not enough LNG available on the global spot market to fill supply deficiencies and enable Europe to meet demand for 2022/23 winter. The renewables build-out is likely to accelerate, but natural gas will remain important both for heating, industrial use, and for reliable and flexible power generation fuel as part of the energy transition.

Key infrastructure investment areas that can potentially gain more support are LNG regasification terminals, LNG vessels, gas storage facilities, the improvement of cross-border transmission capacity; and the expansion of capacity for alternative import pipelines, such as the Trans Adriatic Pipeline. “Now would be the appropriate time to encourage investment in midstream infrastructure, as completion of such projects could broadly coincide with a much better supplied LNG market,” Zempleni said

Download the full report here.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions such as for Credit Sphere.