Announcements

Drinks

Credit Talk: government intervention risks spoiling utilities’ investment plans, credit quality

In this Scope Ratings interview, Sebastian Zank, lead utilities analyst, discusses the consequences of windfall taxes and regulatory uncertainty on the sector with Dierk Brandenburg, head of credit and ESG research.

Dierk Brandenburg: Sebastian, you warned earlier on this year that higher profits in the utilities and broader energy sector would trigger a regulatory response and extra taxation. The warning turned out to be prescient as we have seen with windfall taxes just announced in the UK and Hungary. Should credit investors worry?

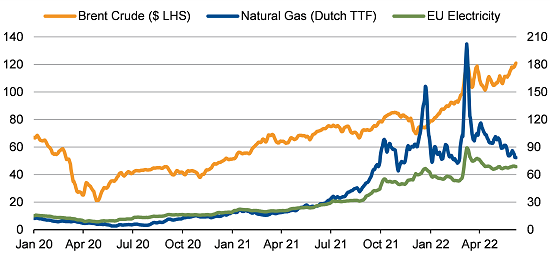

Sebastian Zank: Windfall taxes are not new. In the energy sector in Europe, taxes, levies or price caps that limit extra profits have existed over many years in various forms. Investors should not have been surprised to see governments try to capture a bigger share of recurrent profits as energy prices have rocketed higher in the past year.

Figure 1: Energy prices take roller-coaster ride in Europe (2020-22)

Crude oil (USD/barrel, Brent LHS); natural gas (EUR/MWh, Dutch TTF), EU electricity price index (RHS)

Source: Macrobond

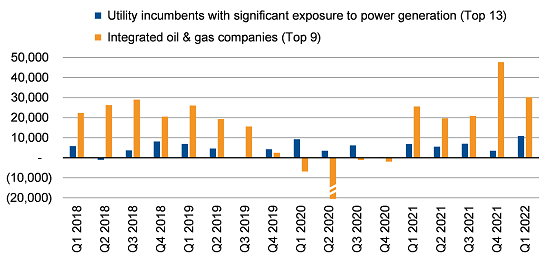

What is on the table in the UK does not yet affect utilities though there is speculation that taxes will go beyond the oil and gas sector. In Hungary, the “extra profit tax” is aimed at a small sub-segment of the utilities - operators of larger-scale solar power plants – as well as other sectors like banks, producers of petroleum products and biofuels. The reason in both countries may be that utilities are paying extra already. The UK put in place electricity price caps last year when Hungary also imposed a Robin Hood tax. In addition, integrated oil and gas companies benefit more from rising energy prices than utilities given their greater exposure to spot prices.

Figure 2: Windfall gains for Europe’s utilities sector vs oil & gas majors

Aggregated quarterly pre-tax profit 2019-22 (in EURm)

Source: Bloomberg Intelligence, Scope

DB: In the UK, the government is accompanying windfall taxes on oil & gas companies with generous allowances for depreciation to encourage investment. Do tax credits work or do new taxes, changing regulations and subsidies create too much uncertainty?

SZ: Tax credits are of course an incentive, but a short-term penalty set against a long-term incentive is an uneven equation. A predictable business environment is more important for long-term investment decisions so temporary subsidies may not offset the extra uncertainty.

DB: Politicians often think it is a winning formula to subsidise households through taxing energy companies. The debate re-emerging in Germany. Might Berlin be tempted to resort to windfall taxes?

SZ: That looks unlikely. Germany burnt its hands with a kind of windfall tax or “Brennelementesteuer” more than 10 years ago with the government’s about-turn on nuclear power. The taxes had to be paid back to the utilities operating nuclear plants after the courts ruled Berlin was guilty of excessive intervention in energy markets. Spain has had a similar experience, with back and forth over energy-sector levies. Providing vouchers and other relief to low-income households facing higher electricity and heating bills can be implemented quickly with less controversy. In the case of any new tax, just think about the likely wave of lawsuits from utilities which have already hedged (sold forward) a large portion of generation capacity.

DB: Do the prospects of windfall taxes have consequences for credit ratings?

Some companies are recording exceptionally large profits – nominally and relatively – but all depends on whether taxes are so high that they offset the extra earnings. Experience suggests that the net effect will not lead to deteriorating credit metrics because not 100% of extra earnings will be taxed. We do not see the risk of a net cash burden for utilities. Companies will still earn more than before.

DB: We know of the high investment needs for the utilities sector – from renewables to replacing Russian gas supplies, the challenge of nuclear investment – and the challenges of inflation and supply bottlenecks. How disruptive for new investment is the timing of these taxes?

SZ: It is poor timing. When companies want to invest and government introduces uncertainty, it is more difficult to execute on the investments. Equally, when inflation is rising, adding extra risk premium to internal calculations of future returns, the danger then is that some projects are no longer viable even with tax relief in the form of tax credits. Yet the investment may be needed to advance Europe’s transition towards more sustainable growth and energy security. You cannot force energy companies, utilities included, to invest in projects with low internal rates of return, even possibly below prevailing inflation rates.

DB: Yes, that is particularly the case in a rising interest-rate environment. What is our overall view on how people should look at the utilities sector – cashflow, credit quality – given the regulatory risks?

SZ: Unlike the oil and gas sector, with the low leverage and exceptionally high credit quality to absorb windfall taxes, the utilities sector in Europe faces plenty of challenges – heavy capex, extra taxes, price caps and other levies – which pressure credit ratings.

Other regulatory headwinds include growing talk about making changes to the electricity market including the merit order system which determines prices. The current system favours lower-cost producers – nuclear, hydroelectric, wind, and some coal – because the overall prices are determined by the most expensive power stations such as gas- or even oil-fired plants. Lower-cost producers have benefited from widening margins as oil and gas prices surged. So, the system is deemed to be unfair in some people’s eyes. Clearly, any substantive change could undermine investment incentives for low-cost producers and have an impact on credit quality.

That said, we need to make a judgement call on whether any extra regulatory burden on utilities will materialise given the plethora of measures already, particularly in France, Italy and Spain.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions for Credit Sphere, providing institutional clients access to Scope’s growing number of corporate, bank, sovereign and public sector ratings.

Contributing writer Matthew Curtin