Announcements

Drinks

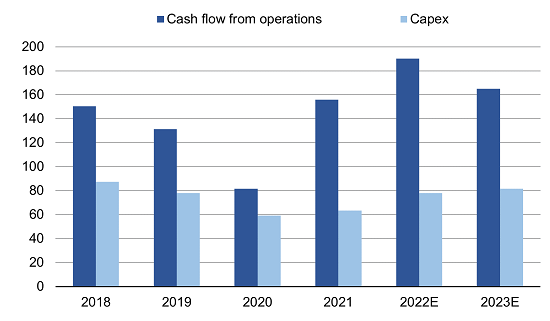

Credit Talk: Oil & gas companies keep capex in check as they confront a cycle like no other

Marlen Shokhitbayev, lead oil-sector analyst at Scope Ratings, explains why in conversation with Dierk Brandenburg, head of credit and ESG research.

Dierk Brandenburg: Oil markets are on a roller-coaster these days. How does this cycle rank – it is different?

Marlen Shokhitbayev: The oil & gas industry has always been cyclical, but this cycle is particularly extreme. With the outbreak of Covid-19 in 2020, the price collapsed in a quick and severe downturn. At the time, experts were not optimistic about the industry’s future. Yet a year a later, we see prices that were almost unimaginable before the pandemic. It is the speed and magnitude of changes in oil prices that are unusual.

DB: Oil prices remain volatile, with Brent recently sliding below USD 110 a barrel. How much confidence should investors have in current prices persisting?

MS: On the demand side, consumption is back at pre-pandemic levels. But on the supply side, output remains curtailed, supporting prices, through several factors, including coordination by members of the OPEC+ group of producers including Russia, not forgetting the impact of US and European sanctions on Russian energy exports. Production from more flexible producers such as the US shale sector has not recovered at the pace that we would have expected at current prices.

Now this is the short-term situation. What happens over the next couple of years relates in part to the demand side as the more rapid-than-expected slowdown in growth in the world’s biggest economies – US, China, the EU – will keep further rises in the price of crude in check and even lead to declines, though not to the lows of 2020. However, the deficit in supply will remain. Environmental concerns, rising interest rates, inflation and geopolitical uncertainty are discouraging the investment in exploration and production that we would normally expect given the incentive of higher prices.

DB: We are also hearing more talk about windfall taxes, notably in the UK and Hungary. Will they have a big impact on capex?

MS: The oil & gas industry is prone to government intervention. Perhaps the biggest surprise is to see the British government consider imposing an extra tax given the UK has a reputation for consistent fiscal policy. In contrast, Norway has a standard tax rate of 78% on the oil & gas sector. But there are still a good number of players operating on the Norwegian continental shelf in addition to Equinor ASA, the local incumbent operator, because the tax regime has proved stable, though an amendment is in the works. Operators there also received refunds when prices collapsed during the pandemic. In other words, if you make good profits, you pay high taxes. But if the market is not so good, you receive some money back. It is policy uncertainty which is a big deterrent for new investment.

European IOCs: capex remains conservative as cash flows in

(USD bn)

Source: Company reports, Bloomberg, Scope Ratings

DB: If we switch to look at refining margins, how have they developed?

MS: The most important factor for the European market is the Brent-Urals spread. With Russia’s escalation of the war in Ukraine, self-sanctioning from oil importers has led a more than USD 30/barrel spread or even USD 40/barrel. Refiners still taking Russian oil are benefiting hugely from high fuel prices and relatively low input costs. In addition, Europe is structurally short of diesel capacity, so it used to rely heavily on Russia. The war has made that deficit worse. Another factor aggravating the imbalance has been refinery closures across the world as demand collapsed during the Covid lockdowns. Demand has since recovered fast, but capacity remains below pre-pandemic levels.

DB: How long will this refining deficit last?

MS: Restarting closed refineries is the least likely development. Many IOCs will rather re-direct capacity and spending toward sustainable fuels and electric mobility. Refining margins are likely to remain elevated for some time – which is unusual. It is worth remembering that typically margins are very thin.

DB: Turning to gas markets, what is your take on the European supply-demand balance?

MS: First, take the political dimension. Is there going to be any normalisation of relationship between Europe and Russia? As of today, the prospects are very remote. European countries look determined to reduce their dependence on Russian gas, supplies of which are declining with adverse consequences not just for some utilities but also some IOCs dependent on Russian product. Take the gas trading business at Italy’s Eni SpA or IOCs more generally reliant on Russian supplies such as Austria’s OMV AG and Hungary’s MOL Ltd. However, we expect governments will intervene to limit adverse impacts on gas importers – by allowing them to pass on the higher costs or by compensating them for the losses – as they strike a delicate balance between limiting inflation and maintaining functioning energy markets in Europe. For IOCs, the upside from higher oil and gas prices will offset potential losses from gas trading.

DB: The flipside to shortages of Russian natural is the growth in imports of LNG? Who is benefiting?

MS: For Shell PLC and TotalEnergies SE, among the world’s largest LNG suppliers, the LNG boom is good news. Longer term, there is plenty of uncertainty which is why we have not seen work start on more new liquefaction projects in the US or elsewhere. Yes, prices are currently high. However, building LNG plants from scratch takes years. To get returns on investment, you need minimum prices with a 10-year of 20-year view. European buyers are reluctant to commit to buying conventional LNG on that basis given the geopolitical and regulatory uncertainty. Only high-potential projects or more sustainable ones – using biomethane or combined with carbon capture – might go ahead. Much depends on what energies will be allowed in Europe in the 2030s and 2040s. Here there is more uncertainty. The EU Taxonomy may switch to excluding from including natural gas and nuclear energy.

DB: What is the answer from the oil & gas companies in contributing to the green transition?

MS: Oil & gas companies know the regulatory goalposts can shift quickly. For them, it might be too expensive to move quickly to dispose of assets only to find that they moved too fast – as we see with oil and coal back in high demand when, during the pandemic, they seemed to be going out of fashion fast. The IOCs are likely to treat exploration and production as cash cows, reluctant to invest heavily in them, and directing capex towards renewable energy, electricity generation and chemicals in a gradual rather than a dramatic transformation of their business.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions for Credit Sphere, providing institutional clients access to Scope’s growing number of corporate, bank, sovereign and public sector ratings.