Announcements

Drinks

Italian banks’ H1 results confirm sector soundness

Cost are under control. The sector’s cost-to-income fell from above 58% in the first quarter of 2021 to 56.5% in H1. Banks that displayed a cost increase were those that accelerated investments, for instance in digitalisation or strategic initiatives. Positive asset-quality trends remain intact, for now. On average, Italian banks are well capitalised despite generous distribution policies. As of June 2022, the average MDA buffer to CET1 requirements was approximately 560bp.

“The full year outlook is robust. Core net interest income will increasingly benefit from interest-rate hikes and will more than offset expiry of the TLTRO bonus rate,” said Alessandro Boratti, an analyst in Scope’s financial institutions team. “The outlook for net fees and commissions is less visible but inflation and economic growth should be supportive. Cost of risk will remain low thanks to low expected default rates and the presence of management overlays.”

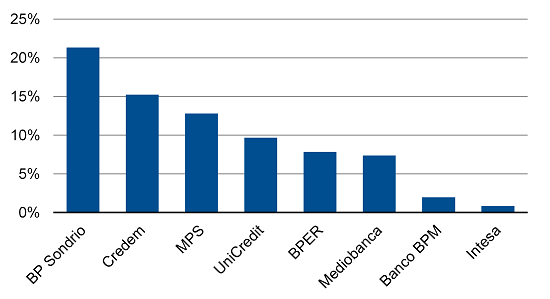

Net interest income – H1 2022 vs H1 2021

Source: Company data, Scope Ratings.

Note: based on management data. Figures for BPER and Credem were materially affected by acquisitions

While Scope does not expect profitability to swing considerably in the second half of 2022 despite a more challenging macroeconomic scenario, Boratti is more guarded about 2023. “As base effects and boosts to economic growth from pent-up demand fade, Italy’s growth is likely to converge to its long-term, uninspiring norm. While core NII expands on the back of higher rates, loan quality may start to deteriorate,” he cautioned.

During the first six months of 2022, Italian banks’ cost of risk fell from 55bp in 2021 to an average of 43bp. This was the result of default rates still at record lows; the partial reversal of pandemic-related overlays; low direct or indirect exposure to Russia, Ukraine, and Belarus (except for UniCredit and Intesa); and limited exposure to energy-intensive sectors, representing just 8.5% of performing business loans as of YE 2021.

In H1 2022, headline NPE ratios continued to trend lower for most banks, mainly driven by asset sales and securitisation. Inflows of new non-performing loans remained low, with no signs of a pick-up in default rates on loans formerly under moratorium. As of June-end, the average gross NPL ratio stood at 3.7%, down 50bp from the beginning of the year.

There are additional downside risks linked to the general economic environment and political instability, however. The energy crisis carries downside risks, as does the global slowdown, partly an engineered policy response to the inflationary threat. “Snap elections in September may trigger a new round of volatility around confidence-sensitive Italian assets, which could harm Italian banks’ market-driven revenues, funding costs, and, under more severe scenarios, ability to tap the markets for wholesale funds,” Boratti said.

Scope has public ratings on the following Italian banks:

Scope has subscription ratings on the following Italian banks. To view the ratings and rating reports on ScopeOne, Scope’s digital marketplace, or to register, please click on the following links:

Mediobanca Banca di Credito Finanziario SpA

Banco di Desio e della Brianza SpA