Announcements

Drinks

Covered Bond Quarterly: strong issuance volumes as cracks appear in house-price rally

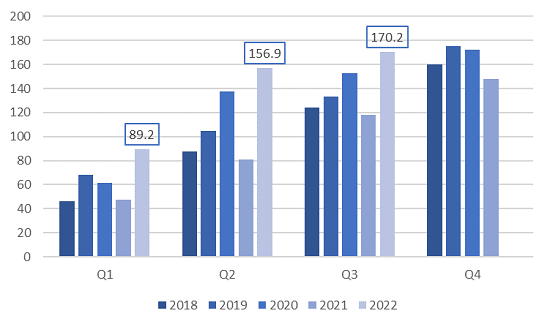

Covered bond issuance is well above expectations. More than EUR 135bn in public placed benchmark issuance has emerged year-to-date. That is above the full-year issuance of the pandemic years and around the levels seen in 2018-19.

“Economic headwinds are increasing but the credit quality of issuing banks and their cover pools is stable,” said Karlo Fuchs, Scope’s head of covered bonds. “Beyond credit factors, issuance this year has benefited from a number of other drivers: covered bonds’ safe-haven status at the onset of war in Ukraine, the ECB’s Covered Bond Purchase Programme (when it was still in purchase mode), and the shift to positive yields, which lured back real money investors, particularly at the long end.”

2022 covered bond issuance

(>EUR 500m/fixed rate)

Source: Refinitiv, Scope Ratings

Headwinds will leave their mark on building activity and house prices. Sweden’s house price index has reacted most strongly so far. From its high of 304 in March 2022, the HOX index dropped to 277 in July while the almost 4% month-on-month decline from May to June was the largest since October 2008.

“The first cracks in the rally have become visible, as growth across Europe becomes uneven.,” Fuchs said. “However, whether the changing trajectory becomes relevant for covered bond investors will mostly hinge on other factors: the extent to which unemployment creeps in and directly leads to defaults, and inflation significantly reduces affordability such that borrowers will need to enter loan restructurings. Both factors will prompt a reversal of current ultra-low NPL ratios.”

The European Covered Bond Directive (CBD) is no longer a fantasy. Updated legislation for all active issuance countries was passed (just) in time before the 8 July 2022 deadline. “However, issuers now realise that many of the subtle details that will be found in secondary legislation – needed for issuance programme updates – are still missing,” said Mathias Pleissner, Scope’s deputy head of covered bonds.

Issuers that cautiously frontloaded to gain time for these amendments will be able to sit back and wait. Others will need to wait for their regulators to be forthcoming and will in the meantime need to explore the limits of grandfathering while tapping existing bonds or even recycling retained bonds – provided significant changes to the terms and conditions do not void the grandfathering.

“Economic headwinds, rising interest rates and wider spreads mean that in coming years, covered bonds will slowly but surely move away from being seen as a rates product towards a more differentiated credit product. Investors who are only accustomed to low spread differentials will need to brush up their knowledge and do some homework. In particular they will need to understand the CBD’s finer details and implications,” Pleissner said.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions for Scope`s credit rating feed, providing institutional clients access to Scope’s growing number of corporate, bank, sovereign and public sector ratings.