Announcements

Drinks

Hungary’s corporate credit outlook: inflation, currency clouds gather after decade of fair weather

The MNB’s recent decision to increase short-term rates even further to 18% to stabilise the currency adds further pressure to Hungarian corporate credit risk.

“We recognise that many Hungarian companies benefit from long-term fixed-rate bonds, while debt amortisation poses no immediate refinancing risk,” says Barna Gáspár, associate director at Scope.

In addition, cash-rich corporates will most easily finance their supply chains while market leaders will try to squeeze suppliers. The government is offering subsidised SME lending for amounts up to EUR 1m though this is becoming costly to fund.

“However, other pressures are mounting across the corporate landscape,” says Gáspár.

Falling demand, notably for consumer products, complicates management’s efforts to pass on costs to customers by raising prices. Uncertainty about state spending and disbursement of EU funds adds doubt about orders and future revenues. The construction sector is vulnerable. Many public sector projects face delays if not cancellation if EU funds are not restored by early next year.

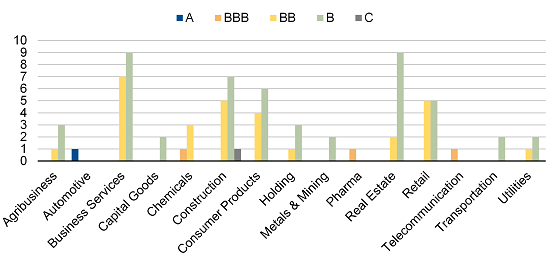

Rating distribution of Scope’s Hungarian corporate issuer ratings

Number of rated companies (lhs)

Source: Scope Ratings

Uncertainty over future investment spending

Meanwhile, companies’ capital expenditure plans are also under pressure. Budgets are in danger of overshooting due to the higher cost of technology and other imports as the Hungarian forint has lost value against the euro.

Faced with high domestic rates and falling bank liquidity, Hungarian firms are more likely to keep cash on deposit than invest, a trend more visible since August. Companies are also turned to cheaper euro financing, variable interest rates, and shorter tenors, pointing to more risky financing structures.

“On the upside, exporters benefit from higher margins in domestic currency, as do some commercial real estate firms with revenues denominated in euro,” says Viviane Anna Kápolnai, analyst at Scope.

Some producers have started linking their prices to the euro despite government incentives for local firms to keep faith in forint. Some multinational firms are linking wages to the euro, a practice which may spread, particularly as wage inflation is accelerating. “There were further increases in September and more are expected in January, according to the companies we follow,” Kápolnai said.

Further reading:

Scope affirms Hungary's BBB+ ratings; Outlook revised to Negative