Announcements

Drinks

Structured Finance Activity Report: rating downgrades catch up with upgrades

The share of NPL downgrades continued to decrease, however, to 15% of NPL monitored actions for the 12 months to end-2022 from the peak of 40% in Q3 2021. Of the 13% of monitoring reviews that resulted in upgrades, this was mainly due to better-than-expected collateral performance.

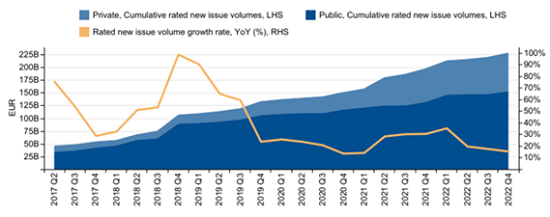

In 2022, Scope’s structured finance team covered 379 instruments across 185 transactions, predominantly NPLs (100 instruments) and CRE/CMBS (66). Coverage included 98 newly rated instruments across 75 transactions. Approximately 57% of the newly rated issue volume was rated AAA, while 5% was rated sub-investment-grade. Total rated volume since 2014 amounted to more than EUR 227bn at the end of 2022, up 15% year on year.

New issuance volumes rated by Scope

Source: Scope Ratings

In the fourth quarter of 2022, we updated the CRE Loan and CMBS Rating Methodology and the General Structured Finance Rating Methodology.

Transaction of the quarter was Shelby Real Estate Funding Limited, a commercial real estate balance-sheet cash securitisation originated by Barclays Bank PLC. Scope Ratings assigned a AAASF and AA-SF and rating to the Class A and B notes; Class C notes were not rated.

Download the Structured Finance Activity Report here.