Announcements

Drinks

Turkey: close election outcome worsens long-running uncertainty over economic policy

By Thomas Gillet, Director, Sovereign Ratings

Turkey’s leader Recep Tayyip Erdoğan appears on course to extend and consolidate his rule, as he goes head-to-head with opposition rival Kemal Kilicdaroglu in a run-off vote on 28 May.

Tackling large external imbalances would require both President Recep Tayyip Erdoğan to shift the policy mix post-election and for the opposition alliance, should it manage to win in the second round, to speak with one voice on important policies. The magnitude of the economic challenges and complexity of resetting policy will require delicate trade-offs for both camps.

As the tensions on financial market to the close first round of the presidential vote on Sunday shows, any upside for Turkey’s ratings (B-/Negative) is unlikely in the near- to medium-term whatever the outcome of the highly contested presidential and legislative elections. Still, the yield on 10-year government bonds peaked above 15% days before the 14 May vote, before declining to 12.8% on Monday.

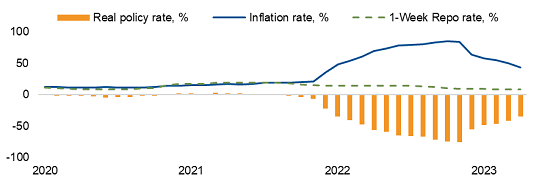

Pressure on the Turkish lira (-34% against the dollar since January 2022), declining net foreign-exchange reserves (USD 15.7bn as of end-February 2023), large current account deficit, and elevated inflation (43.7% YOY in April 2023) will persist with or without new political leadership, given the time needed for any policy normalisation and economic convalescence.

President Erdoğan staying in power after 2023 elections, part of our baseline scenario, would most likely translate into policy continuity and continued uncertainty. Loose monetary policy, increasingly complex macroprudential regulations, and expansionary budgetary policy would leave the economy durably exposed to a disorderly adjustment through a growing currency crisis and deeper balance-of-payments problems. In the absence of multilateral institutional support, Turkey would require ad hoc, short-term agreements with bilateral partners – which in the past have included the Gulf Co-operation Council and Russia – to access hard currency and modestly contribute to meeting external financing requirements.

Receding inflation supports return to higher real interest rates amid still loose monetary policy

Source: Central Bank of Turkey, Scope Ratings

Uphill economic challenge awaits opposition parties should they take power

Similarly, a potential victory of the opposition alliance, a less likely but still possible outcome, would entail large policy uncertainty amid lack of a majority in parliament. Although a reversal of the policy mix will be credit positive in the longer run, by reducing imbalances, it would test the unity of a very diverse and inexperienced coalition of opposition parties, which would need to build credibility and demonstrate capacity with an orderly return to more conventional policies.

Sequencing policy reform, first and foremost on monetary policy and macroprudential measures, including the deposit protection scheme, will be difficult. Tighter monetary policy and lower inflation would help, but Turkey has large, deeply rooted imbalances built up over time under the Erdoğan presidency.

Whatever Turkey’s political circumstances after the elections, downside risks will persist in the near-term, with the worst-case scenario being some sort of political deadlock, with no clear or challenged electoral outcomes and economic policymaking left in limbo.

The lack of landslide victory for Erdoğan’s People’s Alliance party or opposition leader Kemal Kilicdaroglu (Nation Alliance), amid a high election turnout, increases the risk of instability. This would further slowdown the economic activity despite likely GDP growth of forecast 2.7% this year, running below potential of around 4.0%.

The uncertainty on the policy stance post elections entails significant risks that are captured in the Negative Outlook attached to Turkey’s B- ratings since March 2022. Scope Ratings’ next calendar review is on 4 August 2023.