Announcements

Drinks

Climate risk in covered bond ratings can have counterintuitive credit impacts

Download the report here. And watch the replay of our webinar featuring Mathias Pleissner from Scope’s covered bonds team and Arne Platteau, ESG quantitative analyst.

“While early and proactive climate action is socially desirable, it can lead to frontloaded financial stress. For covered bonds this can be reflected in the form of higher over-collateralisation. Conversely, delayed or insufficient action may reduce short-term credit stress but increase long-term vulnerability,” said Mathias Pleissner, Scope’s Deputy Head of Covered Bonds.

While the over-collateralisation (OC) required to support covered bond programmes may increase, we do not expect our current covered bond programmes to be at risk given the current high resiliency and stability of banks.

“Applying the NGFS’s orderly, disorderly and hot house scenarios to our covered bond coverage throws out some counterintuitive insights, however. The highest credit stresses on mortgage covered bonds come from proactive climate-risk mitigation in the orderly scenario, not the hot house scenario,” Karlo Fuchs, Scope’s Head of Covered Bonds pointed out.

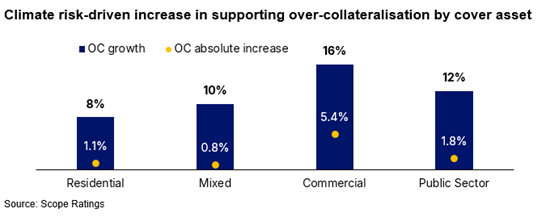

Residential mortgage-backed covered bonds are primarily exposed to transition risk. The orderly scenario indicates an 8% increase in supporting OC, twice as high as the corresponding increase in the hot house scenario, because frontloaded energy expenditures driven by increasing CO2 compensation costs are weighted higher than physical risk compensation. The impact of physical risk is also moderated by amortisation, as most cover pools have an average remaining life of just 5-10 years.

“Commercial mortgage-backed covered bonds see the highest increases in OC. This mainly reflects the generally lower credit quality of the underlying collateral compared to residential mortgages or public-sector exposures.” Pleissner noted.

The results are somewhat different for public-sector covered bonds. Physical risk in the hot house scenario, the most relevant scenario here, drives a 12% increase in OC. Unlike mortgage covered bonds, transition costs only implicitly affect a sovereign’s GDP and with a delay, because transition costs in the private or commercial sector will dampen economic activity.

Affordability most stressed in Southern Europe

There are significant regional differences in the impacts of climate risk-induced housing affordability shocks for residential cover pools. Southern European countries show the highest strains in affordability, led by Spain where climate risk could push up borrower probability of default by 44%.

By contrast, northern countries such as Finland show minimal impact, with climate risk-driven increases only increasing our stressed defaults by 3%. Geographic differences reflect the fact that in Southern Europe, transition risk-driven affordability shocks are more relevant due to generally lower disposable income. At the same time, renewables and biofuel resources in the Nordic countries account for a major share of household energy consumption, which reduces mitigating carbon costs.

We see increased valuation haircuts of 6% on average driven by climate risk-driven impacts on house prices. The steepest declines are in Germany (12%), Belgium (11%), and the Netherlands (10%). Introducing climate-change risk pressures property values owing to a high share of low-efficiency housing stock and capex backlogs. Nordic countries are least affected and therefore also show lower impacts.