Announcements

Drinks

Credit-linked and repackaged notes: understanding risk exposure is key

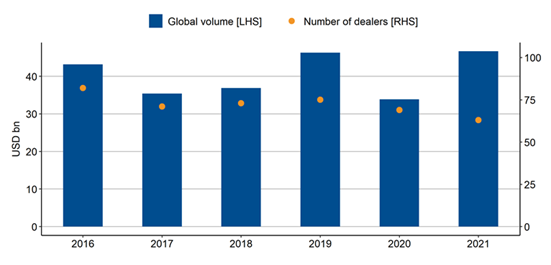

Global credit-linked note (CLN) volume exceeded USD 46bn in 2021, narrowly surpassing the high set in 2019. Industrial and Commercial Bank of China was behind the surge in volumes. German banks have also developed a strong presence in this market, particularly Landesbank Baden-Württemberg (LBBW), which maintains a consistent podium position in the CLN space.

CLN volume syndicated globally

Source: Bloomberg

The performance of credit-linked structures is tied to the credit quality of the issuing entity, the reference asset and all counterparties. “By banking on the creditworthiness of the reference asset and all counterparties involved, investors can use credit-linked structures such as repackaged and credit-linked notes (CLNs) as customised high-yielding investments,” said Benoit Vasseur, executive director in Scope’s structured finance team.

“But beneath the surface of these notes lies a series of risk factors as well as various risk mitigants. The exposure to additional risk that drives the incremental yield on these instruments compared to vanilla instruments needs to be carefully assessed,” Vasseur cautioned.

Repackaged notes and CLNs are funded instruments typically issued by banks or bank-sponsored SPVs. Coupons typically include a risk premium, which varies depending on market conditions. Both instruments involve the use of embedded swaps to achieve a bespoke payoff. Repackaged notes involve interest-rate or currency swaps as opposed to embedded CDS. This means cash flows of repackaged notes generally move further away from coupons of reference assets, and external market conditions exert greater influence.

“The principal risk drivers of repackaged notes are the credit quality of the reference asset and the swap agreement. Structures are also exposed to market risk,” said Jack Holbrook, associate analyst in Scope’s structured finance team. Mitigating these risk exposures are replacement mechanisms included in documentation for the reference asset, swap counterparty, custodian and account bank, as well as credit support mechanisms in the form of collateral and margin requirements. In the case of a defaulting swap counterparty, the replacement mechanism prevents early termination.

“Counterparty risk can be magnified when there is a positive correlation between the probability of default of the reference asset, collateral, and counterparty a.k.a. wrong-way risk. Mismatch risk arises if the SPV is unable to find an appropriate counterparty in a timely manner. In addition, large and unforeseen increases in the mark-to-market position of the swap can result in significant collateral posting requirements and a large settlement if the transaction is terminated early,” Holbrook explained.

Replacement costs and swap mark-to-market payments may be required depending on several factors, such as the time taken to find a replacement, changing market conditions, and whether the SPV is in-the-money or out-of-the-money. Out-of-the-money counterparties may have a greater incentive to default, which introduces additional risk and stresses the importance of collateral posting.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions such as for Credit Sphere.