Announcements

Drinks

European energy price crunch aggravated by Russia-Ukraine conflict

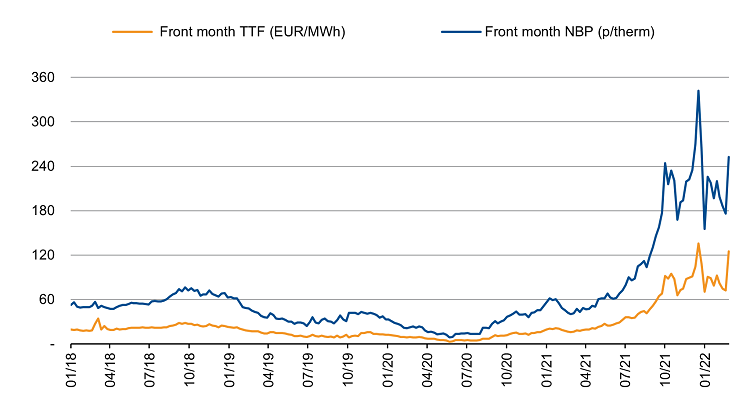

Figure 1: European benchmark gas prices

Source: Bloomberg, Scope Ratings

Source: Bloomberg, Scope Ratings

“Because Russia supplies between 30% and 40% of Europe’s gas, and about one third of Russian gas exports to Europe flow through Ukraine, sanctions impacting Russian gas supplies will push already-high European energy prices higher,” said Sebastian Zank, a director in Scope’s corporate ratings team. “Gas and electricity prices as well as EUR-RUB will be highly volatile. Exchange-rate volatility will in particular impact utilities with direct exposure to Russia, such as Fortum and Uniper.”

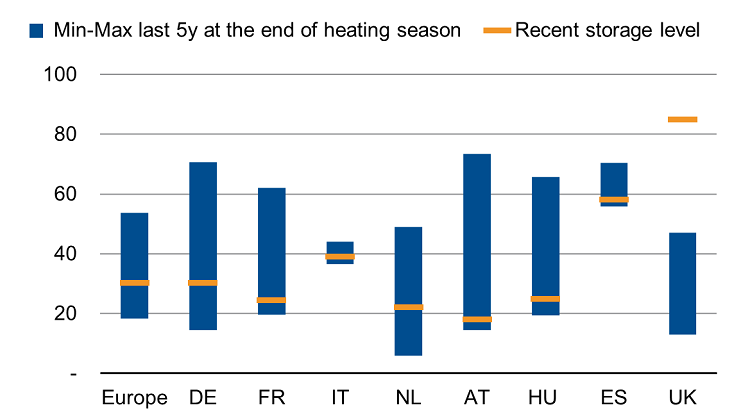

Figure 2: Current storage level well below historical levels in major markets in % (as of 23 Feb 2022)

Source: AGSI+ Aggregated Gas Storage Inventory, Scope Ratings

Source: AGSI+ Aggregated Gas Storage Inventory, Scope Ratings

The effect on gas and electricity prices will be amplified by Russia`s reaction to additional sanctions, which could include an interruption of gas flows to Europe. Russia has repeatedly disputed claims to using gas as a geopolitical weapon; Gazprom says it has fulfilled its contractual obligations to customers

“But disruption to gas flows will translate into greater margin and trading volatility for European utilities with gas-fired fleets, such as Engie, Iberdrola, Enel, and RWE. Gas flow interruptions to Europe would also affect the European gas supply business, primarily of European gas suppliers Uniper and Engie,” Zank said.

Utilities exposure

Only a few European utilities in Scope`s rating universe have direct exposure to Russia. This includes Finland’s Fortum, for which Russia contributes 10%-20% of recurring EBITDA, plus indirect exposure via Germany’s Uniper. Uniper itself generates roughly 20% of its EBITDA from Russian activities. For the time being, all operations are running normally but may be affected by sanctions at some point.

The earnings exposure of these utilities will be affected by adverse EUR-RUB exchange-rate movements and resulting lower earnings consolidation. However, all European utilities (power generators, energy suppliers and to a lesser extent grid operators) will be affected indirectly by upward price pressures on natural gas and wholesale electricity prices.

As we wrote in our update on the European energy price crunch in Oct 2021, upwards pricing pressure has most severe negative consequences on European energy (gas and electricity) suppliers which are not properly hedged and cannot pass on increased commodity prices to retail and commercial/industrial customers.

“Despite higher gas prices, increased commodity prices translate into higher wholesale prices, which is generally credit-supportive for power generators as they can usually pass on higher procurement costs to customers,” said Marlen Shokhitbayev, a director in Scope’s corporate ratings team.

"On the one hand, higher commodity prices improve absolute levels of net cash flow earned in the energy-supply business when supply margins can be upheld. On the other hand, higher wholesale prices widen earnable margins for electricity generators which have the capacity with the lowest marginal cost in the merit order, which runs from hydro, nuclear, unregulated renewables to gas and coal,” Shokhitbayev added.

We assume that big energy suppliers that have multi-year contracts with industrial clients use flexible pricing mechanisms under which increased procurement costs can be passed on to such customers so increase absolute earnings. But it also means that energy suppliers need to provide more upfront funding for margining until contracts have been settled.

There is another caveat. European governments had already shown in the second half of 2021 how nervous they were about near-term political fallout from rising energy prices. Some have either frozen energy prices or stepped in to cover price increases for certain consumer goods. Public intervention is certainly not a sustained solution, hence the risk of adverse political intervention and the potential levying of windfall profits from certain power generation assets is rising, to the detriment of utilities’ credit profiles.

In the end, end consumers will pay the toll, whether that’s households or commercial customers. Looking at the most energy-intensive industries, particularly basic iron and steel, cement, fertilizer, refineries, and organic chemicals companies are the most pressured by sustained high gas and electricity prices in Europe.

European energy policy

Looking at the heavy impact of geopolitical tensions in Eastern Europe and the heavy dependence on Russian energy exports for the whole continent, suggests another twist. Security as well as affordability of energy is paramount, so current geopolitical tensions have serious implications for the development of European gas and electricity supply. We have three principal conclusions:

- Europe needs to fix its gas storage problem. No short-term solution is within reach, particularly after the withdrawal of the certification for the Nordstream 2 gas pipeline. Additional investments in gas storage (better interconnection and potentially new storage capacities in countries where interconnectors may have only a limited support) are needed, along with requirements for of a minimum level at the start of the heating season. While LNG imports were largely able to compensate for the lower pipeline supply from Russia since the beginning of 2022, additional LNG imports are unlikely to replace all Russian gas flows given the limited LNG regasification capacity in Europe and will be costly.

- Renewable energy is the supporting factor towards carbon-free power generation in Europe. But given the low pace of the ramp-up in renewables and their integration into the energy system, nuclear can experience a renaissance. France has already indicated a medium-to-long term revival (as a measure to keep energy prices low and ensure security of supply). Other countries, primarily Belgium, the UK, and Spain might follow with lifetime extensions of nuclear assets. Developments in Central and Eastern Europe could be accelerated.

- Soaring energy prices in Europe underscore the sector’s exposure to regulation and political intervention. That in turn is leading to more political intervention to soften the impact on customers (particularly households and power-intensive industrials) and to limit windfall gains for some generators. If governments (re)-consider imposing caps on prices or limit profits for some generation capacity (hydro, nuclear) that is not good news for utilities’ power supply divisions, while it also limits the cash-flow upside in generation.