Announcements

Drinks

Higher materials and energy prices, supply-chain disruption strain construction company margins

By Rigel Patricia Scheller, Director, Corporate Ratings

By Rigel Patricia Scheller, Director, Corporate Ratings

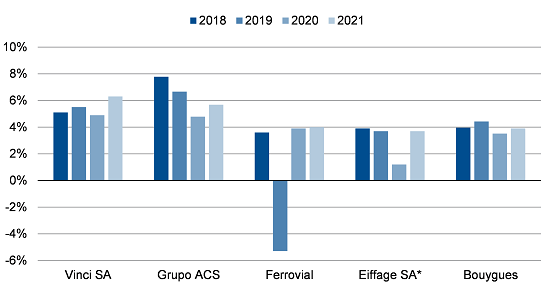

“Large construction companies such as Vinci, Ferrovial and ACS benefit from diversified business profiles, including civil engineering works, industrial construction and concessions, and they have strong bargaining positions,” said Rigel Patricia Scheller, a director in Scope’s corporate ratings team. “As profit margins in their core segment – construction – shrink, these companies have focused their strategies on expanding the concessions segment of their businesses, to benefit from recurring income and higher margins through infrastructure management.” For motorway concessions, average EBITDA margins are between 50% and 80%, for example.

Smaller and geographically concentrated companies might face more difficulties in managing rising construction material prices, not only from the cost side but also due to problems in sourcing essential materials. “This will result in less predictable and more volatile cash flows and profitability and could endanger their ability to complete projects. This will weigh on their business and financial risk profile and could ultimately impact their credit quality,” said Scheller.

Top European contractors: reported EBITDA margin of construction activities

* Operating profit

Source: public information, Scope Ratings

Russia is an important producer of a number of key metals such as copper, aluminium, palladium, platinum and nickel, which are used in the manufacture of stainless steel. Its invasion of Ukraine will exacerbate the shortage in building materials. Also, the production of many construction materials such as steel, bitumen, and cement is energy-intensive and will suffer if energy prices remain high. Other risks to the construction industry include a shortage of labour.

Higher energy prices will likely impact cement production in particular, since more than 50% of the cost of cement is directly or indirectly linked to crude oil prices. According to Germany’s Federal Statistical Office (Destatis), the price of reinforced steel bars grew by 53.2% YoY on average in 2021; the price of bitumen (used in road construction, buildings and foundations) by 36.1%. Producer prices for insulating boards made of plastics such as polystyrene were 20.7% higher; the price of chemical products also increased.

“Higher energy prices will impact construction companies delivering on fixed-price contracts. Customers are also concerned about the sharp rise in the price of materials that has caused delays in the completion of public works, led to stoppages or even on occasions caused cancellations of contracts. Higher materials prices have also led to a growing wave of deserted tenders,” Scheller said.

Download the report here.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions such as for Credit Sphere.