Announcements

Drinks

Aircraft finance: stiff sanctions on Russia put future of near USD 10bn in leased aircraft in doubt

By Dierk Brandenburg, Head of ESG & Credit Research

By Dierk Brandenburg, Head of ESG & Credit Research

Lessors domiciled outside of Russia currently have some 515 commercial jets and turboprops leased to operators in Russia. This represents roughly half of the commercial fleet in service at the outbreak of the crisis. The list could expand if Belarus is included in EU sanctions.

With an indicative current market value of almost $10 billion, these planes represent some 3.2% of the overall value of the global lease portfolio today. EU-based leasing companies account for up to half of the outstanding value, mostly incorporated in Ireland. There are 238 commercial aircraft, with a market value of $4.1bn, leased to customers in Russia from 10 Ireland-domiciled operating lessors.

The first problem for lessors is that the crisis is undermining customer credit quality. The biggest global challenge for the airline industry is rising fuel costs, but the international sanctions on Russia also put pressure on those carriers no longer able to enter Russian and European, and soon, US airspace. The bans disrupt European air travel. Overflight restrictions also complicate intercontinental connections between Asia and Europe. See our aviation commentary for more detail.

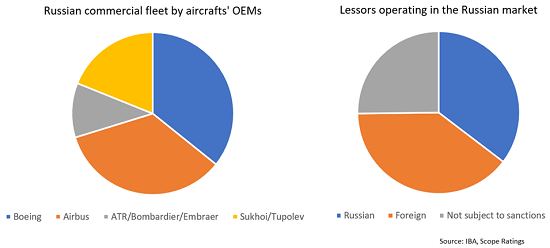

Secondly, aircraft financiers face sanctions-related challenges in Russia. One is the prohibition of the export of aviation technology to Russia. Western manufacturers account for 80% of the Russian civilian aircraft fleet, mainly narrow bodies supplied by Boeing and Airbus. According to aviation consultancy IBA, Russian airlines were expecting a delivery of about 37 new planes by both manufacturers this year.

In the EU, the sanctions prevent the sale of aircraft and spare parts to Russia and require EU-based aircraft finance providers to terminate their leases with Russian operators. EU-domiciled finance providers, including the Irish subsidiaries of non-EU firms, will need to terminate lease contracts and repossess their aircraft from Russia by the end-March 2022.

Those aircraft would need to be remarketed and redeployed elsewhere, thus, potentially putting pressure on lease rates and residual values. See our Project Finance commentary about aircraft values.

AerCap, the world’s biggest lessor after its merger with GE Capital’s leasing arm, has 154 planes leased to Russian customers, with an estimated value of USD 2.2bn or 5% of the value of its global fleet. Ireland’s SMBC Aviation Capital is the next most exposed, with planes valued at an estimated USD 1.3bn leased. Avolon has planes with an estimated value of USD 266m leased, according to Cirium, representing 1.6% of the value of its fleet.

While international lessors subject to the EU sanction regime account for about 50% of the Russian market, the remainder is accounted for by Russian-owned lessors, which are mainly subsidiaries of the large Russian banks many of which themselves are subject to sanctions. Sanctions affect at least 70% of the equipment used by Russian operators. The remaining 20% of the fleet is currently financed by lessors that are not yet directly affected by sanctions.

However. in our view it is unrealistic for lessors to repossess aircraft within a month because more than 80% of the planes are narrow-body and regional jets that unlikely to leave Russia for a neutral jurisdiction. Russia’s aviation legislator has banned international flights with foreign-leased planes from this week. Even under normal circumstances, we would have expected repossessions in Russia to take up to six months.

Without cooperation from the airline, it may also be difficult to track down planes in smaller airports in a country that has the largest landmass of the world. Airspace closures add further complications because flights between Russia and Western neighbors are prohibited. Lessors would need to collect planes in Russia and fly them out using complicated routes through the southern or eastern Russia.

In addition, the Russian Ministry of Transport is considering the nationalization of the Russian fleet to keep it operational. Given the dependence of Russian airlines on Western equipment and finance, that would appear a logical step. Aeroflot, Russia’s flag carrier, has leased about 50% of its fleet by value from non-Russian lessors.

The Russian government has made it extremely difficult for foreign creditors to receive debt payments. We have downgraded the sovereign to CCC, so it is a plausible scenario that Russian authorities block foreign leasing companies from repatriating planes. Airlines may still wish to cooperate to maintain access to foreign financing and planes in future years.

If the equipment is stuck in Russia for a prolonged period, this poses a significant risk to the cash flow for aircraft lessors. At this stage, it is not clear whether such losses are covered by war-risk insurance.

Lessors and other finance providers will struggle to collect rents and maintenance payments due to the SWIFT bans on Russian banks. Obtaining valid insurance cover from international insurers may also no longer be possible under sanctions. Asset values will decline because Russian operators will find it difficult to maintain the equipment with only limited access to spare parts. They may eventually abandon lower value aircraft such as ageing regional jets or turboprops.

One silver lining for lessors is the reduced risk that the global market will flooded with large numbers of Russia-based narrow-body aircraft needing to be remarketed.