Announcements

Drinks

Europe’s auto industry faces more supply-chain disruption, rising input costs amid war in Ukraine

By Georges Dieng, Director, Corporate Ratings

By Georges Dieng, Director, Corporate Ratings

Following the Western sanctions imposed on Russia, most original equipment manufacturers (OEMs) have halted vehicle exports to Russia and suspended deliveries to local dealers. However, it is not clear whether Russian operations will cease altogether as companies reassess strategy for the region. Last week, BMW, Mercedes-Benz Group and Volkswagen AG decided to stop vehicle exports to and halt production in Russia until further notice. The whole industry is expected to follow suit.

European OEMs will not be massively impacted by the collapse of the Russian and Ukrainian automobile markets as the markets are relatively small and car makers’ direct exposure is limited.

Russia and Ukraine combined represent merely 2% of global light vehicles sales despite the potentially much bigger market given their combined population of nearly 200 million people. Russia’s LV sales stood at 1.7m units in 2021, 43% below the 2008 peak, and around half the size of Germany’s. As for Ukraine, with 116k units sold in 2021, it is a tiny market in global terms.

Light vehicle sales in Russia & Ukraine vs Germany – historical trend (000 units)

Source: AEB & Ukrautoprom statistics

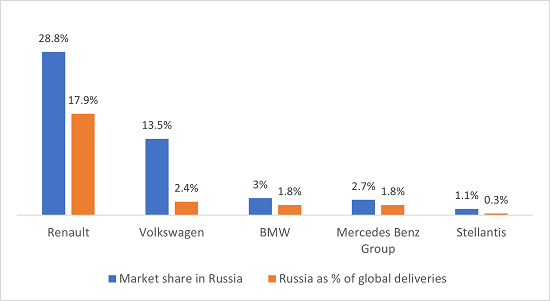

Secondly, with very few exceptions, the largest European carmakers have limited direct exposure to Russia and Ukraine. In Russia itself, the most prominent player is Renault through its own operations and majority-owned subsidiary Avtovaz PJSC, the largest Russian carmaker known for its Lada brand. With a sizeable contribution to its unit sales (~18%), production (~20%) and profit, Russia was undeniably a pillar of Renault’s recent performance.

German OEMs hold a combined market share of around 20% in Russia though their exports to both Russia and Ukraine accounted for only 1.7% of all cars exported from Germany, according to the Germany auto industry federation VDA. Volkswagen has the largest share (13.5%), but Russia represents only 2.4% of its global sales mainly via the Skoda brand, with limited earnings contribution - breakeven in 2017 after years of red ink.

European auto makers – exposure to Russia (2021 data)

Source: companies, AEB statistics

While the sector’s direct exposure to Russia and Ukraine is limited and manageable, we see more risks stemming from indirect exposure related to trade/supply disruption, higher energy/input costs, rising inflation and weaker consumer confidence.

The impact of supply chain disruption is already visible: the list of production stoppages is expanding by the day, especially among German OEMs. This is the immediate consequence of the war in Ukraine and more disruption can be expected due to rising transport restrictions, from no-fly zones for commercial aircraft to rerouting of rail and marine traffic.

Ukraine has become an important manufacturing hub for cable harnesses – labor-intensive components - used in the European automotive industry due to low labor costs and skilled workforce. The war is inevitably compromising the operations of several parts makers such as US-based supplier Aptiv PLC, Germany’s Leoni AG, France’s Nexans SA and Japanese suppliers Fujikura Ltd., Sumitomo Electric Industries and Yazaki Corp.

Leoni has suspended production at its two plants in western Ukraine as did Fujikura and Sumitomo Electric Industries. Finding alternative sourcing quickly will not be easy as cable harnesses are model-specific and complex to manufacture specially for high-voltage cabling required for electric vehicles. All OEMs are actively searching new production locations for this key component.

We expect that EU automotive production, which was set to rebound in 2022 thanks to an easing of the chip shortage in H2, will fall short of expectations.

Other risks include the impact of rising energy and commodity prices on input costs due to the surge in oil & gas prices and supply shortage of key raw materials sourced from Russia used in the industry, including aluminum, palladium and platinum.

Even before the Russian crisis, the industry was factoring in higher cost inflation in their outlook for 2022. Faced with this additional cost pressure, OEMs will try to offset these headwinds through incremental cost reduction programs, cutting non-EV related capex, raising prices and prioritising higher-margin vehicles. The car makers we cover will benefit from their ample liquidity and prudent financial policies.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions such as for Credit Sphere