Announcements

Drinks

European telecoms: operators’ infrastructure sell-off set to slow; credit metrics little improved

“In the case of direct asset sales, the impact on credit metrics has been marginal because the increase in cash balances is offset by additional lease commitments consolidated on the balance sheet in line with new accounting standards, namely IFRS16,” says Thomas Langlet, analyst at Scope Ratings.

“In Europe, there are no clear cases of improved MNO leverage after the partial or full sale of tower portfolios,” Langlet says, noting that long-term operating leases remain typical in the sector.

Europe’s telecoms sector has still undergone significant structural change in the past five years with the growth in the number and size of independent tower companies (“towercos”). Towercos have acquired infrastructure assets from those mobile network operators (MNOs) eager to outsource passive mobile networks: the transmission towers, antennas and associated real estate.

Independent towercos’ share of Europe’s telecoms infrastructure increased to more than 20% in 2021 from 14% in 2018, though passive infrastructure outsourcing remains lower than it is in the US where 90% of towers are operated independently of MNOs. Many large European MNOs have or are now considering more asset-light strategies regarding the operation of Europe’s more than 420,000 mobile towers. Deutsche Telekom AG is reportedly reviewing its options for its mobile business tower in Europe in the latest sign of this trend.

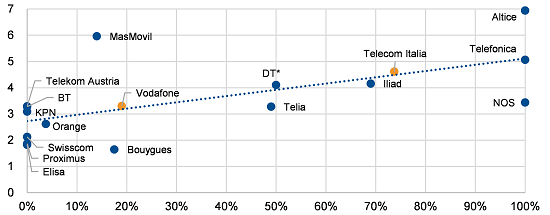

Highly leveraged telecoms operators (net debt/EBITDA) are biggest proponents of infrastructure-light strategies (% tower outsourcing)

*Following reports of possible infrastructure disposals, we assume 50% divestment for DT’s tower assets. TIM and Vodafone have merged their towers in Italy. Source: Scope, Capital IQ

However, the sector is maturing fast. Europe’s standalone telecoms infrastructure sector is now so concentrated that any future consolidation will likely to gain the attention of the competition authorities, while Europe’s most indebted operators are those which have largely or entirely outsourced their infrastructure activities already (see chart).

Cellnex Telecom SA, created in 2016, has become the largest European independent telecom infrastructure company with more than 71,000 towers. The company’s EUR 10bn acquisition of 24.6k towers from CK Hutchinson Holdings raised “significant competition concerns” for the Competition and Markets Authority in the UK. As such, the deal was approved on condition that Cellnex sell 1,000 towers in the UK. Cellnex’s deal with Hivory in France raised similar concerns.

Rising interest rates, the low-growth outlook for the European telecoms sector and reluctance of many of the region’s telecoms operators to lose control over their infrastructure also suggest that deal making will tail off.

“After all, the outsourcing of passive infrastructure involves a trade-off between a reduction in capital investment and a loss in operating and strategic flexibility and control. We expect a reduction in the number of large acquisitions done by independent tower companies,” says Langlet.