Announcements

Drinks

Credit Talk: retailers, consumer goods firms shift priorities to cope with inflation, rate hikes

In this latest Scope Ratings interview, Adrien Guerin and Eugenio Piliego, corporate rating analysts at Scope Ratings, examine these challenges in conversation with Dierk Brandenburg, head of credit and ESG research.

Dierk Brandenburg: Inflation and falling consumer confidence are making headlines. How bad is for retailers and are they passing on higher prices?

Adrien Guerin: It has become tough for retailers to pass on prices due to competition from e-commerce. In a low- or zero-inflation environment, they could squeeze suppliers. Today, with inflation rising throughout the supply chain, retailers are forced to accept higher buying prices or destock items.

For example, Albert Heijn, the Dutch supermarket chain owned by Ahold Delhaize NV, no longer stocks Nestlé SA products on pricing grounds. French retailer Carrefour SA is making suppliers “take-it-or-leave-it” offers. The result of such pushback is clear for example in consumer goods supplier Unilever NV’s latest sales figures, which show an 8% gain in price but 1% decline in volumes.

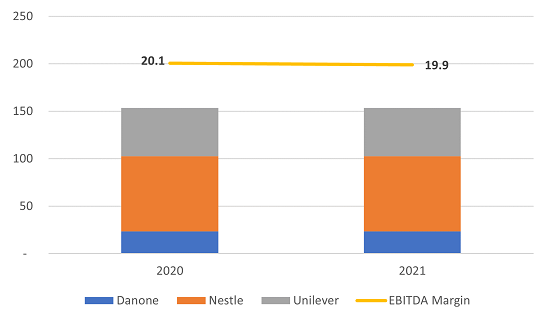

Margins feel the pinch – selected European consumer goods group

Revenues and Ebitda margins 2020-21

Source: Capital IQ, Scope Ratings

After the post-Covid surge in demand, consumers are again delaying discretionary purchases. Pressure is growing on retailers’ margins and Ebitda. Free operating cashflow growth will slow over next few years. In response, companies are building up inventory of non-perishable goods to lock in current prices, or by focusing more on ancillary businesses like services (repair, customisation, renting etc.).

Post-pandemic pandemic demand will peter out in the coming few months given skyrocketing energy prices and lingering supply-chain disruptions limiting the availability of some goods, especially new products. Whether the demand is still there when these goods arrive in stores remains to be seen.

Is there a shift towards discounters again?

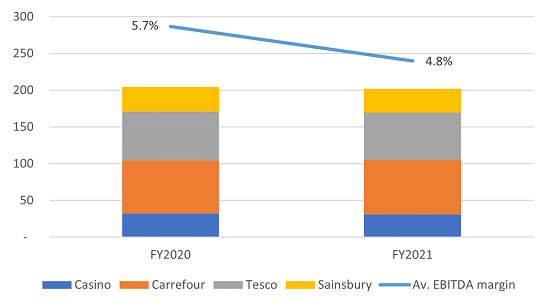

AG: Retailers have long developed private labels. In UK, more than 50% of products sold by supermarkets are own-label products. In the UK, Aldi and Lidl now have 15% market share in UK against only 4% in 2011. Tesco PLC’s recent profit warning shows how discounters are gaining market share.

Margins feel the pinch – selected European retailers

Revenue and Ebitda margins 2020-21

Source: Capital IQ, Scope Ratings

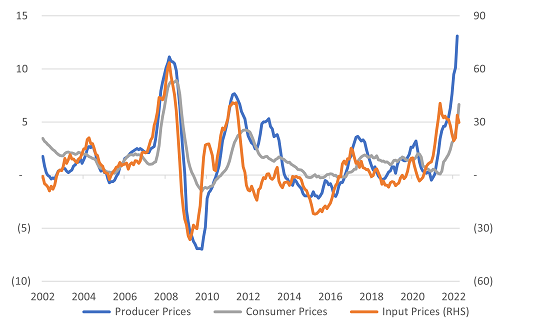

DB: Food prices have surged higher, largely due to the war in Ukraine: what is the sector outlook?

Eugenio Piliego: The war has played its part but input prices for consumer-goods firms were increasing last year: Covid, supply-chain problems, and rising interest rates all played their part. That has continued this year, worsened by the war in Ukraine. Companies have factored in 15% cost inflation in recent guidance, not just for raw material prices but also energy and transport.

We see some pressure on producers’ margins, but retailers have started to accept price increases. Much depends on how long these trends persist, particularly for feedstocks such as wheat or sunflower oil that are impacted by the war.

Inflation surges

Producer, consumer and input prices 2002-22 (% change)

Source: Macrobond

For branded-goods firms, can marketing help compensate?

EG: The big brands are facing competition from all sides, with new rivals offering health-conscious, green and other alternative products. The response is to leverage brand strength and innovation and change their product mix to protect margins. Take French dairy-products supplier Danone SA, shifting to high-protein, health-orientated yoghurt and dairy-alternatives, or brewers such as Heineken pushing the sale of premium brands and tapping growing demand for alcohol-free beer.

How do we see the funding issues for the sectors amid inflation and rising interest rates?

AG: Overall, the retailing sector is well financed. During Covid, the sector used state support and low-interest debt as refinancing opportunities. Gross debt remains manageable. Maturities have lengthened. The pressure is more on short-term financing. We are likely to see higher working capital needs and more recourse to bank facilities particularly to finance seasonal inventories at higher cost.

Capex is a case-by-case question. Some retailers have invested heavily in online and logistics, which leaves room to make savings and invest in generating new sources of revenue. However, many companies are behind the curve as Covid accelerated the shift to online shopping, so some may now face difficulties to finance catch-up investment.

EP: For big brand food producers, we see no serious financing issues, though possibly a change in capital allocation away from dividends and acquisitions. Higher interest rates for euro-denominated debt are not yet a big deal – even now some companies are still refinancing older debt at lower rates.

Smaller producers are more vulnerable to inflation and rising interest rates, particularly in central and eastern Europe. To take one example, Hungarian pork processor Kometa 99 faces cost increases in livestock and feedstock prices.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions for Credit Sphere, providing institutional clients access to Scope’s growing number of corporate, bank, sovereign and public sector ratings.

Contributing writer: Matthew Curtin