Announcements

Drinks

Credit Talk: chemical sector’s speciality, commodity divide widens on deal-making, inflation

In this Scope Ratings interview, chemical-sector analysts Klaus Kobold and Eugenio Piliego talk through the pressing issues facing the industry with Dierk Brandenburg, head of credit and ESG research.

Dierk Brandenburg: The big question for the chemicals sector today in Europe is the security of its supplies of natural gas and the cost of that cost in the context of the war in Ukraine and sanctions on Russia. How is the industry holding up?

Klaus Kobold: For now, the leading chemicals companies that we cover at Scope are taking things in their stride, having reaffirmed their earnings guidance for 2022 at their latest quarterly results presentations. That is a strong signal that cost increases can be absorbed by passing them on to customers, assuming that there is no further escalation in gas prices.

In turn, this confidence suggests that the industry is no immediate danger of a degradation in credit quality even if trading conditions are likely to become more difficult in the second half.

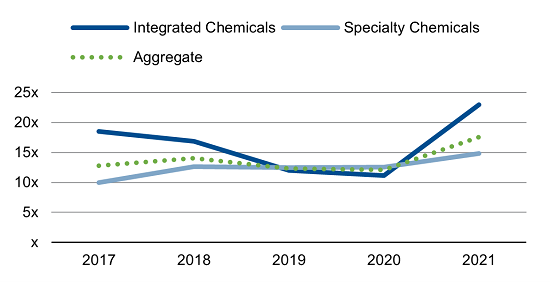

Figure 1: Chemicals sector finances: integrated companies face commodities squeeze

(aggregate Scope-adjusted net debt/Ebidta multiples*)

*Integrated chemicals: BASF, Covestro, Elkem, LyondellBasell; specialty chemicals: Air Liquide, Arkema, Evonik, DSM, LANXESS, Linde, Syngenta

Source: company reports, Scope Ratings

DB: Why are speciality companies so confident that they can withstand raw material price increases? What is the outlook for margins?

Eugenio Piliego: We need to remember that prices for commodity chemicals are market driven whereas speciality chemicals and industrial gas suppliers sell their products on longer-term contracts where prices are negotiated. For the larger specialty producers, they have been able to pass on prices and protect margins. Smaller producers without the same pricing power are looking more vulnerable to seeing their margins squeezed.

KK: Indeed, among the bigger specialty producers Scope covers, we have seen some impressive price increases. Germany’s LANXESS AG raised prices by around 30% in Q1 across their portfolio. More specifically, suppliers of high-performance polymers have pushed through among the highest price increases as have producers benefiting from strong demand such as France’s Arkema SA and Belgium’s Solvay SE.

EP: The question for commodity chemicals producers like BASF SE is more the possibility that the supplies of Russian natural gas on which they are dependent might be disrupted by international sanctions on Russia or Russian retaliation against Europe for its support of Ukraine. For the moment, the commodity chemicals producers who we have been talking to see a greater likelihood of a temporary cut in supply leading to temporary halting of chemicals output rather than any sustained disruption. At the same time, these companies are looking at diversifying their raw material and energy supplies.

Figure 2: Uneven credit pressures in Europe’s chemicals sector

(Aggregate interest cover)

Source: company reports, Scope Ratings

Another question is keeping the right balance between input cost increases and selling price increases. In the fertiliser segment, which has had to cope with steep raw material price increases, companies have preferred to halt production than pass on sky-high input costs to end-market customers.

DB: What M&A trends are we seeing in this context?

KK: Deal making in the sector is not necessarily related to the gas crisis, but we are seeing the continued reshaping of the global industry. In Europe, Netherlands-based DSM NV is combining with Switzerland’s Firmenich to create the world’s largest maker of fragrances with combined revenue of more than EUR 11bn, having sold its materials business to LANXESS and a private equity firm for EUR 3.7bn including debt.

EP: Indeed, this is a good example of how players are jockeying for position to find higher-margin, speciality businesses to concentrate on. One area of focus is food and nutrition as consumer goods companies turn to higher-margin functional products. We have seen earlier transformational deals such as the USD 45bn merger of International Food and Fragrances with DuPont’s nutrition and biosciences unit completed early last year as well as Kerry Group’s push into nutrition.

Specialisation is clearly a way to protect margins. Commodity chemicals suppliers or speciality players exposed to commoditised end-markets such as packaging face the squeeze of rising input costs and possibly slackening demand. Remember, higher oil prices have an impact on demand for all sorts of products, not least cars and automotive-related products such as lubricants.

DB: Demand destruction is an issue for the chemicals sector but if you have a good product mix, that will shore up margins. In this context, what are the credit consequences given interests rates are on the rise again?

KK: From a liquidity and maturity point of view, most European chemicals companies have rebalanced or lengthened maturity profiles in recent years. A combination of business growth and mostly judicious M&A deals have ensured that credit profiles have improved, leaving many companies with balance-sheet capacity for more acquisitions.

EP: The pressure is more likely to emerge at smaller commodity chemicals facing higher working capital requirements, not least if output is disrupted, putting a premium building up liquidity reserves. On the funding front, higher interest rates particularly in central and eastern Europe could represent a constraint on expansion capex for companies which do not have strong specialty portfolios, bearing in mind that inflation is also affecting construction and equipment costs.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions for Credit Sphere, providing institutional clients access to Scope’s growing number of corporate, bank, sovereign and public sector ratings.

Contributing writer Matthew Curtin