Announcements

Drinks

Schuldschein private debt: ESG-linked, SME deals drive market toward record annual volumes

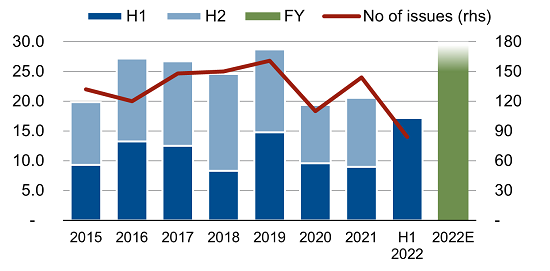

Completed deals plus those being placed in the first eight months of the year amount to around EUR 20.5bn, not far from entire annual activity in 2020 and 2021 when Schuldschein issuance fell back from the 2019 pre-pandemic record of around EUR 29bn. First-half issuance was at least EUR 17.5bn from 80 transactions (based on closing dates).

“The private-debt segment is again demonstrating its appeal in uncertain times as activity dries up in the market for European non-financial corporate public bond issuance,” says Sebastian Zank, deputy head of corporate ratings at Scope Ratings.

“Issuance is likely to slow in the second half of the year after many issuers have already tapped the market to refinance Schuldschein at favourable rates. Coupons, though typically less elastic than on those on public debt markets, are sure to follow bond-market yields higher in due course,” Zank says.

Market rebounds: Schuldschein issuance 2015-22E

Volume EUR bn (lhs); number of issues (rhs)

Source: Scope Ratings

Surge in jumbo deals underpins buoyant volumes

Big-ticket deals from a variety of companies across Europe and mostly, but not exclusively, from capital-intensive sectors have underpinned activity in the private-debt segment so far this year.

German real estate firm Vonovia AG led the jumbo deals with a EUR 1bn issue. Discount supermarket operator Lidl AG raised EUR 850m, while Belgian IT company Etex NV raised EUR 800m, with German flavours and fragrances company Symrise AG and international steel producer ArcelorMittal SA in EUR 750m deals.

Schuldschein issuer diversity grows; ESG deals in favour

“One feature of the year’s activity so far has been the significant number of large, investment grade, and frequent issuers returning to the market often with large ESG-linked deals,” says Zank.

Year-to-date ESG-linked Schuldschein volume has exceeded that for all of 2021, with the proportion of total activity at 40% running ahead of ESG-linked non-financial corporate debt issuance of around 31%. Large ESG-linked Schuldschein ESG deals includes jumbo placements by Etex, Symrise, Holcim, Axpo, Degewo, SIG and OeBB.

“One drawback we have found is the rather insignificant coupon step-ups triggered by a failure to meet the defined sustainability targets,” says Zank. “Indeed, the many deals with a penalty of only 2.5 to 5 basis points look like smoke and mirrors to us. This is significantly lower than what we see for ESG-linked bonds which usually have double-digit basis point coupon steps in the region of 25-75 basis points.”

The variety of issuers that have tapped the private-debt segment this year is a reminder that the Schuldschein retains its appeal for small and medium-sized enterprises (SMEs) as well as large multinational corporations. Deal size has ranged from EUR 5m to EUR 1bn, with SMEs accounting for a significant proportion of issuers.

“Investors still need to be alert about credit quality considering the difficult macroeconomic and financial outlook and the large number of unrated SMEs that have come to the market in 2022 despite the absence of credit events so far this year,” says Zank.