Announcements

Drinks

Global container shipping faces rising macroeconomic, geopolitical and event risks

“At this point in the year, it is very unlikely that overall market constraints will significantly reverse. Declining freight rates underscore the cyclicality the shipping industry has historically been exposed to. But extrapolating favourable market conditions beyond 2022 is difficult,” said Tiffany Ng, director in Scope’s corporate ratings team.

The second quarter had seen multiple earnings beats from major names in the transportation/logistics sector, as supply-chain bottlenecks and high freight rates boosted profitability in ocean freight. Capacity has also shown signs of recovery, albeit still benchmarking lower than 2019/pre-Covid levels.

The downward correction in freight rates has not been mirrored yet in earnings, which have continued to be record-breaking for shipping carriers and have led to continuous upward revisions in guidance for full-year 2022. “But as earnings reflect the freight rate environment on a delayed basis, there is reason for caution after this year,” Ng cautioned, “as other macro events have also raised the level of uncertainty as to how much longer the situation benefiting carriers can persist.”

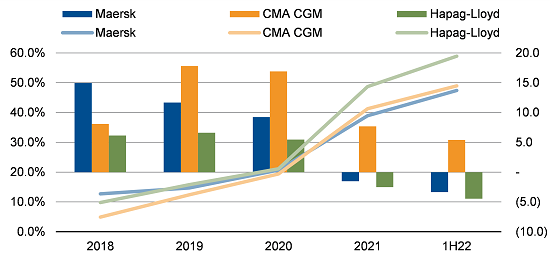

Profitability vs. net debt ($bn) of major container carriers

Notes: Reflects reported EBITDA and reported net debt. 2018-2019 change in net debt at CMA CGM largely due to accounting change (IFRS 16).

Source: CMA CGM, Hapag-Lloyd, Maersk, Scope Ratings.

Reassuringly, companies look to have exercised prudence with respect to their debt levels in this period. They have built robust balance sheets from their bumper profits; some showing a substantial net cash position. This should provide them with some buffer during the impending drop in top-line revenues and EBITDA. The sector could see credit deterioration in 2023 and beyond, though at what pace is uncertain.

The steps carriers have taken to respond to and have invested proceeds of the Covid era to their advantage could dampen historic sector volatility. These steps include right-sizing their capex investment into future assets, such as orders for new and cleaner vessels, and seeking to diversify their operations via M&A into higher growth, less cyclical areas like logistics.

The Covid and post-pandemic eras have shown that effects on transportation/logistics are not one-offs. They have driven a secular change in consumption and logistics patterns that have played a part in feeding the supply-chain bottlenecks that still persist.

“The past two years have given rise to levels of profitability never before seen in the industry. However, companies in the sector need to remain vigilant to the many signals of impending slowdown in their joyride of sequential earnings growth,” Ng said.

Download the full report here.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions for Scope`s credit rating feed, providing institutional clients access to Scope’s growing number of corporate, bank, sovereign and public sector ratings.