Announcements

Drinks

Pharma sector well placed to cope with slowing Covid-linked sales; hospitals face cost challenge

“Underlying growth remains robust,” says Olaf Tölke, head of corporate ratings at Scope. “The sector remains a refuge from geopolitical, economic crises though the dynamic sales growth and earnings impetus from pandemic-related vaccine, treatment, diagnostic demand will slow sharply in 2023.

“Our base case scenario is for a one-third decrease of Covid-related product sales next year compared with 2022,” says Tölke.

While levels of vaccination and immunisation worldwide are high, Covid-related business will remain an important source of revenue and profit – and depend on future rates of infection.

“The sector’s credit quality will at least remain stable, even though there are sub-sectors under specific pressures, most notably hospitals, exposed to rising energy and staffing costs,” Tölke says.

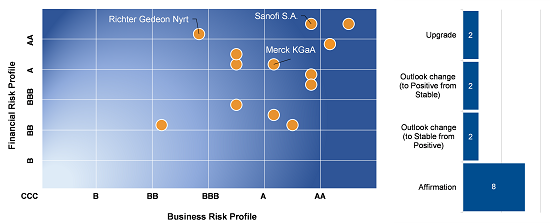

Scope’s healthcare ratings universe and rating actions in past 12 months

While trading conditions in the pharmaceutical sector continue to look good, credit concerns might resurface if companies decide to use their strong balance sheets for largescale debt-financed acquisitions to offset declining pandemic-related revenues rather than the more bolt-on acquisitions typical of the past couple of years.

Scope identifies the following main trends for Q4 2022 and FY 2023:

- No further largescale Covid-related lockdowns look likely in the world’s largest economies, China excepted.

- Covid treatments are likely to remain in demand in 2022, based on hefty government orders. Mid-term prospects depend on infection rates and hospital utilisation, but demand might peak this year.

- Repercussions from the pandemic continue to benefit providers of OTC drugs, diagnostics and medical equipment.

- Credit quality is supported by the favourable outlook for business risk; financial risks remain contingent on corporate strategy, notably M&A and shareholder remuneration.