Announcements

Drinks

EU carbon border tariff could lead to increased carbon leakage

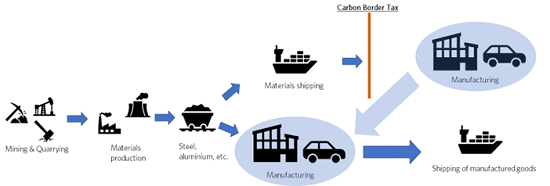

The carbon tax that has been introduced does not apply to imported manufactured products, regardless of their carbon content.

“Selectively taxing imported materials is therefore unlikely to contribute to lower emissions and may even lead to higher global emissions unless the tax is expanded to other sectors,” said Bernhard Bartels, head of ESG at Scope.

To illustrate the point, the carbon emissions of basic metals producers in German production (scope 1+2) of around 650g of carbon per euro of production value compare with around 1.6kg of carbon per euro of production value in China. Relocating metal production and downstreaming processing from Germany to China could therefore increase global carbon emissions while simultaneously leading to a loss of downstream economic activity within the EU.

“In many cases, imported goods have made a long journey from sourced inputs to processing and manufacturing, which involves different countries and emissions intensities according to production step,” Bartels said. “While the supply chain becomes increasingly complex for manufactured products such as computers and electronics.”

Bartels believes the European Commission will face more calls for the carbon tax to be expanded. “Identifying the origins of embodied carbon could become part of the new Corporate Sustainability Reporting Directive,” he suggested. The CSRD will require European corporates to report on supply-chain exposures after 2024.

Large European cement producers like Heidelberg Materials, Saint-Gobain and Holcim are unlikely to shift production to other regions, irrespective of tax regimes. Cement and concrete production is a typical example of rarely-traded goods given their heavy weight and required proximity to final use in local construction: 94% of domestic production takes place within the EU. Since minerals are mostly used for buildings and infrastructure, there is limited scope for subsequent trade of minerals embodied in final goods.

Relocation of manufacturing to avoid carbon taxation

Source: Scope ESG Analysis GmbH

“The EU faces a small tax base for the import of materials but could see some domestic materials and manufacturing relocate without being able to tax re-imported values if these are shipped to the EU as final products,” Bartels said. “In this case, EU domestic production of materials could relocate to jurisdictions with similarly attractive conditions for subsequent downstream sectors, such as automotive and electronics.”

Steel and aluminium have lower trade costs than cement given their different weights. More importantly, basic metals serve as inputs for manufacturing, electronics, and household appliances. These sectors are highly trade-intensive compared to the materials industry. With 14% of total value, the import of basic metals into the European Union accounts for a minor share of total production and thus provides a limited tax base for carbon tariffs.

Download the full report here.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions for Scope`s credit rating feed, providing institutional clients access to Scope’s growing number of corporate, bank, sovereign and public sector ratings.