Announcements

Drinks

Scope Financial Conditions Index improves in January

By Dierk Brandenburg, head of credit and ESG research, Scope Ratings

By Dierk Brandenburg, head of credit and ESG research, Scope Ratings

Risks to credit quality are concentrated in the rate-sensitive sectors such as real estate and consumer products, with little evidence that a widespread wave of corporate defaults is in the offing in Europe.

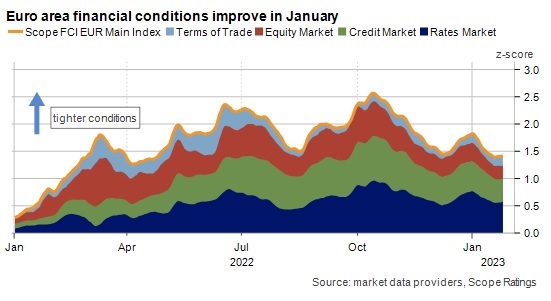

Financial conditions in the euro area are off to a strong start in 2023, according to Scope’s Financial Conditions Index, having weighed heavily on the credit environment throughout 2022. The index tracks 10 financial variables across equity, credit, interest rate, foreign exchange, and commodities markets and measures their movement relative to their long-term historical averages.

As far as wider financial markets are concerned, the index shows that the most recent tightening cycle already peaked in October 2022, when the fear of inflation and recession where the highest in Europe, leading to depressed valuations across rates, credit, and equities. A weak euro provided little relief to exporters as it exacerbated the adverse impact of rising energy prices.

Since October, equities and credit have recovered as energy prices fell and inflation fears subsided. This trend resumed in January amid increased confidence that the euro area will avoid a recession. Scope currently forecasts 0.7% growth for the euro area in 2023, though we expect central banks to keep a tight grip on financial conditions as core inflation will remain high.

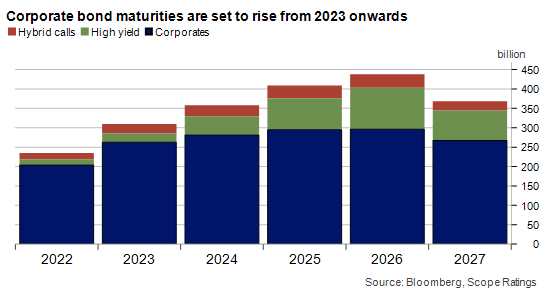

The improvement has opened a much-needed window for European companies to refinance their debt after a marked slowdown in 2022 due to the difficult capital markets environment. While the maturity schedule was relatively light in 2022, refinancing needs are set to rise again from 2023, putting extra pressure on corporate issuers, especially in high-yield and hybrid markets.

Investment grade companies are mostly well placed to absorb the higher coupons, including those on their hybrid debt, but high-yield companies face a higher burden given already elevated leverage. Not surprisingly, high yield issuance dropped sharply in 2022 and has yet to recover.

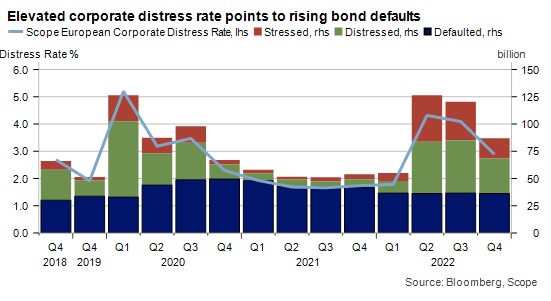

The deterioration of financial conditions has led to a sharp increase in the corporate distress rate in Europe. While low default rates meant that the amount of defaulted debt remain stable, the volume of bonds trading at stressed or distressed levels jumped sharply to levels last seen at the start of the covid crisis and has remained elevated since. Scope’s corporate distress rate tracks the pricing and default status of bonds and loans issued by European non-financial corporates.

As in 2020, it is only a matter of time before default rates accelerate, despite the improved refinancing environment. Two-thirds of distressed debt is concentrated in the real estate and consumer products sectors, especially in Germany, France and the UK. For now, there is no evidence of a widespread wave of corporate defaults across Europe outside these countries.