Announcements

Drinks

Oil and gas: IOCs’ caution on renewables reflects financing conditions, market uncertainty

By Marlen Shokhitbayev, Director, Corporate Ratings

Hurdle rates of investments are primarily driven by cost of capital, project risks and strategy. The surge in inflation in the past 18 months has led to tighter monetary policy and higher market interest rates, thereby driving up the cost of equity and debt.

The IOCs’ investments in the renewables energy sector are far from immune to this change in financing conditions, whatever the political impetus behind the energy transition. Achieving returns on equity of more than 10% on solar and wind power projects in developed countries is possible only through adding leverage – less attractive than it once was – and possibly selling down the IOC’s investment, as TotalEnergies SE did recently with 50% in a portfolio of renewables projects to Crédit Agricole Assurances.

In this context, it is little surprise that IOCs prefer low-carbon and other transformative investments which can be most easily integrated with their core businesses, have short payback periods and therefore better economics, such as sustainable fuels, biogas, hydrogen, mobility services including electric vehicle (EV) charging. Recent examples include acquisition of Archaea Energy Inc. by BP PLC, Nature Energy Biogas A/S by Shell PLC and cooperation between TotalEnergies SE and Air Liquide SA on a range of hydrogen-related projects.

Investments in biofuels and electric mobility solutions are expected to generate returns of above 15%, and even investments in relatively nascent technologies like hydrogen have double-digit return profiles in comparison to the 6-8% unlevered returns for pure renewables, according to BP. Nonetheless, selective investments in electricity value chain (wind, solar, storage etc.) are not completely off the table. The Inflation Reduction Act in the US could attract investments from IOCs which may see similar opportunities in some emerging markets.

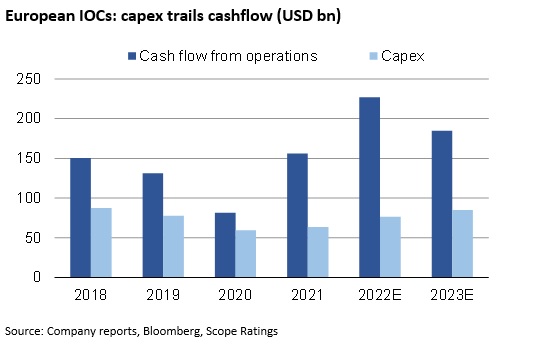

Capex growth in 2022 and future spending should also be seen in the context of cuts IOCs made at the height of the Covid pandemic in addition to the supportive context of the upswing in energy prices and the impact of inflation on project costs.

Europe’s IOCs lead US counterparts in low-carbon investment

US oil majors are still playing catch-up with their European counterparts in terms of investment in low-carbon business, though there is also divergence among the European companies. Shell and BP seem reluctant to increase expenditure on such projects, but TotalEnergies plans to spend USD 5bn in 2023 compared with USD 4bn in 2022, while still recognising the challenges of combining growth and profitability in the segment.

Also worth remembering is that IOC executives are contending with the considerable uncertainty regarding the length of the current commodity cycle linked to the outlook for inflation and growth in the US and Europe, further repercussions of Russia’s war in Ukraine, the speed and scale of the Chinese economy’s recovery from zero-Covid, among other factors.

It is no surprise then that the IOCs are prioritising short-cycle capital projects, paying down debt, and generous shareholder remuneration tilted toward flexible instruments such as share buybacks and special dividends.

IOC hesitancy over full-throated investment in low-carbon projects should not be misconstrued as a lack of overall investor interest in renewable energy.

Utilities, including independent power producers, and financial investors are better positioned for such investment as they typically have lower costs of capital. Power companies in particular benefit from existing expertise in electricity generation, transmission and distribution, positioning them well to integrate wind and solar energy into their businesses.

Rohit Nair, Director, Corporate Ratings, contributed to this commentary