Announcements

Drinks

UK telcos: fibre investment surge to squeeze medium-term interest cover, profit margins

By Rohit Nair, Director, Corporate Ratings

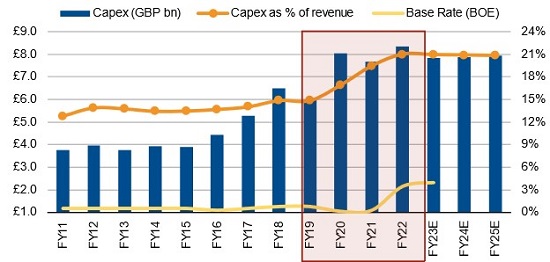

We expect to capex upcycle to continue to at least 2025, primarily on full-fibre broadband rollout but also on mobile services. Industry capex will average more than GBP 9.0bn a year till 2025, as both incumbents and alternative providers (altnets) compete to roll out services in newer areas to secure first-mover advantage.

The spurt in capex partly reflects the slow start that telcos in the UK made in the transition to a full-fibre broadband, leading to increasing capex over the past three years. Capex as a percentage of revenue has increased sharply to around 21% of revenues in 2022 from around 15% in 2019.

Unfortunately, the expansion comes amid increasing interest rates and inflationary pressure, which means that UK telcos will have to pay significantly higher costs for its capex plans over the medium term.

Figure 1: Spending bulge: capex plans for UK telcos 2015-25E

Source: Company reports, Scope, Bank of England

UK sector retains strong credit metrics though interest cover to shrink

To be clear, incumbent UK telcos continue to be well-placed in terms of credit metrics, with operating profitability of over 30%, ensuring they have strong debt protection.

However, the high capex also means that the telcos will be unable to significantly deleverage over the medium-term, which implies that an upward movement in ratings is equally unlikely over the next 18-24 months.

Given that incumbent telcos are expected to maintain dividends and/or share buybacks, debt falling due over 2023-2025 will be refinanced, rather than repaid as they deploy internal cash generation for capex. Nonetheless, as the incremental capex is de facto financed through external debt at higher, and increasing, costs, interest cover for major telcos will likely deteriorate in the medium term, though not sufficiently to lead to changes in credit ratings.

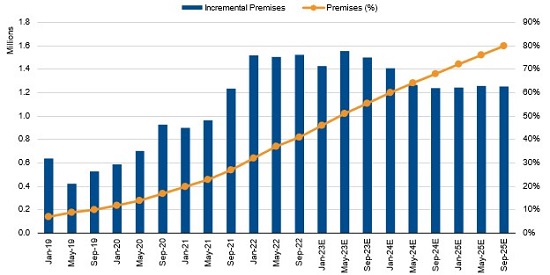

Currently, telcos are adding around 1.5m premises to their full-fibre networks every 4 months, or around 375k premises monthly. We expect this capex to remain at current levels till 2023, before dropping slightly in 2024 and 2025, as most of the urban capex is completed.

Figure 2: Current and projected reach of full-fibre connectivity in UK

Source: Ofcom, Scope

Fibre rollout costs rising; consumer take-up sluggish

The investment in full fibre is not without its challenges, even after accounting for the high cost of building the infrastructure. The high cost of installation means that full-fibre networks are primarily made available in urban areas, where there is a higher population density (allowing for lower costs per line passed) and a greater demand for internet services, leading to increased competition and possible lower returns, even after accounting for inflation-driven price increases.

Given that there are approximately 31.5m premises in the UK, and current targets call for providing full-fibre connectivity to 78m premises. Altnets such as CityFibre and Hyperoptic have promised to connect 30m premises. Openreach, owned by BT Group and whose network is used by Sky Group and TalkTalk Group among others, is targeting 25m premises. Virgin Media O2 is targeting 23m. An average site is expected to have access to more than 2.5 connections. In practice, this would mean urban areas having access to three or more fibre connectivity providers, while rural and less populated areas might have access to one or two at most.

The second challenge involves ramping up use; currently fibre take-up rates remain sluggish, with customers in only 25% of premises where full-fibre broadband is available subscribing. Only with mass-market adoption will the providers be able to sufficiently spread costs and generate profit. Though companies are offering incentives to customers for switching to fibre, such as free installation and discounted rates for switching, take-up has not been as accelerated as hoped.

The ability of telcos to first upgrade their networks at high and increasing cost, and then convince end-customers to switch to full-fibre services over the next 3-4 years will determine if the returns are commensurate with the outlay, notwithstanding the overall economic and societal benefits of faster connectivity. Till then, competition will ensure pricing remains in line with market expectations, while inflationary pressures and increasing costs compress margins and potentially lower interest cover.