Announcements

Drinks

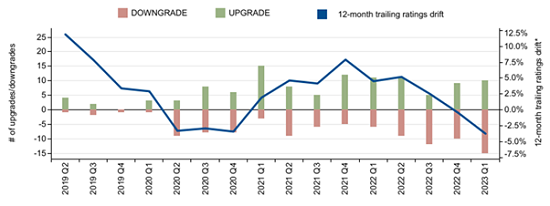

Structured Finance: Downward trend in trailing ratings drift continues

Of the 296 structured finance instruments monitored over the last 12 months, Scope downgraded 16%. Half of those were NPL transactions and one-third were CRE/CMBS. The actions were down to inflation and the rising interest-rate environment.

Twelve per cent of instruments monitored were upgraded, mainly because of better-than-expected collateral performance. Instruments upgraded were principally Auto and Vehicles (23% of upgrades), Other (20%) and some NPLs too (17%). Ratings drift is the ratio between upgrades minus downgrades and the number of monitored ratings over the previous 12 months.

12-month trailing ratings drift

Source: Scope Ratings

At the end of Q1 2023, Scope had rated almost EUR 235bn in structured finance instruments. Year-on-year rated new-issue volume growth stood at approximately 10% in Q1 2023, with a total of EUR 6bn in rated new-issue volumes in the first quarter of 2023. Over the past 12 months, Scope rated 105 new instruments across 79 transactions including 47 CRE/CMBS instruments.

In the first quarter of 2023, we updated the General Structured Finance Rating Methodology, the Consumer and Auto ABS Rating Methodology and the Asset Portfolio Rating Methodology.

Transaction of the quarter was CASSIA 2022-1 S.R.L., a commercial mortgage-backed securitisation (CMBS) originated by Bank of America and Goldman Sachs and sponsored by Blackstone Group. Scope Ratings assigned a preliminary ratings (P) A+SF, (P) BBB+SF and (P) B+SF rating to the Class A, B and C notes.

Scope also released a commercial real estate credit-assessment tool consistent with Scope Ratings’ CRE Loan and CMBS Rating Methodology. The CRE scorecard relies on an expected-loss approach combining term and refinancing default and recovery analysis and leveraging on a Monte Carlo simulation.

Download the Structured Finance Activity Report here.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions such as for Credit Sphere.