Announcements

Drinks

European consumer goods: steady credit outlook for large FMCG firms despite volume, cost pressures

By Eugenio Piliego and Daniel Felipe Gomez Reyes, Corporate Ratings

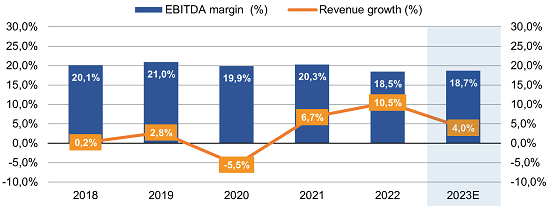

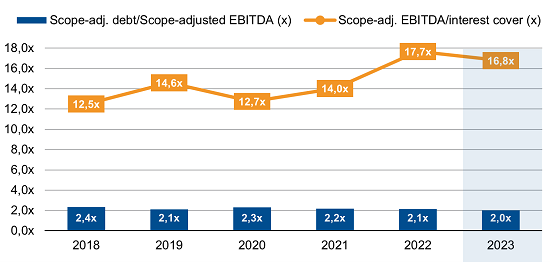

Average leverage, measured by Scope-adjusted debt/EBITDA, is unlikely to improve beyond last year’s performance for large FMCG companies due to the diminishing if still net positive impact of inflation on absolute profitability versus indebtedness and softening consumer demand (Figures 1,2).

In addition, management is likely be more open to putting improved cashflow toward investment and acquisitions after a few years of holding back.

Interest cover, measured by Scope-adjusted EBITDA/interest expenses, is generally not an issue for investment-grade FMCG companies. After inflation boosted EBITDA in 2022 more than interest costs, we expect a slight deterioration in 2023, as the gradual refinancing of maturing debt will lead to higher average interest costs.

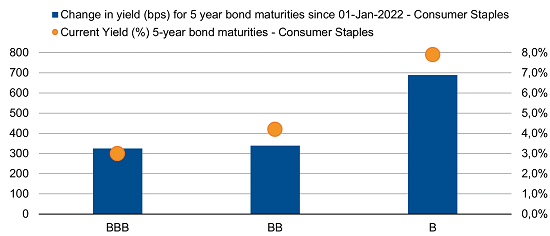

In contrast, the significant increase in interest rates remains a challenge for high-yield issuers, which saw funding costs rising much faster than investment-grade peers over the past year.

Figure 1: Growth in average EBITDA margins, revenue growth for selected FMCG firms*

(*) Sample comprises Nestle SA, Unilever Plc, Anheuser-Busch InBev SA/NV, Carlsberg Group, Henkel AG & Co. KGaA, Orkla ASA, Tine SA, Danone SA, Heineken N.V

Source: Scope

Figure 2: Leverage and debt protection metrics for selected FMCG firms*

(*) Sample comprises Nestle SA, Unilever Plc, Anheuser-Busch InBev SA/NV, Carlsberg Group, Henkel AG & Co. KGaA, Orkla ASA, Tine SA, Danone SA, Heineken NV

Source: Scope

Corporate bond yields on debt for lower-rated issuers (Figure 3) have risen significantly more than in the rest of the sector since January 2022. As funding costs will rise further in 2023, firms with stretched balance sheets and limited pricing power will struggle to maintain credit quality. Profit margins at smaller firms dependent on single persistently inflating commodities and weaker brands will narrow as consumers become more price sensitive to low value-added products.

Figure 3: Yield comparison across different rating categories within Consumer Staples

Source: Bloomberg, Scope

Investment-grade European FMCG firms have pricing power, upbeat on growth

In general, larger companies will be more successful in negotiating price increases with retailers since demand is more inelastic for the stronger brands compared with the sector average. Indeed, large FMCGs have sounded confident in their 2023 guidance on organic growth, with price increases likely to offset downward pressure on sales volumes.

Input costs will continue to rise, albeit at a slower pace than last year. Rising wages - expected to increase by mid-to-high single digits reflecting some catch-up with commodity prices - and still elevated energy costs will keep any near-term improvement in profitability in check for more labour-intensive and energy-sensitive companies across the sector, again with smaller, less profitable, high-yield issuers feeling the strain.

The main risks for 2023 are untamed inflation and/or recession, which would cause a more severe fall in consumer demand, to be felt by the entire sector, and a switch from premium (branded) products to cheaper alternatives, leading to lower margins particularly for larger companies.

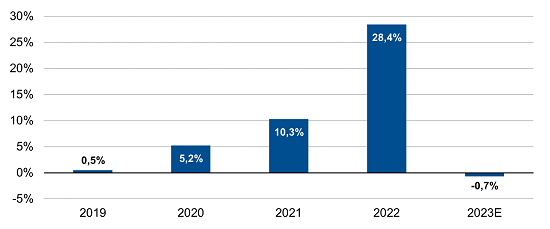

We expect some short-term cash relief from a likely sharp reversal net working capital this year from de-stocking, after many companies built up inventory in 2022 to overcome supply-chain bottlenecks just as growth in sales volumes slowed or reversed (Figure 4). We would still be cautious given that prices of inventories and receivables are still rising. Companies may run a higher risk of holding unsold stock.

Figure 4: Net working capital change for selected FMCG firms*

(*) Sample comprises Nestle SA, Unilever Plc, Anheuser-Busch InBev SA/NV, AB Inbev, Carlsberg Group, Henkel AG & Co. KGaA, Orkla ASA, Tine SA, Danone SA, Heineken NV

Source: Scope

Recovery in EBITDA margins to pre-Covid levels will take time

For now, profitability is slowly recovering after the inflation in the high-teens digits of 2022. While input costs – including raw materials, energy, logistics – have eased in the first quarter, these are still well above pre-Covid levels, so EBITDA margins in 2023 will trail behind historical levels.

Among the FMCG sub-sector, large food companies are moving their product portfolio up market to better serve the consumer demand for healthier and more sustainable products, visible in the solid organic growth in the past few years of ingredients companies such as Kerry Group. This way, they have partly reduced their sensitivity to volatile raw material prices.

For other FMCG issuers, ratings have proved more stable, with positive actions for suppliers of less price-sensitive goods such as alcohol and luxury items.

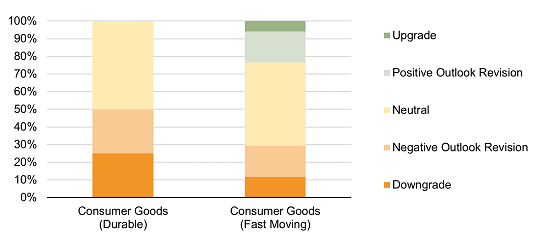

Scope’s rating actions for issuers in the consumer goods sector in the past 12 months have been more negative than positive -- our coverage of the European sector is partial – reflecting the less favourable outlook for durable (discretionary) goods producers.

Figure 5: Scope rating actions on consumer-goods issuers (April 2023 LTM)

Note: The statistic is referred to Scope’s consumer product coverage; it excludes private ratings, as well as new rating issued or ratings withdrawn in the last 12 months.

Source: Scope

The subsector experienced the largest number of downgrades/negative outlooks given the sub-sector’s vulnerability to unfavourable shifts in consumer spending in the past 18 months and lack of pricing power, outside luxury-goods. In segments such as mid-to-low budget fashion/apparel, high-cost inflation has severely crimped profitability considering how difficult it is to increase prices in a highly competitive sector, not least due to the growing share of online sales.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions for Scope’s credit rating feed, providing institutional clients access to Scope’s growing number of corporate, bank, sovereign and public sector ratings.