Announcements

Drinks

Pharmaceuticals: cash-flush but clear-eyed on M&A; executives’ ambitions set to remain modest

By Olaf Tölke, Managing Director, and Azza Chammem, Associate Director, Corporate Ratings

Creditors to the sector will be relieved because the pharmaceutical companies with the strongest business-risk profiles are those which have or are seeking leading market shares in specific treatment areas rather than bulking up across multiple different healthcare segments through large acquisitions or mergers.

The era of large pharma conglomerates is over. The trend among large-capitalisation firms is to streamline their activities and spin-off often multibillion-dollar “non-core” businesses. It is unlikely to reverse.

True, pharma companies are flush with cash. The sustained impact of the pandemic on demand for Covid-related vaccines, treatments and diagnostics and more indirectly government’s awareness of the importance of public health investment have combined to boost cash inflows, providing them with the means to take on ambitious acquisitions.

However, the latest deals point to a distinct intra-US bias and a preference for plugging specific holes in portfolios through bolt-on and mid-sized deals rather than the search for company-transforming or cross-border tie-ups based on absolute scale. They typically present significant integration risk in merging teams across countries and cultures.

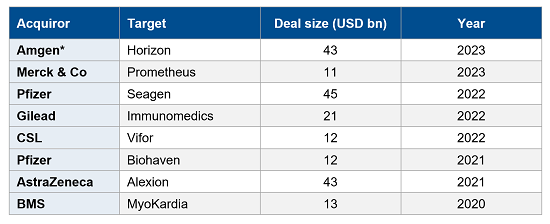

We would categorise even the eight biggest eight acquisitions of the past few years as “mid-sized” as they range between USD 10bn and USD 50bn compared with “bolt-on” deals worth less than USD 10bn.

Figure 1: Shopping cart: biggest recent acquisitions in pharma sector 2020-23

*Deal pending

Source: Scope Ratings, company announcements

A global wave of new M&A deals looks unlikely

More deal making on this scale is likely, not least because it is well within the financial means of the sector. The 10 largest big pharma players have about USD 120bn of cash on their balance sheets.

Compare the size of these transactions with Pfizer’s unsuccessful USD 118bn bid for AstraZeneca PLC in 2014, equivalent to only a little more than half of its target’s current market value of around USD 230 bn.

Big pharma has in the past typically used M&A to offset sales lost the expiry of patents on blockbuster drugs as generic alternatives take market share. Pfizer is again a good example, embarking on a round of deal making after the expiry of the patent for cholesterol-lowing drug Lipitor which had peak sales of USD 13bn in 2006.

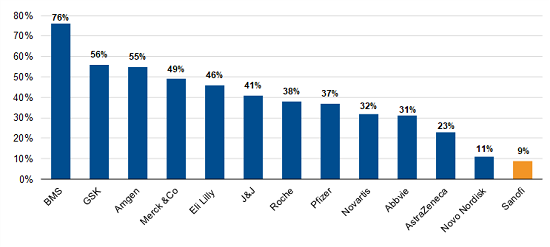

In Europe, unlike the US, there is no dramatic patent cliff facing the industry at present, with the partial exception of GSK PLC, explaining the preponderance of US deals in recent M&A activity. Sanofi SA (rated AA/Stable by Scope) has the lowest exposure at 9% of estimated 2025 revenue for the period 2025-29 followed by Novo Nordisk at 11% and AstraZeneca at 23% among the largest pharma companies (Figure 2).

Figure 2: Loss of exclusivity (LOE): estimated exposure of big pharma 2025-29

% of 2025 estimated revenue

Source: Bloomberg, brokers reports

Treatment areas have become the strategic focus

The global pharma market is worth about USD 1.5trn, so even the largest companies with about USD 50bn in annual revenues have a notional market share of not even 4%. Pfizer recorded revenue of USD 100bn in 2022, but that was an exceptional year related to pandemic. Of course, this way of calculating market share does not account for how diverse the drugs market is, spanning many different treatment areas.

At the pharma companies, most management teams have increasingly focused on specific treatment areas to cut back on complexity and gain special expertise rather than maintain leading positions in often unrelated fields such as, for example, oncology, neurology and diabetes.

In specific treatment areas, talk of market share becomes more relevant. Roche AG and Novartis AG have significant double-digit market shares in oncology as does Eli Lilly Inc. in diabetes. Here, relative size is more relevant than absolute size, hence a preference among some firms to pursue tailored bolt-on and mid-sized deals as well as organic growth. Sanofi recently bought Provention Bio for USD 2.9bn to enhance its immunology franchise.

We would not be surprised to see deals of up to USD 20bn in value in the latter half of 2023 as companies gain more visibility for the next few years, providing the comfort needed for bigger though not transformational deals.

Indeed, most big pharma companies have slimmed down to focus on their core business over recent years. Take GSK’s demerger of its consumer healthcare unit to create Haleon last year, Novartis’ spin-off of Alcon and plan to do the same for generics unit Sandoz this year, in addition to Pfizer’s earlier decision to combine its Upjohn business with Mylan NV to create Viatris Inc.

The sector will find it hard to match the Covid-related revenues of last year in 2023 though the full impact of the pandemic on the topline is far from finished. Pfizer still expects combined revenues of USD 22bn from its Covid vaccine Comirnaty and treatment Paxlovid this year. Commercialisation of Covid treatments is likely to continue not least in China after the abrupt ending of its no-Covid strategy.

Pharma companies still need to tackle increasing energy prices, high inflation, a tightening financing environment with rising interest rates and some supply-chain challenges. In Europe, the euro’s depreciation against dollar exacerbates some the cost and supply-chain pressures, which may oblige some companies to gear towards stock piling, resulting in a negative working capital change by the end of the year.