Announcements

Drinks

Credit Lines: Swedish krona weakness puts corporate indebtedness in focus

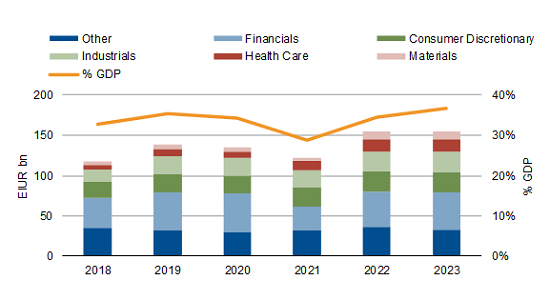

Credit extended to Swedish companies amounted to 180% of GDP at the end of 2022, according to the BIS. The BIS data ranks Sweden top among the Nordics and ahead of much larger economies such as France and China on this metric.

Much of the debt is held in the real estate sector where worries about stretched balanced sheets are concentrated. Credit spreads for real estate firms and credit-management companies have widened this year. Credit ratings have also worsened for the property companies in the wake of higher interest rates, falling real estate valuations and rising refinancing risk.

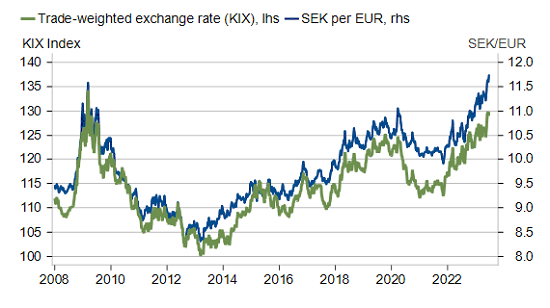

Pressure on the currency has intensified as companies have tried to hedge their exposure, leading to a vicious circle of devaluation, rising local-currency debt-finance costs and leverage.

This leaves Sweden’s policy makers facing the typical dilemma when it comes to how to handle a weak currency. Higher interest rates that could stabilise the currency would put additional pressure on economic growth – Scope forecasts -1% GDP growth in 2023 – and on corporate and household income.

Figure 1: Swedish krona falls to low against the euro

Source: Riskbank, Macrobond

Swedish companies issued high quantities of foreign-currency debt

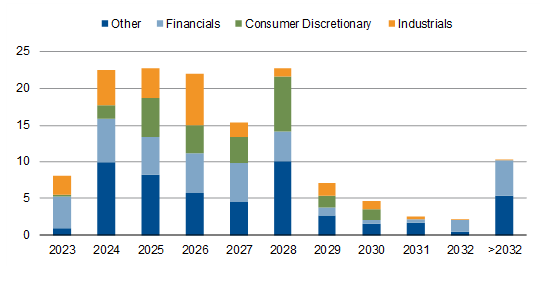

Swedish firms have long raised significant amounts of foreign currency debt, mainly in euros, partly due to the limited size of domestic debt markets. Based on their outstanding public liabilities, Swedish corporates’ euro obligations amount to close to 40% of Swedish GDP, much of which is maturing in the next four years (Figure 2).

Figure 2: Swedish companies have significant euro liabilities

Source: Scope, Bloomberg

Household indebtedness is also elevated, standing at 87% of GDP at the end of 2022, according to BIS data. Loans are often floating rate, representing one of the well documented weaknesses of the Swedish economy, not at least in the view of sharply lower real estate prices that have declined by more than 10% from the peak.

However, there is at least some sign of stability here. Real estate prices have started levelling again out in recent months as households adjusted to higher interest rates. Question is how much further rates can rise from here without generating renewed pressure.

Foreign currency dependence is mitigated by Sweden’s strong export revenues – notably for industrials or healthcare companies – and there is no large amount of foreign currency indebtedness among Swedish households. However, companies with predominantly domestic revenues may increasingly find it unattractive, or indeed impossible, to refinance in foreign currencies.

On the macro-economic front, Sweden enjoys twin surpluses of a positive current account and a solid fiscal position. Sovereign debt makes up less than 40% of GDP and, unlike many European peers, the government recorded a fiscal surplus in in its most recent financial year. While annual inflation peaked at more than 12% at the end of 2022, it has been in steady decline in 2023, though at 6.7% the Riksbank’s preferred CPIF measure still was well above target in May.

Still, further krona weakness threatens to upset Swedish corporate balance sheets, leaving policy makers in bind.

Figure 3: Swedish firms’ euro-denominated debt mostly matures within next five years

Source: Scope, Bloomberg

European CRE groans under the weight of interest rates, sluggish economy

As for Europe’s real estate market more broadly, we have taken a close look at the commercial real estate (CRE) segment, where signs of stress are on the rise both for CRE loans and among some property companies.

In our webinar last week, Florent Albert, senior director in structured finance ratings, told investors:

We see first cracks appearing in the market for CMBS/CRE loans with maturity extensions and defaults. Downgrades are also piling up for stressed construction loans and low-cashflow-yielding CRE loans. In particular, 2017-18 vintage securitised CRE loans struggling to refinance owing to poor planning, tighter underwriting standards and lenders' doubts about terminal value.

Lender concerns are also elevated for properties with poor pricing power to pass on inflation and those facing obsolescence risk (shopping centres, secondary offices), Albert said.

Meanwhile, circumstances for real estate firms are more nuanced, according to Philipp Wass, managing director in corporate ratings.

To be sure, REITs trading at significant discounts to appraised asset values imply capitalisation rates materially higher than those priced in by private markets. Companies that entered 2022 with high leverage and large exposure to the bond market face higher refi risk. However, REITs generally have focused on deleveraging through asset sales, cutbacks in investment, lower dividends and fewer bond buybacks to cope with the impact of rising yields on property market values.

To find out more, please download the presentation and watch the full replay of the CRE webinar.