Announcements

Drinks

ESG-linked bonds: issuance set for 10% decline this year in Europe as real-estate financing shrinks

By Eugenio Piliego and Anne Grammatico, Corporate Ratings

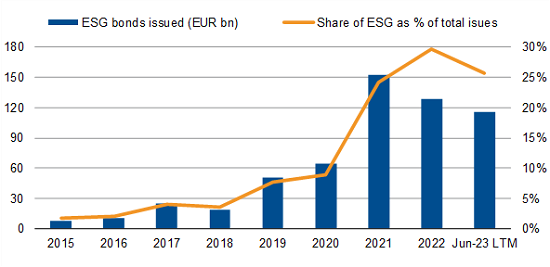

We see ESG-linked volumes falling at least 10% to around EUR 115bn in absolute terms, ensuring that their percentage of overall issuance will continue to fall after a sharp H1 decline.

ESG-linked bond issuance fell around 15% in volume in H1 whereas overall volume of corporate bonds was flat in H1 compared with the same period in 2022, leaving ESG-linked issuance at only 26% of the total compared with a peak of 33% in Q3 2022.

Rising interest rates have limited European companies’ appetite for tapping debt capital markets this year. However, the loss of enthusiasm for ESG-linked paper also reflects concerns among issuers and investors over greenwashing, uncertainty over the regulatory environment and a loss of confidence in so-called “greenium,” the likelihood that bonds linked to environment, social and other sustainability metrics will trade at a premium to unlinked bonds.

Activity in the real estate sector, typically a big issuer ESG-linked bonds, fell particularly steeply – down at around EUR 3.5bn from EUR 17.5bn in the same period in 2022 – a consequence of the slowdown in development projects due to higher interest rates. The sector accounted for only 5% of total ESG bonds so far this year compared with 18% in 2022 and 24% in 2021.

Figure 1: Lost momentum: ESG-linked corporate bond issuance in Europe 2015-23

Source: Bloomberg, Scope

Green bonds remain in favour; waning interest in SLBs

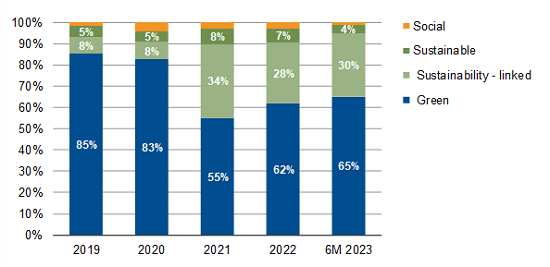

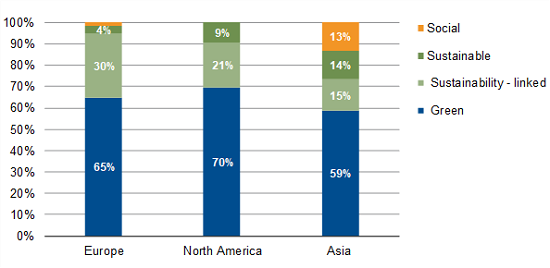

Within the ESG-linked segment, green bonds remained the most common type of fund raising, amounting to 65% of total ESG-linked bonds in Europe, up from 55% share in 2021, followed by sustainability-linked bonds (SLBs).

SLBs have come under more scrutiny in the past year as the embedded coupon step-up is often perceived as too feeble to deter companies from missing ESG targets. The use of call options to recall a SLB bond, possibly ahead of a step-up event, has also alerted investors to the dangers of greenwashing associated with these instruments.

Figure 2: ESG bond issues by type in Europe (% of total)

Source: Bloomberg, Scope

Greenwashing concerns curb enthusiasm for some ESG-linked deals

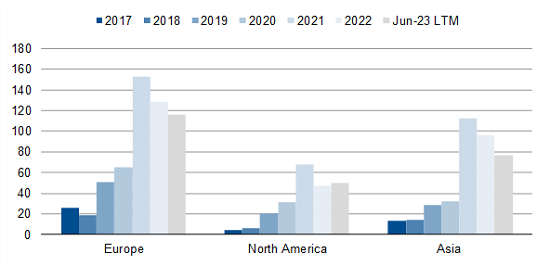

The trends in Europe are visible in the rest of the world, not just in terms of rising interest rates discouraging debt-financed investment, but also in pushing borrowing costs up far higher than any potential greenium from issuing ESG-linked debt.

In North America, the volume of ESG-linked bonds rose in line with the general H1 pick-up of the bond market compared to the same period in 2022, but not as fast as overall issuance, reducing the segment’s share to 4% from 6% of total issuance. Fear of ESG-related litigation is growing. According to a recent survey from Robeco, a large portion of institutional and wholesale investors in North America – around 50% compared with 30% in Europe – fears potential legal actions when investing in ESG, a sign of polarised political climate in the US spilling over to financial markets, notably regarding climate risk.

On a sector basis, utilities still dominated ESG-linked bond issuance in Europe with EUR 25.1bn in deals in the H1 – equivalent to around 38% of the total – down slightly from EUR 26 bn in H1 last year. French power utility Engie SE was the largest European issuer of ESG-linked bonds, worth EUR 3.7bn. We expect the sector to remain a big issuer given the huge capital expenditure they face in modernizing the region’s energy infrastructure in the context of net-zero climate goals.

Automakers were also big issuers as the recovery from the pandemic-related slowdown in demand and investment has passed, though not active enough to offset the decline in real-estate sector issuance.

Figure 3: ESG-linked non-financial bond issuance by region (EUR bn)

Source: Bloomberg, Scope

Figure 4: ESG-linked bond issuance by type, globally (% of total)

Source: Bloomberg, Scope

Make sure you stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.