Announcements

Drinks

European carmakers race to gain competitiveness as opportunity in China turns to threat

By Georges Dieng, Director, Corporate Ratings

European carmakers cannot afford to stand still given their reliance on the world’s biggest car market. For the German original equipment manufacturers (OEMs), China is a sizeable provider of volumes (30%-40%), profits (25% to 30%) and dividend streams, worth in the case of Volkswagen AG around EUR 3bn a year on average over the past 10 years.

The European OEMs need to rethink their whole product strategy in China – from price positioning and segment coverage to technological and digital content – where internal combustion engine (ICE) vehicles are no longer the driving force, with market growth fuelled by electric vehicles (EVs), primarily in the lower-priced segments. Drastically reducing time to market will be crucial to better meet local customer needs.

However, the OEMS face just as big, if less immediate, a challenge from China in Europe. Cost competitiveness remains a burning issue as this is a prerequisite for the industry’s ability to bring affordable cars to market. Today, those cars are increasingly EVs given Europe’s tightening environmental regulations. This will require a sharp reduction in European EV production costs, secure sourcing of critical raw materials and more generally an intensification of cost-saving initiatives to compete with China-made imports.

EU-led protective measures like the US Inflation Reduction Act might safeguard European OEMs’ market share at home, but the combined effect of lower sales in China, lower exports to China and pressure on sales in Europe could mean a significant drag on the sector’s earnings and cash generation by the end of the decade.

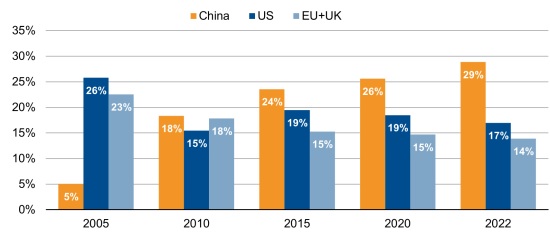

Figure 1: China has a fast-growing share of worldwide automotive market

Unit sales (% of total)

Sources: CAAM, Automotive News, Statista, OICA, Scope

Europe’s entry-level segment vulnerable to Chinese brands; VW, Renault look most exposed

In Europe, many Chinese OEMs are directing their product offering towards the premium segments still dominated by the German brands. We believe these will be hard to crack due to the Chinese companies’ lack of brand recognition.

Conversely, as tougher emission standards are wiping out the entry-level ICE segment in Europe, the Chinese brands could easily fill up this vacuum profitably, courtesy of their lower costs.

Among the German OEMs, Volkswagen is the most challenged, due not just to its reliance on China for earnings but also its high exposure to the European mass market and limited presence in North America.

Stellantis NV and France’s Renault SA have less to lose in China where they have a smaller presence which allows them to pursue an asset-light strategy and envisage new partnerships with local firms.

However, as mass-market producers, both are exposed to Chinese competition in Europe like Volkswagen. Stellantis looks better positioned due its strong operations in North America responsible for 60% of group adjusted EBIT in 2022 whereas Renault, leaving aside its partnership with Nissan Motor Co., is much more dependent on Europe.

EV shift threatens to bring European OEMs’ golden years in China to early close

The rapid growth in China’s car market has long been a huge opportunity for European OEMs as the country sought foreign investment in recent decades, growth accelerated and living standards rose. Western carmakers invested heavily, first in the mass-market segment – such as Volkswagen and PSA (Peugeot’s former parent company) in the mid-1980s and General Motors Co. in the late 1990s – then in the premium segment, initially BMW, Mercedes-Benz, Audi AG and Porsche AG, more recently followed by Tesla Inc.

However, the OEMs’ success was built on ICE technology and they now face an accelerated and irreversible shift in Chinese consumer preferences towards cheap yet tech-rich electric vehicles with advanced driver assistance, infotainment systems and voice-activated controls.

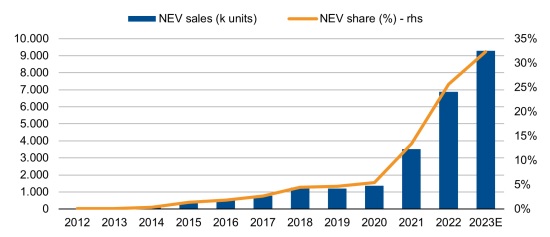

Figure 2: Electrifying: new energy vehicle* penetration rate climbs in China

Sources: CAAM, Gasgoo China news, Scope. * NEVs include battery-electric vehicles, plug-in hybrids and fuel cell vehicles

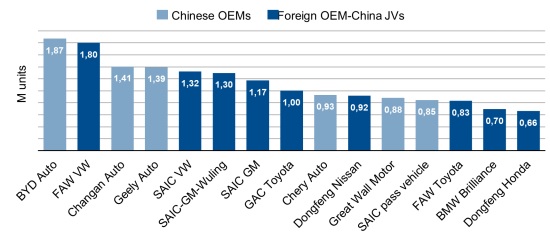

Except for Tesla, the foreign OEMs have struggled to keep pace with the EV demand. Chinese brands now have around 50% of their domestic car market (vs 35% in 2015) and over 80% of EV sales in China. BYD Co., a homegrown EV specialist, dethroned VW as China’s leading auto brand in 2022. Other pure EV OEMs from China such as Leapmotor, Li Auto Inc. Nio Inc., Xpeng Inc. are gaining local market share – and looking at export markets.

Figure 3: Overtaking: BDY topped list of leading 15 passenger car manufacturers in China in 2022

Sources: CAAM, Gasgoo, Scope

The Chinese EV export push was visible in the high profile of China’s OEMs at the Munich international motor show in September, particular as growth threatens to stall in their crowded domestic market amid a slowing Chinese economy.

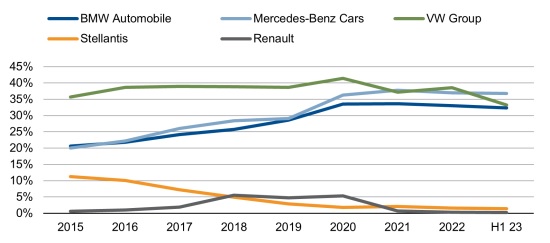

Figure 4: Cliff edge? European OEM China deliveries as % of auto division volumes

Sources: company reports, Scope

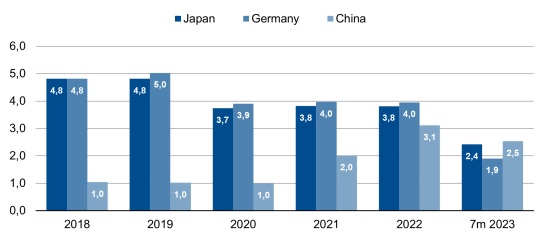

China has this year become the world’s single largest vehicle exporter, overtaking Japan, though exports include Western-branded vehicles built in China like Dacia Spring and Tesla’s Model 3 and Y.

Figure 5: Fast track: vehicle exports from China (m units)

Sources: JAMA, VDA, CAAM, Scope

Europe is perfect market for Chinese OEMs

Europe is a particularly attractive target market for the Chinese OEMs. Trade barriers are modest even as the EU investigates China’s EV subsidies on fair-trade grounds. EV sales momentum is strong (67% CAGR over 2019-22). EV penetration is up sharply at 23% in 2022 vs 3.6% in 2019, according to JATO Dynamics.

Furthermore, the EU ban on new ICE vehicle sales from 2035 leaves the doors wide open to Chinese new EV entrants which have a clear lead over their European peers in EV battery expertise and cost competitiveness.

Chinese OEMs’ share of the European passenger car market is small but rising fast, up at 2.7% in the first seven months of 2023 from 0.9% in FY 2021, according to Schmidt Automotive Research. The gain in market share is more impressive in the BEV segment, up at 8.2% in 7m 2023 from 3.9% in FY 2021., primarily driven by unmatched affordability and improved quality.

For the European OEMs, their China headache will only get worse.

Make sure you stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.