Announcements

Drinks

Credit Lines: might COP 28 be a boon for green bonds?

Uneasiness is growing that, despite years of efforts and billions of euros of investment, global CO2 emissions are on the rise again after a strong and carbon-intensive economic recovery from Covid that coincided with the escalation of Russia’s war in Ukraine. In search of secure and affordable energy sources, even European countries have revived highly polluting energy sources such as coal.

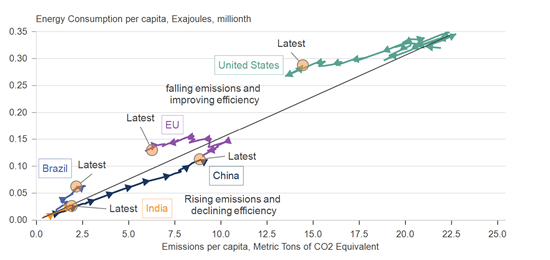

True, OECD economies have made significant improvements in both energy consumption and carbon emissions intensity, if measured per capita.

There are two major caveats. First, these countries have a long way to go, at huge potential long-term cost for governments, as our recent study of EU countries examined: EU climate risks, demographic change and debt sustainability (20 Nov. 2023).

Secondly, OECD emissions improvements are more than offset by the steep rise in emissions in China and other large, fast-growing non-OECD economies, notably India and Brazil.

Global CO2 emissions: one step forward, two steps back?

Source: EU EDGAR, BP Energy Review

At the same time, consumer adoption of low-carbon technologies such as electric vehicles and heat pumps has slowed due to rising cost and falling real incomes in the US and Europe.

The dilemma for climate-focused investors is that in this environment, absolute emissions are tough to control at the company or country level because they depend on macroeconomic factors affecting demand and supply that influence the available energy mix. This leaves the focus on relative improvements in green energy output compared with net-zero scenarios.

With resource constraints in mind, the focus should be on allocating green capital where it makes the largest contribution to net zero, which right now means greening the energy mix available to households, industry, and the transport sector.

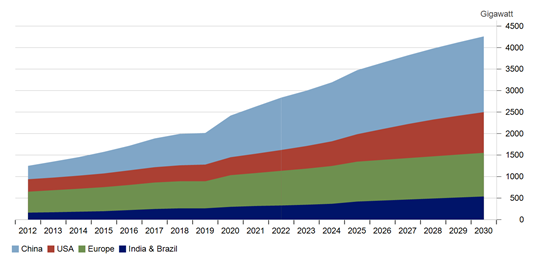

Planned expansion of renewables and nuclear capacity requires significant investment

Source: IEA

Most net-zero scenarios presume a huge increase in global renewable capacity by 2030 – three-fold, according to the IEA – beyond what is planned already. Yet, it is precisely this area where the economics are under pressure. Look at recent profit warnings from alternative energy operators, such as Orsted and Siemens Energy, amid the abandonment of big offshore wind projects in the US and Europe, and the poor performance of alternative energy stocks, globally.

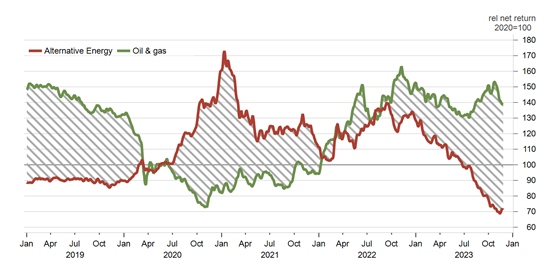

In stark contrast, investors are warming again to oil and gas companies that benefit from rising demand for products that provide more than half of global energy supply while also contributing to rising emissions of greenhouse gases.

Scrutiny of the industry’s net- zero path, especially methane emissions, is entirely justified, but it is also clear that the outcome will ultimately be determined by the availability of green-energy alternatives to oil and gas – and not greener oil and gas. Climate-sensitive investing needs to take a holistic view of the energy sector, including oil and gas.

Alternative energy stocks underperform oil & gas sector as interest rates rise

Source: MSCI, Macrobond

Falling equipment prices contrast with rising project costs, uncertainty over returns

Poor renewables returns are not all bad news if they are related to falling prices, e.g. in solar PV or technological displacement in better turbines and more efficient batteries. However, as far as large-scale energy projects go, inflation and higher interest rates have increased project cost and lowered expected returns. Higher costs are amplified in highly regulated energy markets that adapt only slowly to economic reality.

What does this all mean for bond investors?

With equity investors losing faith in renewables, there will no doubt be increased demand for debt-financed green investment. With yields at a decade high and greeniums extinguished, this may not be such a bad outcome after all.

Indeed, a case in point might be Poland’s energy sector, according to the latest research note from Kamila Hoppe, analyst in corporate ratings at Scope. Hoppe looked at the credit implications of Poland’s plans to carve out coal assets held by four state-controlled utilities into a separate company. Creating financial room for the utilities to ramp up investment in low-emission power generation is urgent. More than a half of the country’s installed power-generation capacity still runs off coal.

The plan should improve the utilities’ access to capital markets and help Poland meet climate goals.

Shorn of their most inefficient and polluting businesses, PGE, Tauron and Enea, would likely find it easier to borrow from banks and tap capital markets particularly through green or sustainability-linked loans and bonds as other EU-based utilities such as Italy’s Enel and France’s Engie have done for some time.

Putting the utilities on a stronger financial footing – the state is offering utility companies around PLN 18bn (0.5% of GDP) in aggregate in the proposed deal – and creating more financial headroom for accelerated investments in renewables would also help Poland meet a new binding renewable energy target of 47% of gross final energy consumption by 2030, up from the previous target of 23%, equivalent to doubling the share of renewable energy in country’s energy mix.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions for Scope’s credit rating feed, providing institutional clients access to Scope’s growing number of corporate, bank, sovereign and public sector ratings.