Announcements

Drinks

European commercial real estate: Signa insolvency rattles sentiment; wider impact to be modest

By Philipp Wass and Thomas Faeh, Corporate Ratings

With predominant exposure to retailing and real estate, Signa has faced stiffer headwinds than most companies in these two sectors.

While the retail sector is suffering from changes in consumer behaviour that is impacting sales and profitability, the real estate segment needs plenty of liquidity to complete construction projects and refinance debt particularly when financing costs are rising and valuations are falling. At Signa, a very complex corporate and financing structure has made lenders reluctant to provide the required funds, which ultimately puts Signa in a tight spot.

The financial distress of Signa’s real estate division and the probable sales of assets, at likely sharp discounts to book value, will certainly not help market sentiment. The restructuring of its bank debt involves potential losses for creditors, among them Austrian, German, Italian and Swiss lenders. They may well now prove more reluctant to lend to other commercial real estate (CRE) borrowers, contributing to tighter financing conditions for the sector.

Signa’s business model is to some extent similar to those of other large European real estate investment firms. In mixing property development with investment, these companies aim to expand their long-term income-producing portfolio and at the same time generate recurring income to cover operating costs.

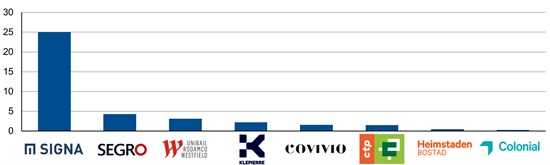

However, Signa – through subsidiaries Signa Prime Selection, Signa Development Selection, Signa RFR US Selection AG and Signa Luxury Hotels – has proved a particularly ambitious property developer. The development pipeline was about to double its current gross asset value of EUR 27bn. The firm’s multibillion-euro, mostly short- to medium-term development pipeline, which is among the largest in Europe, was adversely affected by higher construction costs, a jump in financing costs and a decline in demand from tenants and investors alike.

Figure 1: Signa’s projects outstripped its rivals’: development pipelines of selected peers (EUR bn)

Sources: public information based on latest company quarterly reports, media reports; also see Die SIGNA Unternehmensgruppe | Signa

Signa stands out in sector with outsized development pipeline, high valuations

As a result, Signa found itself dependent on the availability of external financing or asset sales amid growing uncertainty over sustained asset values if it was to secure the liquidity needed to complete construction of projects already underway and refinance debt falling due.

The task has proven too difficult. The construction of several projects, including the Elbtower project with total investment costs of around EUR 1bn, was suspended. Any sale of uncompleted development projects will result in significant losses not only for Signa, but also for the lenders. Banks are likely to be even more reluctant to finance property developments, which could further drain liquidity in this segment, particularly in Germany and Austria.

In addition, Signa’s real estate property was looking overvalued before the rises in interest rates and slower-than-expected economic growth this year piled pressure on Europe’s real estate sector. Take Signa Prime Selection's properties that were exposed to a decline in fair value of around EUR 1.1bn in 2022, which corresponds to a negative adjustment of around 6%. Last year, rising prime yields pointed to a decline of at least around 20%, which increased to around 25% at the end of June this year.

Prices for asset sold to pay down Signa’s debts will have to reflect this 20-25% over-valuation. This does not necessarily imply a fire sale which would drag other valuations lower. Signa’s creditors will seek to recover as much of their money as possible from a company whose properties make up a small fraction of the overall market, even if it is the owner of trophy assets such as Upper West in central Berlin.

Interest-rate sensitivity of European sector exposed in current downturn

Signa's troubles still highlight the broader weaknesses of the sector in the context of only a modest recovery in growth in the euro area in 2024 amid lingering uncertainty and high interest rates.

In particular, real estate firms' high interest-rate sensitivity leads to pressure on interest cover, especially for those with limited hedging such as Nordic companies and property developers, which have high exposure to floating rate debt. In addition, rising yields lead to continued pressure on property valuations and constraints on liquidity when external funding is not fully available. European real estate firms are faced with capital market debt of around EUR 120bn maturing in 2024-26, an increase of around 75% compared with 2021-2023 – hence the sector's refinancing challenge. Falling valuations and debt yields below current funding rates for some companies limit refinancing options.

To be sure, Signa’s business model has compounded multiple adverse trends facing the European retail and real estate sector. However, the company’s experience should help guide investors in risk assessment of other individual European issuers.

Take UK-based Segro PLC, which ranks second among European firms in terms of the size of its development pipeline but has a low leverage ratio (LTV of 34% as at the end of September 2023) and healthy demand for logistics properties (pre-let rate of 64%). On the other hand, SBB i Norden suffers from liquidity problems. The Nordic real estate firm has deteriorating credit metrics amid concerns about governance and transparency despite no significant development exposure.

Credit quality under pressure despite hopes interest rate cycle has peaked

Although the sector is grappling with a cyclical downturn, increased liquidity requirements and expensive or limited refinancing options, there is some cause for optimism given growing confidence that the interest-rate cycle has peaked. If that view was backed up by pauses in rate increases by central banks, financing conditions for the sector might improve for refinancing and/or new transactions.

However, such relief will be limited. We expect credit quality in the commercial real estate sector to come under further pressure in the coming months with an increasing number of distressed asset sales that will lead to repricing of older, non-ESG compliant properties, notably in the office sector, despite some signs that the market is bottoming out in the industrial and retail segments.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions for Scope’s credit rating feed, providing institutional clients access to Scope’s growing number of corporate, bank, sovereign and public sector ratings.