Announcements

Drinks

Italian power utilities: capex burden grows as sector plays catch-up in Europe’s energy transition

The utilities’ activities are significantly more carbon intensive than the European average while they face industry-wide pressure from policy makers and regulators to make more progress towards net-zero environmental targets.

“The consequence is that five of Italy’s largest utilities - A2A SpA, Acea SpA, Enel, Hera SpA and Iren SpA – are to intensify capex in the years ahead beyond the compound average annual growth of 16.5% recorded in 2018-2022, judging by their updated investment programmes,” says Marco Romeo, analyst at Scope.

“More than 80% of future capex is related to strengthening transmission and/or distribution infrastructure and boosting installed renewables capacity as part of efforts to align with the EU’s taxonomy for sustainable activities and meet sustainable development goals (SDGs),” says Romeo.

Meeting capex targets would enable the five companies to reduce their carbon footprint by 47-50% on average by 2030 while also improving the business risk profile, mainly by obtaining a better position in the electricity market’s merit order and improving profitability.

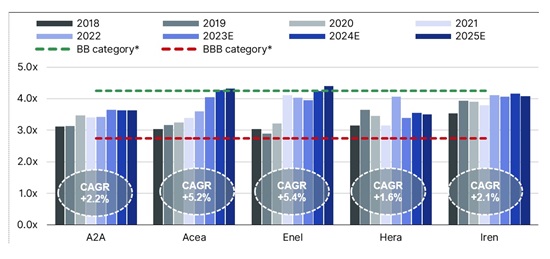

“The flip side is the pressure the rising capex represents for the utilities’ financial risk profile in challenging economic circumstances which is leading to a deterioration of credit metrics, notably rising leverage,” says Herta Loka, analyst at Scope.

Italian utilities’ leverage, Scope-adjusted debt/EBITDA (2018-2025E)

Note (*): thresholds derived from a blended approach of regulated and unregulated utilities. Source: company reports, Scope estimates

“Countermeasures – such as divestments, use of hybrid debt securities, and possibly more conservative shareholder remuneration – look necessary to ease pressure on balance sheets and safeguard creditworthiness,” says Loka.

While A2A, Acea and Iren reported carbon-dioxide emissions for their power stations well above the average in Europe in 2017-2022 despite growing regulatory pressure for a switch to lower-carbon production, Enel, a first mover in the decarbonisation race, provides a good example of how management has handled the capex and financing challenges.

The utility has carried out hefty investment in recent years, worth EUR 52.5bn between 2018-2022, to emerge as one of the largest renewable energy producers worldwide. Such spending has strained Enel’s balance sheet, particularly as interest rates have risen in the past 18 months, leading to a EUR 21bn asset disposal plan, the partial reallocation of investments to take advantage of favourable regulatory frameworks, and greater recourse to partnerships and grants.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions for Scope’s credit rating feed, providing institutional clients access to Scope’s growing number of corporate, bank, sovereign and public sector ratings.