Announcements

Drinks

Bond market access a credit differentiator for real estate companies

By Philipp Wass, Corporate Ratings

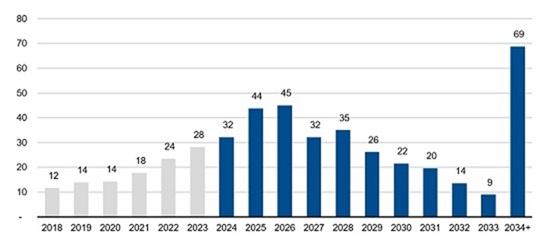

Europe’s real estate companies are facing significant refinancing requirements in the coming three years: EUR 32bn this year, EUR 44bn in 2025 and EUR 45bn in 2026. This refinancing wall comes at a time of higher (albeit likely peak) interest rates thus higher financing costs, continuing high energy costs, rising environmental capex needs, an affordable housing crisis and pressure for more investment.

Access to new funding will be vital to protect credit quality. European real estate companies have been active issuers in the international bond market in recent years but volumes have dwindled since sector headwinds emerged. From roughly USD 30bn-equivalent in both 2019 and 2020, volumes peaked at above USD 59bn in 2021 before falling 60% in 2022 and another 80% in 2023 to just over USD 4bn equivalent, according to Bond Radar data [The USD 4bn number excludes the flow of small-scale predominantly domestic SEK/NOK issuance by Nordic companies and issuance in other domestic market segments]. The sector has also been a premier issuer of ESG-labelled international bonds, supplying approximately USD 50bn since 2020.

Figure 1: Refinancing challenge looms for European real estate firms

Maturing capital market debt (European issuers with outstanding capital market debt of >EUR 10m; in EUR bn)

Source: Bloomberg, Scope

While real estate issuers (Unibail, Vonovia, CTP) have started to return to the bond market, it is too early to make predictions about annual flows and sector-wide access, though the companies that have returned in recent weeks have seen solid investor engagement. P3 Group is the latest to approach the market. The Luxembourg logistics and industrial real estate company appointed underwriters on 5 February to arrange investor calls ahead of a senior unsecured six-year green bond, subject to market conditions.

CEE-focused CTP NV priced a EUR 750m six-year senior unsecured green bond on 30 January, the day after hosting investor calls, alongside a cash tender for three outstanding bonds. Europe’s largest listed owner, developer and manager of industrial and logistics real estate by gross lettable area went out with initial price thoughts of 260bp-area over mid-swaps, guided to MS+230bp area and priced at MS+220bp against a peak order book of EUR 4.1bn (final book EUR 3.5bn).

Vonovia tapped the bond market twice in January, which helped build up sector momentum especially as the previously frequent issuer had been absent from the market since November 2022. Its CHF 150m 2.565% five-year senior unsecured notes on 24 January (its CHF debut) priced at 140bp over mid-swaps, having gone into marketing showing initial thoughts of MS+135bp-140bp for a minimum CHF 100m. A company official noted that more than 50 Swiss real-money investors came into the deal.

The GBP 400m 5.5% 12-year senior unsecured bond on 11 January (a sterling debut) was heavily oversubscribed, attracting peak orders of GBP 3.45bn that allowed final pricing of 157bp over Gilts from initial thoughts of 190bp area. In pre-marketing, 55 investors took part in calls with management.

Both issues were swapped into euros. Positive swap dynamics gave Vonovia attractive arbitrage funding significantly through its euro bond curve: 10bp for the Swiss notes, 30bp for sterling. Proceeds of both bonds will be used to repay loans falling due from 2025. The company noted that all unsecured liabilities up to and including the first quarter of 2025 are covered.

Unibail-Rodamco-Westfield had taken advantage of positive yield and credit spread developments in early December 2023 to issue a EUR 750m seven-year senior unsecured green bond at 4.125% against an order book of EUR 4.25bn that allowed pricing to tighten from initial thoughts of MS+190bp area to MS+145bp.

Asset sales could set off vicious cycle

Companies lacking capital markets access will be forced to engage in asset sales to meet creditors’ expectations around balance-sheet de-risking (equity issuance is likely off the table as an option for many). But asset sales will only be possible at lower valuations than most recent appraisals. A sharp fall in values could therefore be counterproductive as it could further weaken balance sheets.

The sector credit outlook will increasingly diverge between companies able to cope with refinancing challenges and weather a property-market downturn while continuing to invest, and others, for which the credit outlook is negative. Banks and investors will focus their attention on companies with robust business models, good market access, scale, strong asset quality and low leverage. The greater differentiation in cost of capital will become a guiding factor in distinguishing credit quality.

Some firms had accessed the bank market for secured lending rather than tapping the bond market for unsecured funding. Indeed, the wide differential between secured and unsecured spreads forced Vonovia out of the bond market altogether in 2023. The company raised EUR 3bn in long-term secured bank debt instead.

Recourse to the banks will not be possible for all issuers in an environment where lenders have become more selective and focused on the strongest names. Private debt providers can offer an alternative to the banks in financing high-quality assets for issuers that meet their higher return hurdles, which will tend to mean sub-investment-grade companies.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions for Scope’s credit rating feed, providing institutional clients access to Scope’s corporate, bank, sovereign and public sector ratings.