Announcements

Drinks

Telecommunication sector credit outlook stable on resilient cash flow; fixed-line capex remains high

By Jacques de Greling, Director, Corporate Ratings

M&A in the sector will remain elusive, as the number of possible targets is limited in Europe, synergies are negligible in cross-border deals, and the competition authorities are opposed to national mobile consolidation. Some European telecoms firms are likely to dispose of smaller foreign businesses and telecoms infrastructure, improving credit quality on the margin.

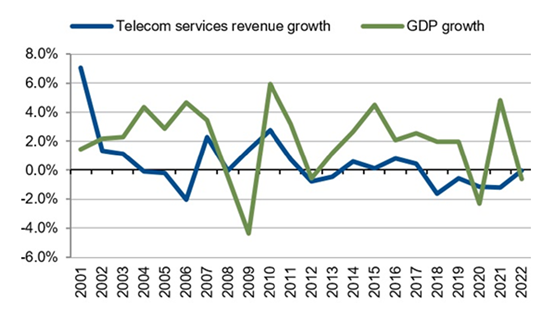

Stability in revenues, margins and leverage

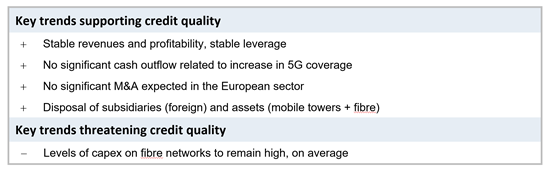

The leverage of European telecommunication companies has remained, on average, remarkably stable over recent years, with Scope-adjusted debt/EBITDA at around 2.7x. We expect that to stay the case or decline slightly in 2024. This is due to stable revenues and margins this year and longer term. Capex will remain high, although without preventing dividends from increasing slowly.

Figure 1: Average SaDebt/EBITDA for European Telecommunications operators (2018-2025E)

Sources: Companies, Scope Ratings

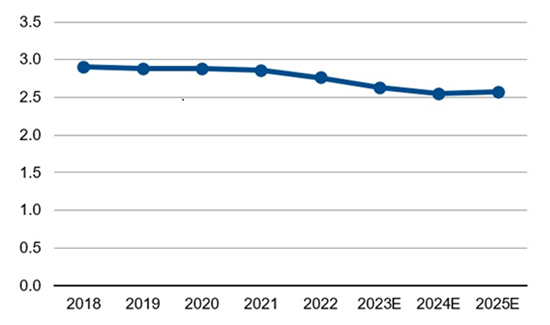

As a result, beyond changes specific to some issuers, there was no marked trend in outstanding ratings/Outlooks in our sector coverage during the past twelve months.

Figure 2: Change in ratings and Outlook for Scope-rated telecommunications companies, FY 2023

% of companies

Source: Scope Ratings

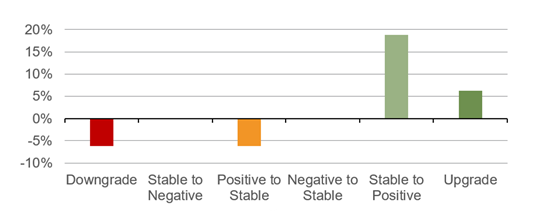

We still expect the telecommunication services companies in Europe to deliver flat revenues in the coming years, if not slight increases, demonstrating the maturity of the industry and its low cyclicality, notably during the pandemic. The European telecoms market is saturated. The entire adult population has access to a mobile phone and broadband, allowing only marginal increases in operators’ customer bases, while sufficient competition and regulation prevent any increase in prices in real terms.

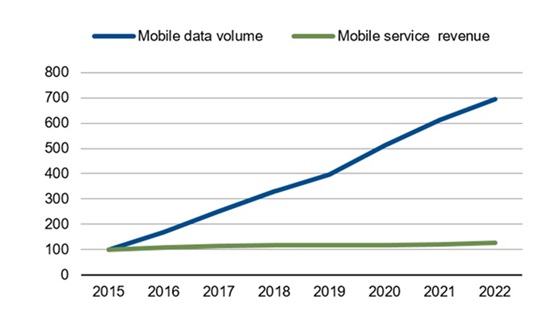

Increased usage of mobile data also does not translate into substantial increases in revenue. This is fully illustrated by the advanced Finnish mobile market. Here, average consumption is about 40 GB per month per user (a world record), with an annual average growth rate of 32% over the past eight years, yet mobile revenues are growing only slowly (+3% on average), and not compensating for the decline in the use of fixed-line services.

Similarly, we also believe that the current lobby from telecommunication operators to have content-providers (Netflix, Google, etc.) pay to access their networks (so-called “fair share”) will not bring any additional revenues, as they have failed to convince most European governments and regulators, including the Body of European Regulators for Electronic Communications (Berec), of their case.

Profit margins will remain, on average, at very similar levels to those of the recent past, even in an inflationary environment, as operators will continue to clamp down on costs, not least related to personnel, visible in the 3-5% average yearly decline in numbers of employees in the sector.

Figure 3: Telecom revenues growth and GDP growth in Sweden, 1999-2022

Sources: PTS, World Bank, Scope Ratings

5G brings no significant increase in cash outflows

Most 5G spectrum in Europe have now been allocated through auctions at reasonable prices, and the risk that unexpectedly expensive auctions suddenly increase operators’ leverage is now remote. This is due to the almost total absence of any new mobile operators entering the market in major European countries (except for Belgium and Portugal), and the very limited additional revenue generated by 5G usage. The 26 GHz band, which is the last block of 5G spectrum, is still to be allocated in most countries but will attract limited interest from operators. Investment in this remaining spectrum will be marginal.

Figure 4: Mobile data volume and mobile revenue increase in Finland (2015=base 100)

Sources: Traficom, Scope Ratings

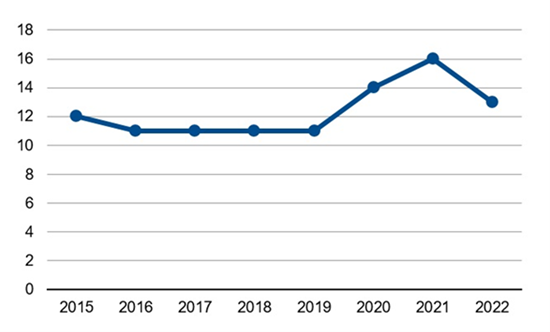

Beyond spectrum sales, the introduction of 5G has not led to any significant increase in mobile network investment, which has remained stable over the recent years, as it was after the introduction of 4G, as simply the newest technology replacing older standards. This is well illustrated by mobile capex (excluding licences) in Finland, the first European country to allocate 5G licences, where spending over the past eight years has steadied at around 13% of mobile services revenue.

Figure 5: Mobile capex (excluding licences) in Finland as a % of mobile revenue, 2015-2022

Sources: Traficom, Scope Ratings

Fibre capex remains at a high level

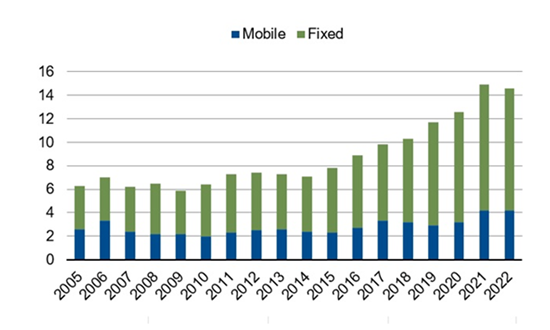

The main driver for the capex (excluding licences) increase for European telecommunications companies is fibre roll-out in European countries. In France, fixed capex (of which about 45% is directly fibre) represents about 72% of the total telecom capex in the country over the past five years. We estimate that fibre-to-the-home (FTTH) now represents on average about 38% of all broadband lines in Europe, a level that will increase if governments are to meet their targets for providing high-speed communications to households and business.

Figure 6: Telecom capex in France, €bn (2005-2022)

Sources: ARCEP, Scope Ratings

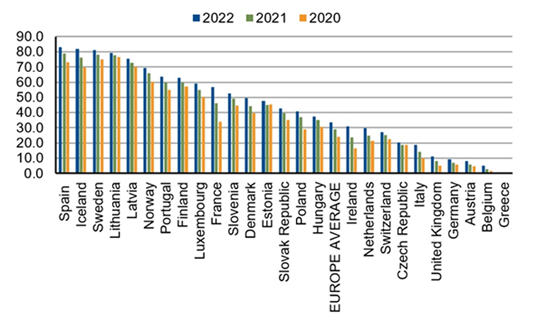

Still, the roll-out of fibre differs significantly from one country to another. In Spain and France, most of the roll-out is already done and we have started to see a decline in capex. The opposite is true in countries like Belgium, Italy and Germany, with capex here is set to rise as fibre roll-out is running significantly below the European average. Rolling out fibre networks is a lengthy and progressive process, so the related capex will remain elevated in the coming years in Europe even if we do not expect any significant increase in overall fibre investment in the region.

Figure 7: Percentage of fibre in broadband per country, 2020-22

Source: OECD

Limited M&A, and minor disposals

European telecoms operators will undertake little large-scale M&A in the coming years, as large transnational deals between European players offer no meaningful synergies. And we see little chance for non-European players to take over a major operator in Europe, as governments regard domestic companies as strategic assets. National deals are now almost impossible as most cable operators in the EU are now in the hands of telecoms companies. Domestic consolidation among mobile operators is de facto blocked by the regulatory authorities, notably the European Commission, on competition grounds. Consequently, there will be no significant increases in leverage due to M&A in the sector in the coming years.

Deal making is not entirely off the table. European operators will continue to sell smaller telecommunications businesses in foreign, mostly emerging-market, countries, as these assets are generating less and less growth as markets mature. In addition, European operators will continue to sell some infrastructure assets (mobile towers, parts of fibre networks) to specialist companies or financial investors, moves that will underpin credit quality.

To download the full Corporates Outlook 2024, please follow this link.

Webinar: Tuesday, 20 February at 15:30 CET

Please join Scope Ratings analysts for an in-depth discussion of the European corporate credit outlook for 2024 by registering here.

Make sure you stay up to date with all Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds.