Announcements

Drinks

European direct lending: credit metrics strained but negative ratings migration likely to ease

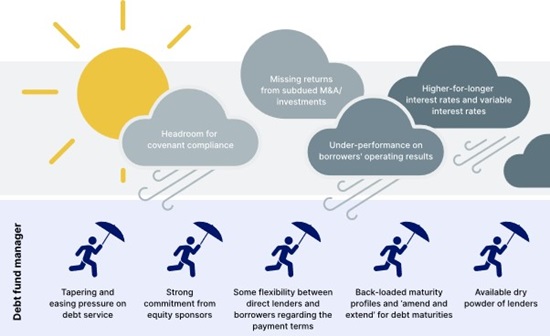

“Weaker credit profiles have primarily been driven by the impact of variable, unhedged interest rates, weaker-than-expected operating performance, subdued returns from reduced investments, and delayed deleveraging,” said Sebastian Zank, head of corporate credit production. “But we believe the erosion of credit quality has bottomed out in light of interest-rate tapering, easing concerns about economic growth and adaption to the more challenging environment, while higher default risk can be mitigated by an array of measures provided by equity sponsors and direct lenders.”

These measures include greater flexibility between direct lenders and borrowers on payment terms compared to more traditional financing; commitments from equity sponsors for equity injections or shareholder loans that can be converted into equity or PIK facilities; plus significant dry powder that can be used to provide bridge financing to companies that are likely to struggle.

Figure 1: Direct lenders shielded from stormy weather

Source: Scope

Scope has now assigned 70 private ratings and 24 point-in-time credit estimates on different borrowers that use direct lending with rated aggregated loan exposure of more than EUR 5.6bn. Issuer ratings are largely concentrated in the B category.

“What is most striking is the ratings migration. While around half of the ratings in our coverage could have been maintained or reflect ratings upside, the other half shows ratings erosion, either through actual downgrades/lower point-in time ratings or weakened Outlooks,” Zank said. “But this does not point to widespread and permanent credit erosion. When looking at Outlook distributions, a large part of the negative credit migration has already been reflected and credit erosion is likely to slow.”

Assets under management of debt fund managers focused on lending to European companies has reached USD 400bn, although we expect growth to continue at a slower pace than the CAGR of 17% of the past 10 years, at least until the current constraints on economic growth and investment (such as higher-for-longer interest rates) are outweighed by supporting factors.

While the strong growth of direct lending over the past decade has been supported by a wide array of factors, we do not believe recently emerging headwinds are strong enough to stop the growth in fundraising and deal allocation. We expect direct lending activities in Europe to continue to grow, albeit at a slower pace than the average annual debt fund-raising of around USD 40bn over the last five years.

Download the full report here.

Stay up to date with Scope’s ratings and research by signing up to our newsletters across credit, ESG and funds. Click here to register.