Announcements

Drinks

European autos: tariffs, regulations cloud credit outlook amid cyclical, structural margin squeeze

Reversing declining sales volumes and deteriorating profitability is likely to prove difficult, hence the prospect of diminishing longer-term credit quality for Europe’s original equipment manufacturers (OEMs).

Near-term credit implications remain modest; longer-term risks rise

For now, the credit implications are modest. Due to strong cashflow in previous years, the OEMs retain solid net cash positions at their industrial operations, an important buffer during downturns. European auto makers had benefitted from the tightening of supply and demand in the aftermath of the Covid pandemic to optimise their product mix in favour of higher-margin cars and light trucks. They also took advantage of favourable pricing in 2023. That resulted in healthy profit margins and bumper earnings as recently as last year.

However, the industry’s more recent performance has proved less robust. European OEMs’ operating profit margins covered by Scope shrank by up to 6.5 percentage points in the nine months to end-September 2024 compared with the same period the previous year, with an aggregate decline of around 1m in unit vehicle sales. The OEMs have only partially offset declines in revenue and the squeeze on margins with price increases and sales of higher-priced models.

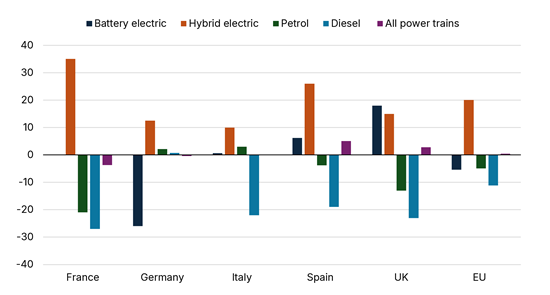

Figure 1: Bumpy ride: post-Covid new car sales recover unevenly in China, EU, US

New passenger vehicle registrations 2020-24E (units, m)

Source: ACEA, Statista, S&P, NADA, CAAM.

*2024 totals are estimates

The danger is that if the cyclical downturn continues or even intensifies and European OEMs fail to address the structural challenges, the combination of rising capex commitments, weak sales, and falling profitability will eat into their cash holdings and weaken balance sheets, not least with the extra uncertainty over global trade ahead of a second, possibly more protectionist Trump presidency.

European OEMs dependence on China – once a strength, now a weakness

The biggest, most immediate challenge is the unfavourable market in China, no longer offsetting weak demand in Europe and the US for the OEMs.

Not only is the overall Chinese car market sluggish as the domestic economy slows, but in the booming EV segment – with EVs increasingly the preferred choice of Chinese consumers – the market is oversupplied. European models are struggling to compete with cheaper and more advanced Chinese cars. European OEMs’ sales in China fell in 2023 and slumped last year. For example, Volkswagen AG delivered 10% fewer new vehicles in the nine months to end-September than the same period the year before.

For some European OEMs, notably Volkswagen, sales in China have long been important to offset the more mature European sector with thinner profit margins in the OEMs’ respective home markets where, since 2021, energy and payroll costs have risen as companies raised R&D spending to develop new vehicle platforms.

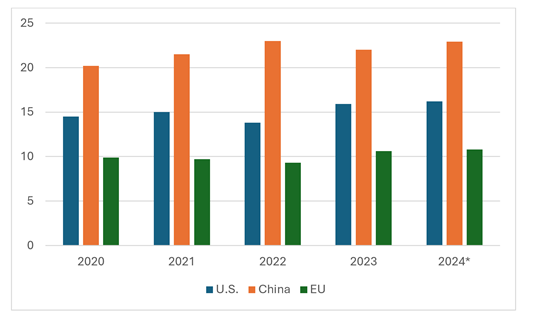

The combination of higher costs and a particularly unfavourable European car market is exposing more than ever the overcapacity of the European industry given slack demand for battery electric vehicles (BEVs) – the UK market is an exception – and falling demand for petrol and diesel cars (Figure 1). The one bright spot is robust demand for hybrid vehicles where Japan’s Toyota Motor Corp. is particularly well placed with registrations of new Toyota cars up 17% in the 11 months to end-November in a flat overall market.

The result is the growing pressure to close factories at home and grow market share abroad. Volkswagen is planning plant closures in Germany with thousands of jobs at risk while it has recently replaced its head of North America to improve sales in the region.

Figure 2: Europe new car registrations stagnate: weak demand for battery-electric, petrol, diesel cars offsets higher hybrid-electric sales

New passenger vehicle registrations, 11-months end-Nov 2024 (% change on same period the previous year)

Source: ACEA, Scope Ratings

Weak global auto demand weighs most heavily on mass-market OEMs

A weak US auto market, the world’s second biggest, has contributed to pressures on European OEMs, notably Stellantis NV, owner of the Crysler and Jeep brands, which is more reliant on the US and Europe than China. Its chief executive Carlos Tavares resigned suddenly in December.

Volkswagen and Stellantis, both primarily mass-market OEMs, are more vulnerable to these difficult trading conditions than premium-priced car makers BMW AG and Mercedes-Benz Group AG and smaller rivals Ferrari SpA and Porsche AG.

As volume manufacturers, Volkswagen – whose mass-market brands include VW, Skoda and Seat – and Stellantis – also owner of the Fiat, Opel/Vauxhall and Peugeot brands – face the huge capital cost of re-equipping their facilities for making EVs, a market for which there is relatively little visibility.

The heavy investment comes as demand for existing models with internal combustion engines (ICE) is weak. Meanwhile, low-cost EVs from Asian OEMs are taking market share in a segment where is not growing as fast as expected in Europe and the US.

Rising tariff barriers, regulatory pressures loom large in 2025-29

Another danger is the prospect of a US-led rise in tariffs, raising the cost of exports of cars made in Europe and exports of US- and China-made vehicles to other markets, under the aggressive trade policy promised by President-elect Donald Trump. If the tariffs are introduced, this will have an impact on sales volumes and profitability, although the effects on European OEMs should vary. Much will depend on how much of local demand can be met by local production to avoid tariffs, the flexibility to adjust production capacity and the ability to absorb extra costs through price increases.

Also hanging over the European OEMs are possibly heavy fines in Europe if the OEMs fail to meet the targets for reducing average carbon dioxide emissions from new vehicles as sales of low-emission and zero-emission vehicles fall behind target – hence lobbying by the industry for governments to do more to encourage demand for EVs and ease the compliance burden.

The EU has, for example, set a target of 93.6g of CO2/km for 2025-29 for new vehicles. European OEMs have invested heavily in electric cars to fulfil this goal, but due to the significantly weaker adoption of electric cars in particular in Europe, demand has remained well below expectations.

Signs of strategic rethink among European OEMs

The result is that OEMs have had to have a strategic rethink. Take Mercedes-Benz which announced in summer 2024 that, contrary to its previous strategy, it would not be reducing its investments in combustion engines as planned and thus abandoned its ‘all-electric’ approach. Mercedes-Benz now expects to maintain the mix of combustion engines, hybrids and electric cars in the long term.

Among European OEMs, only Volvo Cars had already hit the target in 2023, with most of the other OEMs at least 10g off target. The EU has a zero emissions target for 2035.

Results from European OEMs in the coming quarters are likely to show the depth of the problems the industry faces amid weak economic growth and shrinking car demand in important home markets such as France, Germany and Italy. These trends are reflected in our ratings on the sector. We made no downgrades last year but most of our ratings for automotive OEMs carried a Negative Outlook at year-end 2024.

Further reading:

Sovereign Outlook 2025: robust fundamentals, rising fiscal pressures and geopolitical uncertainty (5 December 2024)