Announcements

Drinks

US tariffs pose broad challenges for European vehicle makers, but impact will vary

The proposed tariffs on imports from Mexico, Canada and China come as European original equipment manufacturers (OEMs) are facing stiff challenges in China – relatively slow overall market growth, rapid shift to electric vehicles – and regulatory pressures in Europe. The unfavourable mix contributed to our negative outlook for the industry, revised from balanced in 2024. See Scope’s Corporate Outlook 2025.

Much uncertainty on the new US tariff regime remains. President Donald Trump announced hefty tariff increases on imports from Canada and Mexico only to suspend them after negotiations with his Canadian and Mexican counterparts. New tariffs on imports from China remain for now.

Still, the European industry is vulnerable to more protectionist US trade policy given exports to Mexico and Canada from factories in the two countries. Vehicles are Mexico’s largest export sector to the US (worth about USD 130bn in 2023). The automotive sector’s US-export exposure in Canada is significantly lower at USD 56bn. For China, it stands at USD 18bn.

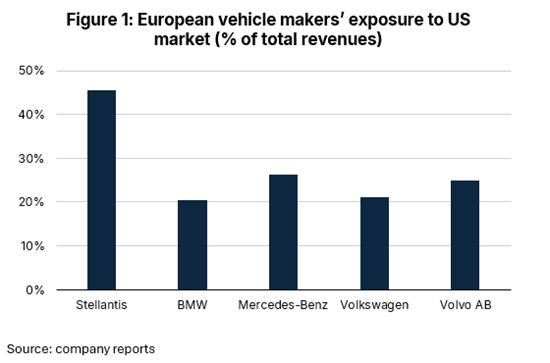

The adverse impact on European carmakers would be exacerbated if the Trump administration extends tariffs on imports from the European Union, as total EU vehicle imports to the US amounted to USD 54bn in 2023 (Figure 1).

Stellantis most exposed to US protectionist shift, Volkswagen vulnerable

European OEMs such as Stellantis, Volkswagen, BMW and Mercedes-Benz operate production facilities in Mexico (Stellantis also manufactures in Canada) due to lower labour costs and proximity to the US market. Renault SA by contrast would be much less affected by US tariffs as it has no direct exposure to the market.

The overall impact will vary depending on the importance of the US market as a sales market and the proportion of imports coming from Mexico and Canada. In addition, the ability to shift production to the US and adjust pricing will also be factors in mitigating the overall impact.

Stellantis – owner of the Chrysler, Jeep and RAM brands – is expected to face the greatest impact due to its high exposure to the US market, which accounted for around 46% of sales in 2023, and its substantial dependence on production in Canada and Mexico.

With 21% of its sales in the US market, Volkswagen's exposure to the US market is comparable to that of BMW and Mercedes. Nevertheless, we believe Volkswagen – as a mass-market car maker and truck supplier – is likely to be more affected by the tariffs on Canada and Mexico and the potential tariff increase on European imports.

A significant portion of its US sales come from Mexico (e.g. VW Tiguan and Truck brand International) and its luxury brands, Audi (excluding the premium SUV Audi Q5 and its sports and plug-in hybrid versions produced in Mexico) and Porsche, in particular, are imported into the US market, which is a disadvantage compared with BMW and Mercedes.

Premium car makers should prove relatively resilient

Both BMW and Mercedes are significantly exposed to the US market, which accounted for 20% and 26% of their revenues in 2023 respectively. However, as Mexico plays a smaller role in their supply chains compared to European imports, the tariffs on Canada and Mexico imports are less of a concern.

In addition, premium car manufacturers are in a relatively better position to absorb the additional costs through price adjustments, as their customer base tends to be more willing to accept price increases.

Customer also have limited alternatives in the premium market dominated by Audi AG, BMW, Mercedes, Porsche AG and smaller luxury manufacturers such as Aston Martin Lagonda Ltd., while OEM competitors also face similar tariff-related cost pressures.

Truck, capital-equipment makers face tariff-related strain

In the truck segment, North America is Volvo AB’s second-largest market, contributing about 30% of total revenue. While higher U.S. tariffs on European imports could present challenges, the Swedish truck maker – not to be confused with car maker Volvo Car AB – is largely protected due to its strong local manufacturing presence. This is particularly true for the main truck division (70% of 2024 group’s industrial sales). In fact, Volvo produces 100% of the trucks sold in the U.S. locally in its manufacturing plants in Virginia and Pennsylvania, with plans to further expanding production in the country.

Similarly, though to a lesser extent, Volvo’s construction equipment division — the group’s second-largest segment (18% of industrial sales in 2024) significantly mitigates potential tariff risks thanks to its local production facility in Pennsylvania. On the other hand, the buses division is more dependent on European imports, although its North American sales represent a smaller share, around 2% of total group sales in 2024.

On the positive side, we note that European OEMs will enter 2025 with solid net cash positions in their industrial operations due to strong cash flows in previous years. We also expect lower payouts to shareholders in 2025 which could help preserve financial flexibility amid all the challenges (Figure 2).