Announcements

Drinks

Oil & gas sector credit outlook shifts to balanced from positive; crude prices reflect ample supply

By Marlen Shokhitbayev, Corporates Ratings

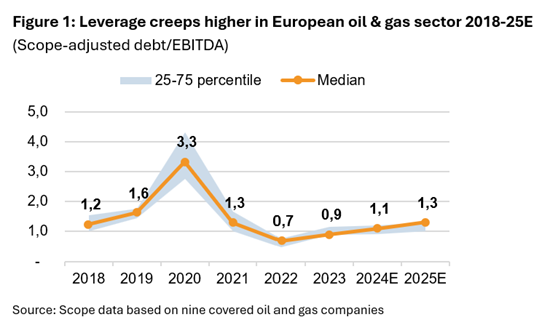

The IOCs’ operating cashflow will remain solid, so while average net debt/Ebitda will edge higher, leverage will remain well below levels during and immediately before the Covid pandemic.

Management remains focused on efficiency as one of the companies’ competitive advantages, with measures ranging from accelerated automation and digitalization to the shrinking or disposal of less profitable activities, in addition to mergers and acquisitions in the search of cost savings and revenue gains.

Crude prices to reflect well-supplied oil market

Crude prices to reflect well-supplied oil market

In the absence of major shocks – such as a dramatic escalation of the conflict in the Middle East, a break-up of OPEC+ or a global economic recession – we expect Brent oil price to subside, averaging between USD 65 and 75 a barrel, down from USD 81/bbl in 2024. While the global oil market was largely balanced in 2024, a lot will depend on OPEC+ ability to extend and even deepen production cuts to avoid a potential oversupply as non-OPEC+ production is projected to grow by around 1.5 mb/d in 2025, i.e. at similar pace as in 2024.

Unlike global oil markets, European gas market is likely to tighten in 2025 driven by some recovery in consumption and a further reduction in supplies from Russia following the end of transit via Ukraine. This explains the diverging trends in oil and European gas prices with Dutch TTF expected to average around between EUR 40 and 45 a megawatt hour. We also expect refining margins to remain below multi-year averages.

M&A activity to continue into 2025; organic capex to remain largely flat

Given moderating prices and healthy balance sheets, M&A activity will continue into 2025, driven mainly by potential synergies and portfolio high-grading in the sense of seeking low-cost, low-emission assets. The US will likely remain the main market for deals though for now much uncertainty continues to surround the policies of the new Trump administration and their consequences.

We expect to see more non-US deals in 2025, including from Europe-based companies. While the number of deals is likely to remain the same or even increase compared to 2024, the total deal value is unlikely to reach the levels of 2023/2024, which included several very large transactions. Another motivation for M&A, particularly among European players, will be to bolster reserves, which they have neglected amid the low-carbon push ahead of the spike in energy prices, inflation and interest rates in 2022.

Concerns about energy security, the need for affordable energy and, as a result, less stringent environmental policies are making investment in hydrocarbons more attractive, though a jump in capex is unlikely. IOC management remains committed to spending discipline. The easing of supply chain issues and the introduction of new technologies should keep costs in check. For some Europe-based IOCs, higher spending on hydrocarbons at the expense of low-carbon projects will help keep overall spending flat.

Shareholder remuneration to match cashflow trends; debt issuance to pick up

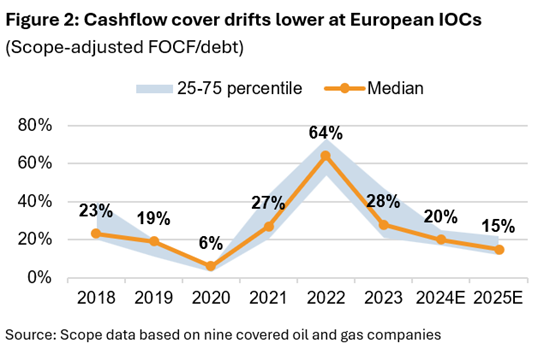

Shareholder remuneration is likely to follow the operating trends as healthy balance sheets are on the top of management agendas. Regular dividends will remain unchanged or grow moderately at the cost of less generous share buybacks and special dividends, thereby diminishing total shareholder remuneration.

While debt issuance is likely to pick up, it will remain at low levels and will be mainly focused on refinancing of debt maturities as the sector continues to generate solid free operating cash flow.

Energy security concerns support IOCs near-term as the long-term risks intensify

Less stringent environmental policies, particularly those announced by the new US administration, continue to support the industry in the short term, though longer term, the risk remains of tougher regulation and the changes in the economics of oil and gas projects which result in stranded assets.

Continuing investment in traditional oil and gas activities supports profitability but it is also likely to put pressure on the companies’ business risk profiles.