Announcements

Drinks

European CRE/CMBS: retail leads the way in loan repayments, signalling improved fundamentals

Of the repayments, retail assets account for EUR 550m across five loans, while the rest is distributed across two industrial properties (EUR 760m), two residential (EUR 300m), one office (EUR 220m), two telecom exchanges (EUR 75m) and one hotel (EUR 31m). Of the 10 loans maturing in 2025 for an aggregate EUR 1.65bn, three of the four that have been extended are backed by office properties.

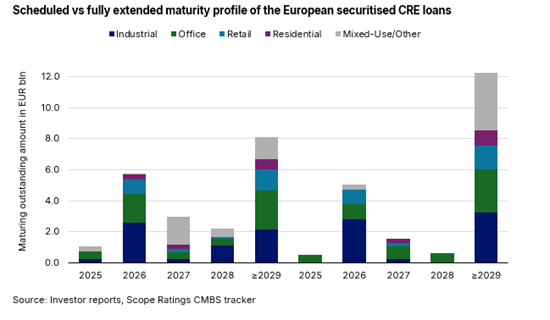

To date, four loans (40%) have been extended and five repaid, while around EUR 5bn of fully extended securitised loans have had their maturities pushed back to 2026, 55% of which by volume are backed by industrial and logistics assets, 20% by office, 19% by retail and the remainder by motor services assets and telecom exchanges.

“We had previously expected six loans – 60% by number – to face high or very high refinancing risk due to lower asset values and relatively compressed debt yields, but only one loan remains at high risk of refinancing: the senior Squaire of Taurus 2021-3 DEU office transaction,” said Benjamin Bouchet, director in Scope’s structured finance team.

The Squaire, secured by the eponymous property located at Frankfurt airport with large office space and two hotels, closed a year after the start of the pandemic in 2021 and never really recovered. While last year’s hotel revenue returned to pre-pandemic levels, net operating profit is down 22%. The gross rental income from the office space fell 11% between 2020 to June 2025 and is scheduled to drop further from 2028 when KPMG AG (the main tenant in the property accounting for 59.8% of the income) moves to new offices in the city centre.

On the positive side, three Italian retail loans sponsored by Blackstone – Franciacorta and Palmanova (secured in Deco 2019-Vivaldi S.R.L), and Valdichiana (Pietra Nera Uno S.R.L.) – have prepaid. “The loans have rebounded well since the pandemic. Having hit a trough in 2021 with a debt yield as low as 2.9% and a vacancy level as high as 16.5%, they have since outperformed, with the yield at 13.4% and vacancy around 6%, said structured finance analyst Krisztián Bellon.

The strong performance of the retail villages together with the equity injection from the sponsor when it extended the loans by three years in 2024, has enabled the weighted average LTV to remain between 65% and 80% since June 2019.”

“Retail loan delinquency has greatly improved, dropping from 64% in December 2024 to 29% in Q3 2025,” Bouchet said. Mixed-use/other sector also experienced a significant improvement following the repayment of the Aries and Nucleus loans of ERNA S.R.L., improving the ratio of delinquent loans to 17% in Q3 2025, down from 50% in December 2024. “The office sector remains the laggard, with delinquency decreasing marginally from 50% to 43% following the refinancing of the extended Viridis loan securitised in ELoC 38,” Bouchet added.

Most loans outstanding in December 2024 have shown an improvement in one or both key loan metrics (debt yield and loan-to-value). Twenty loans (50%) have improved on both key metrics, and 16 (40%) on at least one. Of the four loans (10%) with both metrics deteriorating, three are secured by office properties, one by industrial properties.