Announcements

Drinks

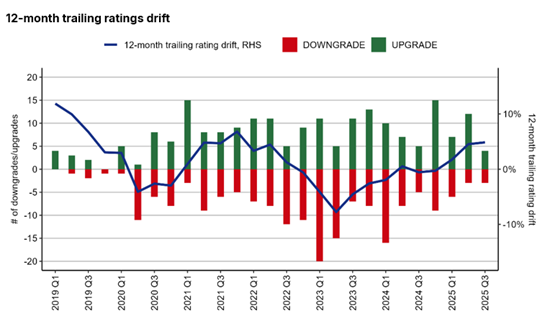

Structured Finance Activity Report: ratings drift levels out in positive territory

Source: Scope Ratings

Source: Scope Ratings

In the last 12 months, consumer ABS transactions showed a strong positive ratings drift, mainly driven by upgrades on mezzanine tranches. RMBS also continued to demonstrate strong performance and stability, with most reviews resulting in affirmations and a smaller share in upgrades, consistent with historical trends.

SME ABS ratings also remained stable during the period, with all senior tranche reviews affirmed and a small portion of subordinated tranches upgraded. Corporate CLO/CDO ratings reflected similar resilience, with most reviews resulting in affirmations.

NPL ABS was the weakest-performing asset class: 20% of senior tranches were downgraded. Subordinated tranches were largely affirmed while there was a modest number of downgrades. Overall, the period was characterised by strong rating stability across most structured finance segments, with positive drift prevailing except for NPL ABS.

Of the 350 monitoring reviews conducted in the 12-month period across 158 outstanding transactions, 10.9% led to rating upgrades, 6% to downgrades.

Scope assigned new ratings or ancillary services to 122 instruments on 65 structured finance transactions in the 12-month period to the end of September, raising new-issue volume by 17.5% year-over-year. A total of 49.5% of the new-issue volume over this period was rated AAA while 2% was rated sub-investment-grade.

By the end of Q3 2025, Scope had rated or initiated ancillary services on EUR 367.8 bn-equivalent in structured finance instruments since 2014. Year-on-year new-issue volume growth stood at 17.5%, with a total of EUR 17.4bn-equivalent in new-issue volumes in the third quarter of 2025.