Announcements

Drinks

Covered Bond Outlook 2022: credit stability to persist

Banks entered the pandemic with sound prudential capital levels and got their booster shots from fiscal and monetary support. The end of dividend bans and the subsequent resumption of share buy backs are unlikely to change the situation. Additional protection for preferred investors from higher MREL buffers further supports the soundness of the sector.

“We expect bank asset quality to remain stable in 2022 despite the gradual expiry of support measures. Risks to asset quality could arise from tighter financial conditions and possible house price corrections, making it harder for highly leveraged borrowers to service their debt,” said Karlo Fuchs, head of covered bonds at Scope.

Even so, abundant liquidity will remain in 2022 despite the slow but steady tightening by central banks. Therefore, the banks’ own Achilles heel – liquidity – will remain well covered. Cover pools remain strong and legislation remains supportive.

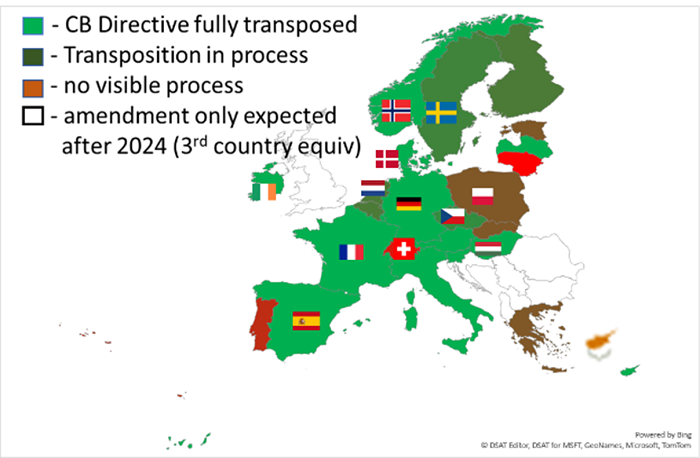

“Some countries are not yet compliant with the Covered Bond Directive. In fact, only 41% of member States have announced full transposition to-date, but we believe that those that haven’t made the cut will make the compulsory upgrade in time, otherwise issuers will lose their preferential risk treatment,” said Mathias Pleissner, director in Scope’s covered bonds team.

European covered bond harmonisation

Source: National legislators, Scope Ratings

Covered bond issuance started the year strongly. Banks had raised EUR 28bn as of 24 January, a start to a year not seen since 2011. What’s particularly positive, certainly for investors, is that none of the transactions came with a negative yield. This marks the way back to normality as January is traditionally one of the strongest issuance months.

However, our base case is that 2022 will be the fourth year of net negative supply in the benchmark segment. New issuance will not be sufficient to end the trough. Covered bond supply will be held back because very high excess deposits and non-preferred funding targets allow lending growth to be easily absorbed at attractive rates.

One additional positive is the volume of retained covered bonds will not see further growth. The favourable conditions under TLTRO III will likely fade by end-June 2022 and so will the preferred use of covered bonds as collateral. “However, investors should receive more information on their management, which can swiftly and strongly impact the risk profile and thus ratings,” Fuchs said.

Environmental factors on covered bond collateral are becoming increasingly important for credit analysis. Actual information on how green the cover pools really are remains scarce, however. Energy efficiency data has only recently been requested for newly-originated mortgages, while only a few countries have centralised data repositories allowing a broader picture to form.

“Missing performance information and the absence of a common taxonomy between countries currently prevents our credit analysis from distinguishing between standard collateral and ESG-compliant collateral,” said Pleissner. “We therefore warmly welcome the numerous industry initiatives to tackle these data gaps.”

Fuchs adds that green covered bonds only provide a minuscule ‘greenium’ of 2-3bp compared to non-ESG compliant covered bonds but the gap may increase if rates and spreads widen. Issuers with a more diversified funding profile and access to a broad group of investors may be less exposed to refinancing risk.

Download the Covered Bond Outlook here.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions such as for Credit Sphere.