Announcements

Drinks

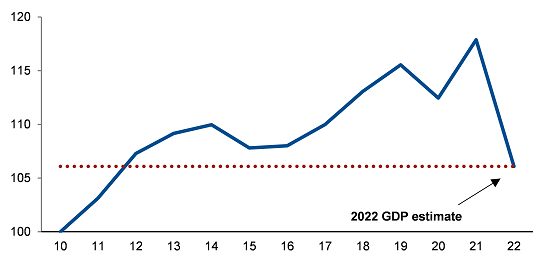

Russia’s economy to shrink significantly in 2022 due to war in Ukraine, sanctions

The country’s rapidly contracting economy reflects a dramatic reversal from the economic outlook before the war when buoyant energy prices and a rebound from the Covid-19 crisis underscored expectations for robust growth. Our December forecast was for 2.7% growth this year. Our current estimate of around a 10% reduction in real output is subject to significant uncertainty depending on the duration and broader consequences of the war, the scale of Russia’s financial crisis and the likelihood of further international sanctions.

Russia’s economic growth 2010-22

Russia, real GDP

2010=100

Source: Rosstat, Scope Ratings GmbH.

The speed, depth and breadth of international sanctions imposed on the Russian economy have severely impaired economic output while increasing the potential of a near-term selective default, as reflected in our downgrade of Russia’s credit ratings to C last week.

The Bank of Russia raised its key policy rate to 20% on 28 February 2022 from 9.5% to help defend the rouble, which has lost more than half its value against the US dollar since the beginning of this year.

We expect significant acceleration of inflation near term, and a severe impact on business and consumer confidence, job creation as well as investment. Inflation was an elevated 9.2% YoY in February even before the sharp drop in the rouble’s value. We expect inflation to average around 15% over 2022.

Longer run, the repercussions of the war and sanctions undermine the country’s already tepid medium-run growth potential, which we estimated around 1.5-2% before the escalation of the conflict – modest for an economy with comparatively low per capita income of around USD 12,000 in 2021.

Growth is likely to falter on rising financial instability, diminished institutional credibility as well as deteriorating investment conditions. Government and private enterprises must contend with severely curtailed access to foreign capital and financial markets, capital outflows, tighter domestic financial conditions as well as a weakened financial-system and external-sector buffers.

Net outflow of private capital from Russia has been accelerating, rising to USD 72bn in 2021 from USD 50.3bn in 2020 and USD 22.5bn in 2019.

The reversal of investment flows hinders transformation of Russia’s economic model towards a reduction of the state’s involvement in the economy which has discouraged competition and private investment. The Russian state is estimated to account for about 40% of formal sector value added and half of formal sector employment.

Regardless of the design of any further sanctions likely aimed at Russia’s energy sector, Europe’s intensifying initiatives to reduce its dependence on Russian oil and gas are likely to exacerbate medium-run challenges for the Russian economy given the government’s lack of ambition in the past in addressing the economy’s structural reliance on energy exports.

Russia could counteract European measures partly through greater energy cooperation with other countries, such as China and India, subject to scaling up the required infrastructure. The EU is Russia’s largest trading partner, with imports of Russian petroleum, natural gas and coal worth around EUR 100bn in 2021, equivalent to nearly two thirds of all imports from Russia.

Currently high energy prices underpin Russia’s significant current account surplus, estimated at USD 39.2bn in January and February this year, and are a critical source of foreign exchange revenue, especially since sanctions have frozen around half of Russia’s international reserves.

For a round-up of Scope’s latest rating action and analysis of the unfolding crisis triggered by Russia’s invasion of Ukraine in February and its impact on European sovereigns, banks, corporate sectors and markets, please follow this link.