Announcements

Drinks

Central and eastern Europe: growth slows, inflation rises from war in Ukraine; ECB, EU cushion blow

By Jakob Suwalski, Director and Levon Kameryan, Senior Analyst, Sovereign Ratings

We expect EU CEE average growth to decelerate to 2-3% this year, a downward revision from our December forecast of 4.6%. Inflation could average close to 10% in EU CEE member states this year.

The readiness of the ECB to provide liquidity support to central banks in non-euro area EU countries is one key sign of the European solidarity in face of Russia’s invasion of its neighbour.

More Europe-wide support will emerge from discussions among EU member states, perhaps along the lines of the Covid-19 EU Recovery and Resilience Facility and a reinforced commitment to help CEE countries to reduce dependence on Russian energy imports.

The CEE region is particularly vulnerable to the consequences of the war beyond its proximity to Russia and the refugees from Ukraine. The military conflict and sanctions on Russia are stoking inflation by pushing up commodity prices – from oil and gas to metals, fertiliser and food – and disrupting supply chains while creating extra volatility on financial markets.

Higher commodity prices in the run-up to the war had contributed to turning current account surpluses into deficits in Poland (A+/Negative), Hungary (BBB+/Stable) and the Czech Republic (AA/Stable) or widened deficits as in Romania (BBB-/Stable) since second half of 2021. Prolonged inflation risks squeezing the competitiveness of the region’s export sector.

The macroeconomic conditions put the regions’ central banks in a difficult position. They need to manage inflation without jeopardising the economic rebound and excessively pushing up debt-servicing costs. Inflation expectations are rising. Currency volatility will persist amid possible capital outflows, putting pressure on foreign-exchange reserves even as central banks tighten monetary policy.

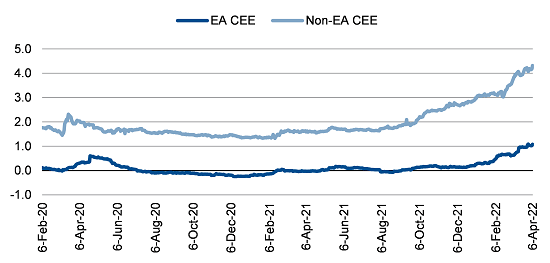

Debt financing costs for non-Euro area CEEs have increased materially

Government 10-year benchmark yields (%), national currencies

Source: Macrobond, ECB, Scope Ratings; *averages; EA CEE include Slovakia, Slovenia, Lithuania, Latvia; Non-EA CEE include Poland, Hungary, Czech Republic, Romania, Bulgaria, Croatia.

The ECB’s decision to grant non-euro area central banks access to euro liquidity through new swap and extended repo facilities, which were established during the pandemic, demonstrates wider EU readiness to provide further support, including fiscal help, tailored to the most vulnerable CEE countries.

Under the new swap line, Poland’s central bank can borrow up to EUR 10bn from the ECB, which is equivalent to around 7% of the country’s international reserves, in exchange for Polish zloty. Under a bilateral repo line, Hungary’s central bank can borrow up to EUR 4bn from the ECB, equivalent to around 11% of its total reserves, in exchange for adequate euro-denominated collateral. Such support has contained euro-denominated interest costs in CEE EU member states in previous crises given the sizeable share of euro borrowing in the region, at around 20% of public debt in Poland and Hungary.

We expect more EU-wide burden-sharing such as the almost EUR 17bn to help Ukrainian refugees and the member states hosting them. Poland requests EUR 2.2bn from the EU budget support to refugees.

The war in Ukraine and sometimes differing approaches to it is changing intra-EU relations, notably between Brussels and EU member states such as Poland and Hungary. While institutional disputes between Poland and the European Commission are unlikely to easily subside, the EU might unlock promised funding if the government in Warsaw displays a greater respect for the rule of law.

Hungary, however, risks increased political isolation within the EU, increasing uncertainty over its stable inflow of EU funding over the medium run, as reflected in the EU’s upcoming initiation of a conditionality mechanism for Hungary linking its EU budgetary financing to adherence to the rule of law.

The CEE region does have multiple economic strengths. Foreign exchange reserves of the central banks of Poland, the Czech Republic, and Hungary fully cover their short-term external debt, an important shock absorber amid currency volatility. Romania’s reserves cover nearly 90% of its short-term external debt. Croatia (BBB-/Positive) and Bulgaria (BBB+/Stable), as candidates of euro adoption, benefit from membership in the EU’s Exchange Rate Mechanism II and the Banking Union, ensuring close cooperation with the ECB.