Announcements

Drinks

European house prices: stretched affordability makes mortgages a luxury, dampens demand

European households are facing the highest debt to income and leverage seen in the last decade. House prices have grown by more than 5% per annum for eight consecutive years, while average wage growth has only hobbled along at around 2%. “Stretched affordability is increasingly becoming a factor for banks underwriting mortgages, as highly geared households are failing affordability tests – particularly when including potential rate hikes,” said Mathias Pleissner, Scope’s deputy head of covered bonds.

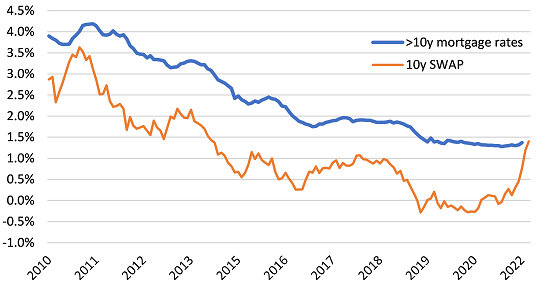

The mix of rising inflation and the impact of the war in Ukraine has already prompted higher European mortgage rates, mainly in fixed-rate markets. Ten-year euro swap rates have increased sharply. With an average lending margin of European banks of 1.35% on top of the bank’s pricing base for 10-year mortgages, mortgage rates will likely reach 2.75% within few weeks. The rate on a 10-year mortgage in Germany has already doubled to about 2%, a level not seen since 2015.

European fixed rates* (10 years-plus) vs EUR 10y swap

Source: ECB, Bloomberg, Scope Ratings

*until end of February 2022

A EUR350,000 10-year fixed-rate mortgage taken out six months ago and assuming a 2% annual amortisation required a monthly payment of around EUR 1,000. If today’s 10-year swap is fully reflected in lending rates, this would lead to a 40% increase to EUR 1,400 per month. On top of that, borrowers will also have to pay for the increased cost of living.

“Borrowers who have not yet locked into low fixed rates will see their financing packages for home purchases challenged. They will either have to postpone their home purchases or, if they are lured by lower floating rates, they will become exposed to rate increases at the next re-fixing,” cautioned Reber Acar, associate director in Scope’s covered bonds team.

Average quarterly growth in European house prices (including the UK, Norway and Switzerland) stood at 2.5% in the last quarter of 2021. This is slightly down compared to Q2 and Q3, when growth hit the 3% mark, but despite the lower quarter-on-quarter growth, annual average house price increases hit 11.3%. The last time, annual growth was in double digits was in 2006 but prices found a sudden reversion in the guise of the global financial crisis.

“Despite all of the pressures, we do not expect a sudden or sharp decline in nominal house prices,” Pleissner said, “as inflation in building materials prices will keep them buoyant. Also, undersupply of housing still prevails in many European countries. Oversupply driven by speculation, which contributed most to severe slump in house prices in Ireland and the European periphery, is not visible today,” Pleissner said.

Download the full report here.

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions such as for Credit Sphere.