Announcements

Drinks

France: welfare state faces fiscal squeeze if no change in policy under next president

“France’s social spending is among the highest in the world and is an important source of budget rigidity and cyclicality,” says Thomas Gillet, analyst at Scope.

The Covid-19 crisis has further exacerbated the vulnerabilities of the system as spending on health and unemployment benefits shot up while revenue declined. In addition, the costs of population ageing, albeit less significant than for some other advanced economies in the long run, will structurally increase fiscal pressures, while room to increase fiscal revenue is limited by an already elevated tax burden.

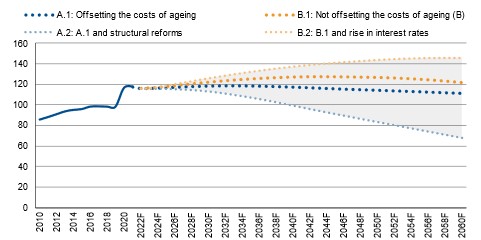

“Reforming the overall welfare state post Covid-19 will be critical for France’s public finance and credit outlook, given the importance for the budget balance and public debt,” says Gillet (see chart). The two presidential candidates have diverging approaches for balancing the social security budget. Emmanuel Macron wants to simplify the welfare payment system. Marine Le Pen believes instead that giving preference to French people to access the most important social benefits and cut benefits to immigrants is the better route.

Looking at the different pillars of the social security system, Scope has focused on those having an important impact on public finances (i.e., pensions, health, unemployment) to highlight the main challenges ahead from a credit perspective.

France’s public debt trajectory under various policy scenarios

% of GDP

Note: The different scenarios and associated assumptions are detailed in the Appendix.

Source: OECD Economic Surveys: France 2021

“The most important observation is that France’s large welfare state shields households and businesses from external shocks such as the Covid-19 pandemic, but it also raises important fiscal challenges in the long run,” says Thibaut Vasse, analyst at Scope.

“The history of CADES, the state body created to pay down the country’s accumulated social-security debt in 1996, is a good example, with its mission, originally set to end in 2024, now extended to 2033 after the transfer of additional EUR 136bn in social-security debt on to its books in 2020,” says Vasse.

France spends more than its peers in almost all components of social spending, which results in elevated budgetary rigidity and sensitivity to economic shocks. Social spending totalled 31% of GDP in 2019, well above the OECD average (20% of GDP) and indeed the highest among OECD countries.

In addition, the social security system has been severely impacted by the Covid-19 crisis. Its deficit reached a historical high in 2020 at 1.7% of GDP, mainly due to the sudden rise in health expenditures, reversing the material reduction in deficits in the period 2011-18.

“Long-term fiscal pressures from the rise in age-related costs are lower than many advanced economies but remain a tangible risk to the trajectory of France’s public debt given the rise in social debt,” says Brian Marly, analyst at Scope.

France’s pension, health and unemployment insurance systems result in strong social outcomes for the elderly at a high cost. “Reforming them to address inefficiencies and enhance financial sustainability are critical to France’s credit outlook, particularly because the country’s high tax burden curtails the government’s ability to address fiscal pressures with additional tax revenues,” says Marly.