Announcements

Drinks

Hungary: triggering EU conditionality mechanism could lead to major funding cuts

.jpg) By Jakob Suwalski, Director, Sovereign Ratings

By Jakob Suwalski, Director, Sovereign Ratings

The triggering of the EU’s conditionality mechanism, a budgetary tool available since the beginning of 2021 and established to protect the EU budget against breaches of the rule of law, will define relations between the EU and Hungary (BBB+/Stable) over the coming years.

The mechanism puts the EU in a better position to influence Hungary by withholding financial support. But at the same time, in view of the rising strategic importance of Hungary and the broader CEE region following Russia’s invasion of Ukraine, we expect a pragmatic balancing act by the EU to avoid provoking Hungary into blocking EU decisions on energy policy, security and migration.

The share of EU monies affected by Hungary’s worsening rule-of-law dispute with the EU is already substantial: the EU is currently withholding EUR 7.2bn (4.7% of 2021 GDP) in pandemic recovery funding in the form of Next Generation EU grants which are planned to be disbursed over 2022-26.

The ongoing negotiation process is expected to be lengthy and protracted. Any potential cuts to Hungary's EU funding would need to be endorsed by a qualified majority in the Council. This is an important difference in the decision-making process to Article 7, where unanimity is required.

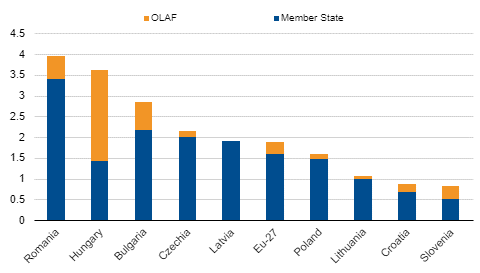

OLAF, the EU's anti-fraud agency, has put Hungary at the top of its list of countries with irregularities involving EU funds, with public projects considered to be over-budgeted and over-priced. These considerations have prevented the approval of Hungary's national recovery fund.

Unlocking recovery funds withheld by the EU will play a key role in fixing Hungary’s budget and preventing a sharper slowdown in economic growth. The Hungarian government needs to address rising budgetary pressures just as the economy is set to slow amid rising inflation, sanctions on Russia and supply-chain disruptions to the country’s exports, notably in the automotive sector. We expect Hungary’s economy to grow by 3.5% in 2022, revised down from 5.4% in December.

Figure 1: Member State/OLAF detection of irregularities

Financial impact in European Structural and Investment Funds and Development Funds 2016-2020 (% of payments)

Source: OLAF, Scope Ratings

Hungary also expects to receive an additional EUR 35bn (22.8% of 2021 GDP) from the EU’s 2021-27 long-term budget over the coming seven years, mostly via structural and cohesion funds. But the new conditionality mechanism entitles the EU to partially suspend or reduce these allocated funds and to force the Hungarian government to repay pending loans earlier than expected.

Given that the scope and duration of the response vis-à-vis the new conditionality mechanism must be proportionate to the damage caused by the legal breaches, a total suspension of EU funds is unlikely. This is also because the final recipients of EU funds, such as NGOs and farmers, are entitled to receive the funds assigned under pre-existing obligations, including from the EU’s 2014-20 budget.

Still, withholding EU monies – whether from the new NGEU programme or traditional structural and cohesion funds – would be credit negative for Hungary in the near term. EU funds are an important driver of Hungary’s growth prospects as it compensates for low savings and accounts for a crucial share of public investments for infrastructure and innovation and supports governments’ long-term planning and efficiency.

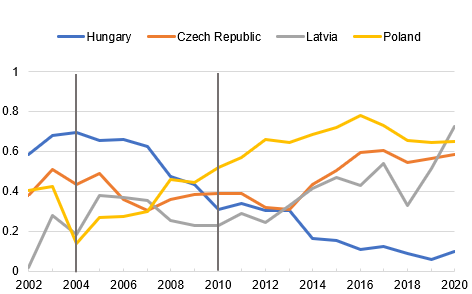

However, over the medium term, withholding these funds thus strengthening the effectiveness of the conditionality mechanism, could result in stronger governance and, notably, lower corruption in Hungary and other EU Member States. The principle of conditionality was a primary driver of CEE countries’ improved institutional frameworks for fighting corruption, and it has been a central element of EU policy towards candidate States.

However, based on most corruption indices, the effectiveness of addressing corruption for Hungary, which entered the EU in 2004, peaked in the year surrounding accession and has further deteriorated since Viktor Orbán assumed office as Prime Minister in 20210.

Figure 2: Worldwide Governance Indicators for select countries

Control of Corruption Index

Source: World Bank, Scope Ratings

We believe that the conditionality instrument can become a powerful tool to enhance corruption-fighting capacity in Hungary and support reforms of CEE countries post-accession.

Since the conditionality mechanism has never been used, there is some uncertainty about how long the process will take, but it will likely be at least six to 12 months. If after several rounds of negotiation, the Commission issues a recommendation to freeze EU funds, Member States will have up to three months to adopt the Commission’s proposal with a qualified majority in the Council.

This is an important difference to Article 7, where unanimity is required to suspend certain rights of a Member State, with Poland and Hungary having vowed to support each other during previous disputes with the EU. This change in governance is critical for the relevance of this instrument.

While the burden is high for the European Commission to build a legal case that establishes an evidence-based link between the breach of EU law and the EU budget, its stronger governance structure should allow the EU to transform this mechanism into a more comprehensive instrument over time.