Announcements

Drinks

Finland, Sweden: Covid-19 resilience creates buffers against conflict costs and geopolitical risks

By Giulia Branz, Analyst, and Eiko Sievert, Director, Sovereign Ratings

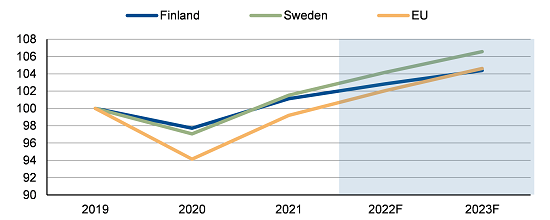

The economies of Finland (AA+/Stable) and Sweden (AAA/Stable) proved resilient during the Covid-19 pandemic. Economic contraction in 2020 of 2.3% and 2.8% of GDP respectively was approximately half the average of EU countries. This was followed by rapid recoveries, with real GDP already reaching pre-pandemic levels in both countries in the first half of 2021 (see Figure 1).

The strong economic rebound also allowed for a quick recovery in the countries’ government budgets last year, with a rapid reduction in headline fiscal deficits to levels well below European peers and already in compliance with the 3% Maastricht reference deficit limit.

The short-lived effects of Covid-19 leave the countries well positioned to face the adverse economic ramifications of the Russia-Ukraine war. We expect the war to affect both countries’ economies via several channels, including trade links and commodity price shocks.

We have thus revised down our economic forecasts for this year by about 1pp in the case of Finland to 1.7%, and by 0.7pp in the case of Sweden to 2.6%. Next year, we expect Finland to grow by 1.5% and Sweden by 2.3%.

Figure 1: Economic recovery from Covid-19

Real GDP, 2019=100

Source: IMF, Scope Ratings

The growth revision of Finland reflects its geographic proximity to Russia resulting in strong economic links between the two countries. Russia was Finland’s fifth most important export market in 2021, accounting for about 5% of total exports and more than 1% of value added. Sweden’s trade relations with Russia are less significant, accounting for just above 1% of total exports.

In addition, Finland has a higher energy dependence on Russia than Sweden. However, when compared with the EU average, Finland’s energy mix benefits from a wider diversification of sources and lower reliance on natural gas. Inflationary pressures are visible in both countries, with Finland’s March inflation rate at 5.8% and Sweden’s at 6% YoY.

The implications of the Russia-Ukraine war are primarily political, with geopolitical concerns as a tail risk to the countries’ credit outlook.

This is reflected in fiscal and foreign policy shifts. Defence spending is set to increase in both countries, however, approved measures do not as yet indicate a reversal in the gradual improvement of headline fiscal deficits expected over the next few years.

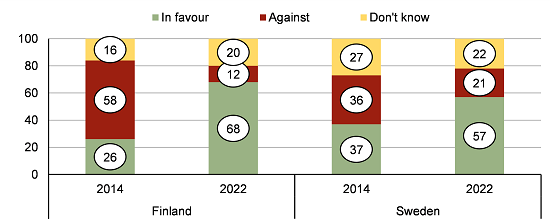

Figure 2: Public support for NATO membership

Public opinion survey results, %

Source: 2014: Source: 2014: YLE, Taloustutkimus, Novus; April 2022: Mtv uutiset, Aftonbladet, Demoskop

Source: 2014: Source: 2014: YLE, Taloustutkimus, Novus; April 2022: Mtv uutiset, Aftonbladet, Demoskop

More fundamentally, official debates concerning the decision to join NATO have intensified in recent weeks. Many political forces have already expressed public support for membership. This reflects a shift in public opinion since the war in Ukraine began. There is now a solid majority in both countries in favour of joining the military alliance (see Figure 2). Both countries are likely to present a joint membership application in the coming weeks.

Finland is particularly exposed given its geographical proximity to Russia: the shared border stretches over 1,300km. This explains why Finland has taken the lead among the two countries around next steps in applying for NATO membership.

At this stage, we consider an escalation in geopolitical risks to the point of threatening either country’s macro-economic stability as very unlikely. This is also due to the very strong international ties of Sweden and Finland to European and other Western allies, which in our view create a fundamental deterrent to a direct attack from Russia.

Alessandra Poli, Associate Analyst, contributed to this commentary.