Announcements

Drinks

Credit Talk: Europe’s airline sector faces tough financing, operating conditions

In this latest Scope Ratings interview, Azza Chammem, senior analyst leading airline-sector coverage in Scope’s corporate ratings team, explains her outlook in conversation with Dierk Brandenburg, head of credit and ESG research.

DB: How do you see airlines coping with the problem of surging fuel prices?

AC: Most airlines have resumed their hedging programs after the Covid-related hiatus, extending their horizon out over the next 18 months. Having found themselves over-hedged during the pandemic, most airlines are now taking a more cautious approach.

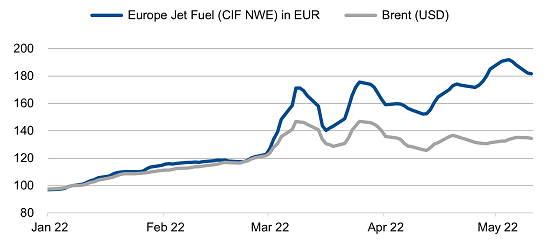

One problem is that while there has been a strong rebound in passenger numbers this year, most bookings continue to be made short term, reducing visibility on future traffic. Underlying volatility in oil prices and the wide jet crack spread further complicate hedging, especially for European airlines that are also exposed to euro’s weakness against the dollar. While oil prices rose by almost 40% in USD terms during 2022, the EUR price of jet fuel is up 80% over the same period due to the combined impact of a weaker euro and the wider jet crack spread after the outbreak of the war in Ukraine.

Figure 1: Fuel costs surge for Europe’s airlines: kerosene (EUR), crude oil (USD) compared (indexed: 1 Jan 2022 = 100)

Source: Bloomberg, Scope Ratings

Rising fuel prices increase pressure on airlines to invest in fuel-efficient aircraft, but, with interest rates and borrowing costs rising, many airlines are still burdened with debt incurred during the Covid crisis. In other words, replacing fleets is a tough ask for many operators. Aircraft lessors themselves face the additional pressure from losses on their Russia exposure with hundreds of aircraft trapped in the country. Airlines face higher lease rates as lessors look for greater risk-compensation in the context of the war in Ukraine.

DB: How does all this play out for airline revenues and profit margins?

AC: The good news is that the recovery of passenger numbers is well underway, except in Asia-Pacific due to the Covid restrictions in China. Bookings through March and Easter and towards the summer in Europe imply a strong increase this year compared with 2021. Ticket prices are up as airlines take advantage of pent-up demand.

IATA reports that the airline industry's passenger revenue kilometres in March 2022 were at their highest since the pandemic though 41% below where they were in March 2019. It will take at least another couple of years for traffic to fully recover. Ticket sales dropped at outbreak of the war in Ukraine, but they rebounded in March.

In Europe, discount airlines such as easyJet PLC and Ryanair PLC are benefiting from the faster recovery in short-haul vs long-haul traffic. However, the picture remains blurry. Not only are advance bookings weak but the full ramp-up of capacity back to pre-pandemic levels has yet to take place. Look at Germany where the Frankfurt-Berlin route is busy for Deutsche Lufthansa AG, but the airline operates fewer daily flights compared with pre-Covid.

While legacy airlines have been benefiting from good cargo yields, cargo volume has started to decline due to the slow-down in global growth. IATA reports that global cargo tonne kilometres declined by 5.2% during the first quarter of 2022, a trend that is likely to continue in view of declining export orders in many regions.

The bigger question is how long it will take for long-haul traffic to recover, especially on North Atlantic routes, with the rebound in traffic to Asia unlikely until China relaxes its increasingly tough Covid lockdowns. For now, Lufthansa is one airline that says premium traffic is holding up well and yields are good despite tough competition from US carriers on transatlantic routes.

DB: What about the prospects for industry consolidation in Europe?

AC: Airlines face high fuel costs and higher airport fees as airports seeking to recoup revenue lost during the Covid crisis in addition to potentially higher passenger duties and rising staff costs as wages climb, partly due to labour shortages. Airlines will need to add more capacity to improve unit revenues. We still see a negative outlook for the European airline industry.

A big issue remains the lack of consolidation in Europe on the same scale as the US. Surprisingly, not much took place despite the pandemic’s shock to the sector.

Norway is a good example. Take the survival of Norwegian Air Shuttle ASA, due to government support and a major restructuring. Norse Atlantic ASA, a new local airline, is trying to establish the transatlantic long-haul low-cost business model that Norwegian jettisoned. Meanwhile, Flyr AS, another start-up, is competing fiercely with Norwegian and SAS AB on some routes.

DB: What is the refinancing risk for the sector in the context of rising rates?

AC: Leading airlines have been building up liquidity, which is why we had few downgrades during Covid crisis with our emphasis of looking through the cycle. However, the funding situation is getting more challenging, for sure.

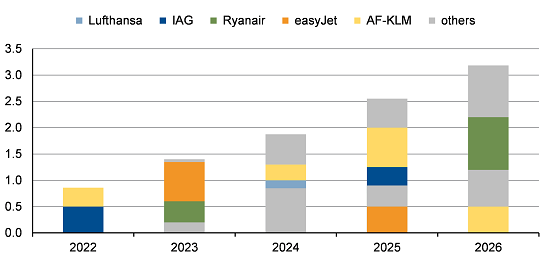

Figure 2: selected European airline bond maturities 2022-26 (EUR bn)

Source: Bloomberg

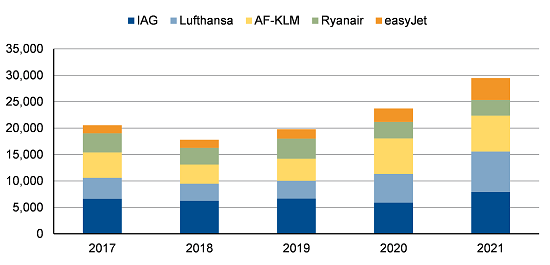

Airlines set a liquidity buffer as a cushion to avoid any surprising new Covid-19 wave or future disruption. At the end of 2021, the big five European airlines had close to EUR 30bn cash compared with EUR 20bn pre-crisis. Revenues and EBITDA for the five improved by EUR 8bn compared with 2020, but revenues so far are only 44% of pre-crisis levels.

Still, airlines have started to repair balance sheets, reducing aggregate net debt slightly to EUR 33bn. We expect deleveraging will continue in 2022, helped by improving passenger traffic. Airlines are faced with higher coupon payments on loan facilities and bond refinancing though there are relatively few bonds maturing this year and next.

That said, higher interest charges and leasing rates, driven higher by sanctions against Russia, will squeeze EBITDA and make it harder for companies to stick to leverage targets. Equity increases are therefore possibly in the offing – one example is the restructuring planned at SAS – while some airlines will continue to try to sell non-core assets. For example, Lufthansa is again looking to sell its catering and servicing units.

Figure 3: Cash and short-term investments (EUR m) for Europe’s leading carriers

Source: Capital IQ

Access all Scope rating & research reports on ScopeOne, Scope’s digital marketplace, which includes API solutions for Credit Sphere, providing institutional clients access to Scope’s growing number of corporate, bank, sovereign and public sector ratings.

Contributing writer: Matthew Curtin